In a notable shift for the tech investment landscape, billionaire investors Daniel Loeb of Third Point Capital and David Tepper of Appaloosa Management have increased their stakes in Nvidia (NASDAQ: NVDA) over the past two quarters. This comes despite the stock’s staggering rise of 1,100% since 2022, as competition in the artificial intelligence (AI) chip market intensifies. These moves signal confidence in Nvidia’s ability to maintain its lead amid emerging rivals.

Nvidia’s strategy involves cultivating a robust ecosystem of hardware and software solutions tailored for AI researchers. This strategy appears well-timed as the demand for AI capabilities continues to surge. Hyperscalers are ramping up investments in data center capacities, driven by new AI models necessitating greater computing power. This uptick has translated into substantial financial gains for Nvidia, with its data center revenue increasing by 66% year over year in the latest quarter.

While some competitors, including Broadcom, are gaining traction by offering custom AI chips, Nvidia remains steadfast in its dominance. A critical component of its strategy is providing free development tools like CUDA, which facilitate the building of applications on Nvidia’s hardware. The adoption of CUDA has grown significantly, with 5.9 million developers utilizing it in 2024, up from 4.7 million the previous year. This creates a barrier for AI researchers contemplating a shift to alternative chips, as switching platforms could disrupt ongoing projects.

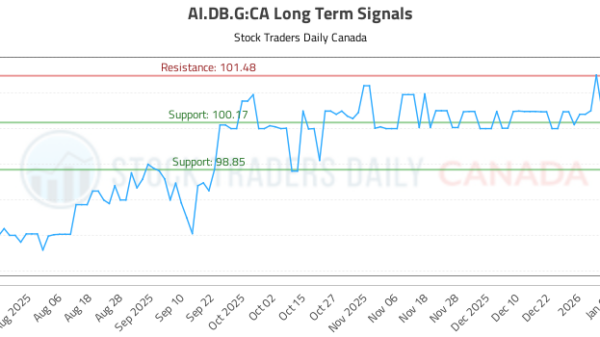

The confidence displayed by investment titans Loeb and Tepper reflects a belief in Nvidia’s long-term viability. The company’s stock currently trades at a forward price-to-earnings ratio of under 25, a figure that many analysts consider attractive given the momentum in its data center business.

However, potential investors should approach this market with caution. The Motley Fool Stock Advisor team recently highlighted a list of the ten best stocks to buy, and Nvidia was notably absent. Historical performance from the Stock Advisor team shows significant returns from companies like Netflix and Nvidia itself during past recommendations, emphasizing that while Nvidia has been a lucrative investment in the past, future prospects require careful consideration.

Amid a rapidly evolving tech landscape, the stakes in the AI chip market continue to grow. As Nvidia fortifies its position through a combination of hardware prowess and developer support, the company stands at a crucial juncture in the industry. The balance of power may shift as emerging competitors vie for market share, yet Nvidia’s established ecosystem and substantial developer base provide it with a formidable competitive edge. Investors will be closely watching how this landscape unfolds, particularly as demand for AI technologies shows no signs of abating.

See also Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity

Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity Affordable Android Smartwatches That Offer Great Value and Features

Affordable Android Smartwatches That Offer Great Value and Features Russia”s AIDOL Robot Stumbles During Debut in Moscow

Russia”s AIDOL Robot Stumbles During Debut in Moscow AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse

AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse