Lenovo is shifting its strategy in the fast-evolving artificial intelligence (AI) landscape by seeking partnerships with leading firms such as Humain, Mistral AI, Alibaba, and DeepSeek, rather than developing its own large language models (LLMs). This approach aims to replicate its success from 2025, when the company emerged as a leader in the PC industry, shipping 71 million units. However, rising memory and storage costs may present challenges for Lenovo in 2026.

At the 2026 World Economic Forum in Davos, Lenovo Group’s Chief Financial Officer, Winston Cheng, outlined the company’s ambition to become a key player in the global AI market through collaborations with top developers. Instead of building its own AI models, Lenovo plans to integrate solutions from established firms, enabling it to navigate complex global regulations while offering tailored regional AI applications.

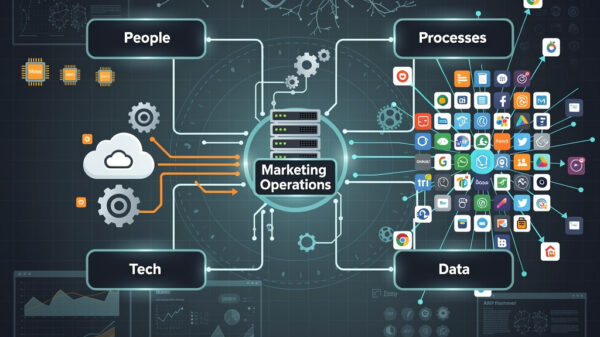

Cheng emphasized that Lenovo’s strategy, termed the “orchestrator approach,” positions the company not as a competitor to model developers but as a platform for their technologies. This contrasts with companies like Apple, which has limited its AI integrations primarily to OpenAI and Google’s Gemini, thus restricting its ecosystem’s flexibility.

Given the diverse regulatory landscape for AI data and security across different regions, Lenovo is focusing on relevant partnerships in major markets. In Europe, the company is collaborating with Mistral AI, while in China, it has aligned with Alibaba and DeepSeek. In the Middle East, Lenovo is eyeing a partnership with Humain, a Saudi-based AI initiative, to ensure compliance and address unique local needs.

Cheng noted that Lenovo is the only company, aside from Apple, with substantial market shares in both the PC and mobile phone sectors. This unique positioning allows Lenovo to leverage its extensive ecosystem of devices running on Windows and Android to enhance user experiences through advanced AI capabilities.

One of Lenovo’s latest initiatives is the rollout of its built-in cross-device intelligence system called Qira, introduced at CES 2026. Qira, described as “Personal Ambient Intelligence,” operates seamlessly across laptops, tablets, and smartphones, providing users with capabilities such as meeting summaries, document drafting assistance, and predictive analysis based on their schedules and files.

By integrating AI models from partners like Alibaba and Mistral AI directly into the Qira system, Lenovo aims to deliver high-speed AI performance without requiring users to open separate applications. This integration is expected to enhance multitasking and productivity across various devices.

Lenovo is also expanding its infrastructure capabilities in collaboration with Nvidia through the introduction of the “AI Cloud Gigafactory.” Utilizing Lenovo’s Neptune liquid-cooling technology alongside Nvidia’s advanced chips, including the new Vera Rubin NVL72 architecture, these facilities are designed to expedite the establishment of large data centers for AI cloud providers. Cheng stated that this partnership focuses on global deployment, with plans for expansion in Asia and the Middle East.

The global PC market experienced over 9% growth in 2025, solidifying Lenovo’s position as the market leader with 71 million units shipped. However, the company faces rising costs, with memory and storage prices increasing by as much as 40% to 70% during the year. To safeguard profit margins, Lenovo has indicated plans to raise consumer prices in response to these escalating costs.

As Lenovo sets its sights on becoming a prominent player in the AI sector through strategic partnerships, its innovative approaches underscore the growing importance of collaboration in navigating the complexities of the global AI landscape while providing tailored solutions to consumers.

See also 2026 Workforce Revolution: Companies Mandate AI Fluency Amid Skills Crisis and Hiring Overhaul

2026 Workforce Revolution: Companies Mandate AI Fluency Amid Skills Crisis and Hiring Overhaul Explore AI Ethics at 2026 Catholic Studies Series with Microsoft’s Taylor Black

Explore AI Ethics at 2026 Catholic Studies Series with Microsoft’s Taylor Black OpenAI Invests $500 Billion in Stargate to Mitigate Local Electricity Costs

OpenAI Invests $500 Billion in Stargate to Mitigate Local Electricity Costs CrowdStrike’s $4.6B Revenue vs. SentinelOne’s $956M: Capitalize on Cybersecurity Growth Now

CrowdStrike’s $4.6B Revenue vs. SentinelOne’s $956M: Capitalize on Cybersecurity Growth Now AI-Driven Ad Surge Floods Platforms, Threatens Brand Integrity and Consumer Trust

AI-Driven Ad Surge Floods Platforms, Threatens Brand Integrity and Consumer Trust