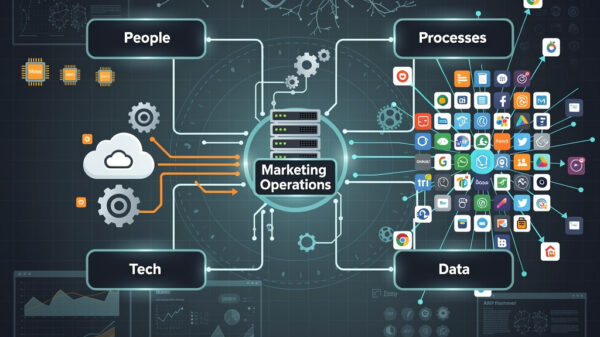

Billionaire investor David Tepper has made headlines again with his latest moves in the technology sector. Known for his contrarian investment strategy, Tepper’s hedge fund, Appaloosa Management, has recently reported significant stock sales in companies that have capitalized on the artificial intelligence (AI) trend, including Micron Technology, Oracle, and Intel. Tepper’s recent 13F filing with the SEC reveals a pivot in his portfolio, reallocating profits from these rapidly appreciating stocks into other opportunities, particularly in AI chipmakers.

Despite enjoying remarkable gains, Tepper appears to be shifting his focus towards a company with a future potential in AI chip manufacturing. One notable investment is Qualcomm, which, while primarily recognized for its wireless technology, is positioning itself to benefit from the expanding AI landscape. Qualcomm’s high-end Snapdragon processors are integral to many smartphones, and the company is launching new AI chips designed for large language model inference in 2026 and 2027.

Tepper’s strategy seems rooted in a value-oriented approach. In particular, he capitalized on a surge in Intel‘s stock price following a government announcement of a stake purchase in August 2024, which contributed to a recovery from earlier lows. The investment landscape for Intel had been rocky, as the company grappled with a challenging foundry business and the demand for its technology. Yet, Tepper’s timely entry into Intel allowed him to reap substantial gains before the stock approached its high valuations.

Similarly, Tepper’s investment in Oracle reflects a keen eye for potential. The company has made strides with strong earnings in its cloud infrastructure segment, buoyed by a significant contract with OpenAI valued around $300 billion. However, mixed signals from Oracle’s balance sheet and its heavy reliance on OpenAI’s success have added some uncertainty to its future prospects. Tepper’s timing was crucial as he divested a large portion of his holdings as the stock surged, perhaps indicating a cautious approach to the uncertainties that lie ahead.

In the semiconductor sector, Micron Technology has also seen fluctuations that align with Tepper’s investment patterns. While it was once a major position for the hedge fund, recently, Tepper has taken profits amid indications of pricing power for memory chips. This strategy, although profitable in the short term, raises questions about the cyclical nature of Micron’s business, which could face challenges as supply and demand stabilize.

Spotting Opportunity with Qualcomm

Qualcomm stands out as a surprising choice in Tepper’s portfolio, given its traditional focus on wireless connectivity. However, the company’s newer ventures into AI chip design indicate a strategic pivot. As demand for AI applications grows, Qualcomm’s diversification could provide it with a competitive edge. The anticipated rollout of its AI-focused chips aligns with a broader trend towards on-device AI, which may encourage higher utilization of its Snapdragon processors in smartphones.

Moreover, Qualcomm’s burgeoning automotive business, projected to see a 36% revenue increase in 2025, could further enhance its position as AI becomes more integrated into vehicle technology. As other chipmakers vie for market share, Qualcomm’s established presence could help it navigate the evolving landscape, especially as it faces a potential loss of a significant baseband customer in the coming years.

Looking ahead, Tepper’s investments in AI and technology reflect a broader confidence in the sector’s growth potential, despite the inherent risks associated with emerging markets. As companies like Qualcomm provide innovative solutions tailored for AI applications, investors may find value in diversifying their portfolios within this evolving landscape. With Qualcomm trading at a forward P/E ratio of just 13, it presents a compelling opportunity for those looking to capitalize on the AI boom.

As Tepper navigates through a rapidly changing investment climate, his latest moves underscore a commitment to identifying undervalued companies that stand to gain from the AI transformation. With AI anticipated to reshape numerous industries, investors and analysts alike will be keenly observing the outcomes of such strategic realignments.

See also AI Designs First Complete Genetic Blueprint for Virus Targeting Superbugs, Revolutionizing Synthetic Biology

AI Designs First Complete Genetic Blueprint for Virus Targeting Superbugs, Revolutionizing Synthetic Biology World Economic Forum Reveals Critical AI-Workplace Inflection Point Amid Skills Gap

World Economic Forum Reveals Critical AI-Workplace Inflection Point Amid Skills Gap AI in Customer Support: Study Shows 14% Speed Boost, But Quality Takes a Hit

AI in Customer Support: Study Shows 14% Speed Boost, But Quality Takes a Hit Rambus (RMBS) Gains Analyst Upgrade Amid AI Memory Surge; Fair Value Set at $120

Rambus (RMBS) Gains Analyst Upgrade Amid AI Memory Surge; Fair Value Set at $120 Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere