Advanced Micro Devices Inc. (NASDAQ:AMD) has emerged as a focal point in investment discussions following notable comments from financial commentator Jim Cramer. The semiconductor firm, known for designing and selling computer chips for various applications including computers and data centers, has seen its shares surge by 119% over the past year, along with a 13% rise year-to-date.

In January, Citi maintained a Neutral rating on AMD, setting a price target of $260. The firm highlighted the company’s AI business and its margins as significant factors to consider. Similarly, RBC Capital initiated coverage of AMD with a Sector Perform rating, pegging a price target of $230, acknowledging that the stock’s valuation already reflects the anticipated ramp-up in AI chip production. Additionally, Jefferies reiterated a Buy rating on AMD, while Truist also maintained a Buy rating, raising its price target to $277.

Cramer, known for his insights on the stock market, has praised AMD’s CEO and the company’s traction in the AI chip sector. In a recent segment, he remarked on the strong demand for AMD’s products, emphasizing that “those stocks are up” as the year began. He noted that AMD faces a shortage that cannot be met, suggesting a robust market position for the company. This commentary has fueled investor interest, aligning with broader trends in the tech sector.

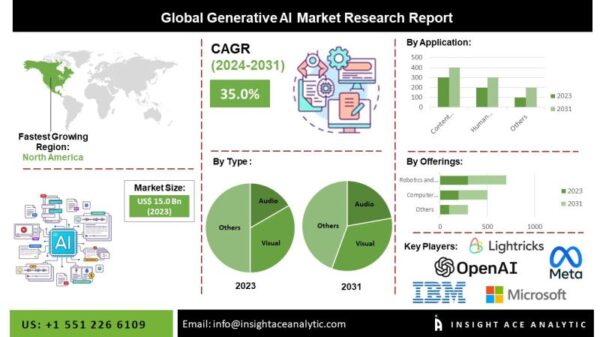

Despite the positive outlook for AMD, some analysts express caution. They argue that while AMD shows promise, there are alternative AI stocks that may offer higher returns with less downside risk. This nuanced perspective invites investors to consider a broader landscape of AI-related investments, especially as advancements in artificial intelligence continue to gain traction.

The demand for AI technology has surged across various industries, leading to increased competition among chip manufacturers. Companies are racing to develop and deploy AI chips capable of meeting the needs of evolving applications. As a result, AMD’s strategic positioning in this sector could be pivotal in sustaining its growth trajectory. Observers note that the company’s recent performance reflects not only its technological capabilities but also its ability to capitalize on market trends.

As the tech industry evolves, AMD remains a key player in the semiconductor market, driven by innovation in AI and computing. Investors will be closely monitoring the company’s developments and market responses in the coming quarters. The broader implications of AMD’s growth could extend beyond its own performance, influencing the dynamics of the entire semiconductor industry as well.

In conclusion, while AMD’s stock performance has captured significant attention, the competitive landscape in AI chip manufacturing suggests that the company will need to maintain its momentum. The ongoing dialogue surrounding AMD and its peers highlights a critical juncture in the tech sector, where investors are increasingly focused on companies that can effectively navigate the complexities of AI technology.

See also Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity

Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity Affordable Android Smartwatches That Offer Great Value and Features

Affordable Android Smartwatches That Offer Great Value and Features Russia”s AIDOL Robot Stumbles During Debut in Moscow

Russia”s AIDOL Robot Stumbles During Debut in Moscow AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse

AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech

Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech