In a climate marked by concerns over a potential artificial intelligence (AI) bubble, Canadian uranium producer Cameco (CCJ +3.66%) presents a strategic investment opportunity that allows stakeholders to hedge against risks while still positioning themselves to capitalize on the ongoing AI boom. The apprehensions surrounding AI investments echo the anxieties of the late 1990s dot-com bubble, where rapid technological advancements led to heightened speculation and unsustainable valuations.

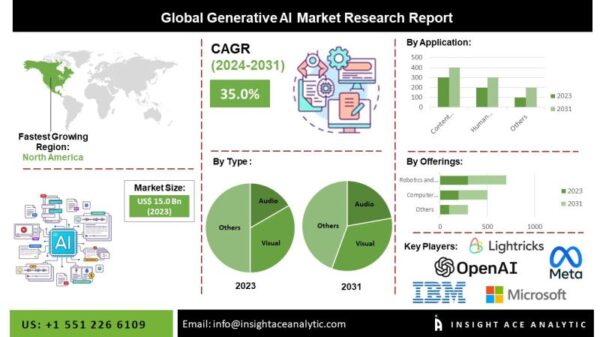

The AI market has experienced a meteoric rise, drawing parallels to the internet’s transformative impact. However, with billions of dollars pouring into AI and skepticism about short-term returns, investors are left grappling with the potential for over-speculation. Amid this uncertainty, Cameco offers a semblance of stability, rooted in its pivotal role in the global energy supply chain.

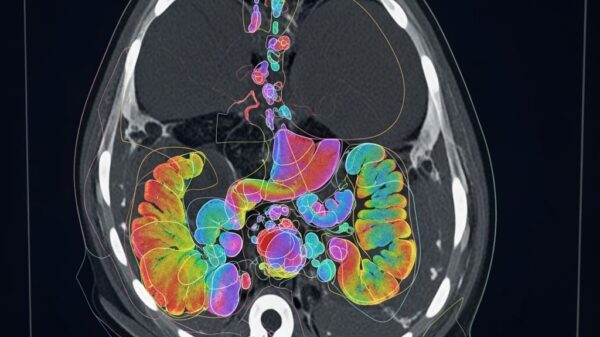

Cameco, the world’s second-largest uranium miner, is integral to meeting the energy demands of AI technologies. Its operations are not only vital to the nuclear power sector but also align with the increasing global focus on low-carbon energy solutions. The U.S. Department of Energy has set an ambitious goal to triple America’s nuclear capacity by 2050, underscoring the importance of uranium in the nation’s energy landscape. Currently, nuclear energy accounts for approximately 21% of the total energy output in the U.S., with 94 reactors relying on uranium as their primary fuel source.

Over the past year, Cameco has seen its stock price rise significantly, reflecting investor confidence. Despite a 15% dip in revenue for its third-quarter 2025, the company reported a 17% increase in revenue and a 31% surge in gross profits for the first nine months of the year. This uptrend is supported by a compound annual growth rate (CAGR) of 10.28% over the last five years, which accelerated to 24.18% in the past three years. This growth trajectory positions Cameco well within a market poised for expansion, as global uranium demand is projected to increase by 28% by 2030, according to the World Nuclear Association.

In addition to its production capabilities, Cameco owns the highest-grade uranium mine globally and the largest high-grade uranium mine, both located in Canada. The strategic significance of Canadian uranium is underscored by favorable tariff treatment in the U.S., where Canadian energy exports are subject to a reduced tax rate of 10%, compared to the standard 25% for most other goods. This preferential rate highlights the crucial role that Cameco and Canadian uranium play in supporting U.S. energy needs.

Moreover, Cameco’s 49% stake in Westinghouse Electric Company further enhances its positioning within the nuclear supply chain. Westinghouse is responsible for producing the AP 1000 reactors that the U.S. government has committed $80 billion to procure, ensuring that Cameco stands to benefit from multiple aspects of the nuclear energy sector.

As the world grapples with energy transition challenges, countries are once again reevaluating nuclear energy as a viable solution to meet growing energy needs sustainably. With 70 new nuclear reactors currently under construction and a further 115 planned globally, Cameco is well-positioned to supply the uranium required for these developments. Its robust operational framework and market positioning bode well for future growth, even amid market uncertainties associated with AI investments.

For investors looking for a way to shield themselves from the volatility associated with AI stocks while still gaining exposure to the sector’s growth, Cameco offers a compelling alternative. By capitalizing on the dual forces of nuclear energy demand and AI technology growth, Cameco represents a potential win-win scenario, positioning itself as a crucial player in an evolving energy landscape.

See also Bank of America Warns of Wage Concerns Amid AI Spending Surge

Bank of America Warns of Wage Concerns Amid AI Spending Surge OpenAI Restructures Amid Record Losses, Eyes 2030 Vision

OpenAI Restructures Amid Record Losses, Eyes 2030 Vision Global Spending on AI Data Centers Surpasses Oil Investments in 2025

Global Spending on AI Data Centers Surpasses Oil Investments in 2025 Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge

Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge Investors Must Adapt to New Multipolar World Dynamics

Investors Must Adapt to New Multipolar World Dynamics