Microsoft CEO Satya Nadella’s recent claims regarding the widespread adoption of the company’s Copilot AI have sparked significant debate about the actual penetration of artificial intelligence tools in enterprises. Speaking during the company’s fiscal second-quarter earnings call, Nadella highlighted that Microsoft’s AI assistant has gained considerable traction among customers. However, questions remain about whether usage metrics correspond to the transformative potential that warranted billions in infrastructure investments.

According to TechCrunch, Nadella asserted, “people are using Microsoft’s Copilot AI a lot,” citing engagement figures that the company believes validate its AI-first strategy. This statement comes at a crucial juncture as enterprise clients assess whether generative AI tools offer measurable productivity improvements that justify their premium pricing structures. Priced at $30 per user per month, in addition to existing subscription costs, Microsoft 365 Copilot demands a significant financial commitment from organizations already facing economic challenges.

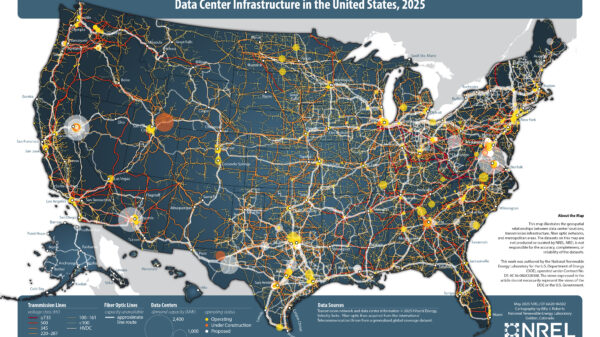

The timing of Nadella’s defense is especially critical given increasing pressure from investors who are seeking tangible returns on Microsoft’s estimated $50 billion annual expenditure on AI infrastructure. While the company reported substantial contributions from AI services to Azure’s growth, the essential test lies in turning cloud consumption into sustained Copilot seat adoption, determining if generative AI has transitioned from experimental use to mission-critical workflows.

One of the technology industry’s most contentious issues is defining what constitutes meaningful AI adoption. Microsoft has disclosed that hundreds of thousands of organizations utilize Copilot, yet the company has been cautious in providing detailed metrics regarding daily active users or engagement rates. This lack of transparency has fueled skepticism among analysts who observe that enterprise software often suffers from the “shelfware” phenomenon, where purchased licenses remain largely unused.

Industry analysts note that Microsoft’s definition of usage may cover a broad range, from employees who utilize Copilot multiple times a day to those who engage with the feature sporadically for specific tasks. This distinction is crucial for evaluating whether the technology has achieved the necessary workflow integration to drive renewal rates and expansion sales. Without standardized benchmarks for AI adoption, companies can present vastly different narratives using technically accurate but strategically selective data.

The challenge extends beyond mere usage statistics to issues of value realization. Early adopters report mixed outcomes, with some departments finding Copilot essential for drafting communications and analyzing data, while others struggle to identify justifiable use cases. This variability implies that successful deployment necessitates not just licensing the technology but also investing in change management, training, and workflow redesign—elements that Microsoft’s usage claims may not fully encompass.

Microsoft’s financial disclosures shed light on the economics behind Copilot adoption, indicating that AI services are growing faster than any product in the company’s history. However, this growth reflects Azure AI infrastructure consumption by both Microsoft’s services and third-party developers, not exclusively Copilot subscriptions. Understanding whether enterprises are primarily purchasing AI capabilities or AI-enabled productivity tools is essential for grasping Microsoft’s competitive positioning.

The competitive dynamics are intensifying, as Microsoft’s promotion of Copilot occurs amid growing competition from the likes of Google, Anthropic, and other specialized AI vendors. Google’s Workspace AI features, offered at similar pricing, present an alternative that integrates into a different productivity ecosystem. Meanwhile, firms such as Anthropic position Claude as a safer option for enterprises facing stringent compliance requirements, potentially fragmenting the market Microsoft aims to dominate.

Conversations with enterprise IT leaders reveal a complex decision-making process that goes beyond Copilot’s technical capabilities. Chief information officers frequently cite concerns over data governance, accuracy verification, and integration complexity as impediments to deployment, even when pilot programs show promise. Ensuring that AI-generated content adheres to regulatory standards in sectors like healthcare, finance, and legal creates a validation burden that can hinder productivity gains.

Security and compliance teams have expressed significant concerns about Copilot’s access to organizational data, fearing potential exposure of sensitive information or unintentional data breaches. Although Microsoft has implemented controls to respect existing permissions, enterprise security architectures often require additional safeguards that complicate deployment. Consequently, even willing organizations may take months to transition from limited pilots to company-wide rollouts.

Another barrier to adoption is the ongoing skills gap. To maximize Copilot’s value, employees need to become proficient in prompt engineering and understand the tool’s capabilities and limitations well enough to verify outputs. Effective use requires more than merely enabling the feature; structured training and best practices tailored to specific roles are essential. This additional investment increases the total cost of ownership beyond what Microsoft’s per-seat pricing reflects.

Looking forward, achieving the extensive adoption that Nadella suggests will necessitate addressing several fundamental challenges. Microsoft must clearly demonstrate ROI metrics that resonate with CFOs contemplating expansion beyond initial pilot programs. Vague productivity claims need to transition into specific benchmarks showcasing measurable improvements in task completion times, error reduction, or output quality.

Ultimately, as enterprise AI evolves from experimental to operational status, customers will demand rigorous usage reporting akin to that expected for other critical systems. Microsoft’s ability to deliver this transparency while safeguarding competitive information will significantly influence the acceptance of Nadella’s assertions regarding widespread adoption. The stakes extend beyond Microsoft’s financial results to the broader question of whether generative AI can fulfill its transformative promise in enterprise environments.

See also Global Aerospace’s Jetstream Reveals Key Innovations and Risks Shaping Aviation’s Future

Global Aerospace’s Jetstream Reveals Key Innovations and Risks Shaping Aviation’s Future Outtake Secures $40M Series B Funding to Enhance AI Security Solutions for Enterprises

Outtake Secures $40M Series B Funding to Enhance AI Security Solutions for Enterprises 2026: Leaders Navigate AI Risks and Geopolitical Volatility Amid Ongoing Economic Uncertainties

2026: Leaders Navigate AI Risks and Geopolitical Volatility Amid Ongoing Economic Uncertainties Bloom Energy Surges 79% Amid $2.65B AI Data Center Power Deal, Faces Valuation Risks

Bloom Energy Surges 79% Amid $2.65B AI Data Center Power Deal, Faces Valuation Risks Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere