Bloom Energy (BE) has regained investor attention following a significant long-term offtake agreement with an American Electric Power subsidiary, valued at approximately US$2.65 billion. This contract is linked to the increasing power demands of data centers driven by artificial intelligence (AI), highlighting a burgeoning market opportunity for Bloom Energy’s solid oxide fuel cells.

The recent momentum in Bloom Energy’s stock is noteworthy, with a 30-day share price return of 79.36% and a year-to-date increase of 58.59%. However, the stock experienced a slight decline of 5.37% in the last trading session, closing at US$156.51. Despite this recent dip, the one-year total shareholder return remains robust, and the five-year total shareholder return has nearly tripled, indicating a sustained upward trajectory.

As AI continues to shape power demand, investors are likely to examine other high-growth tech and AI stocks within this dynamic landscape. The recent contract with American Electric Power comes on the heels of a six-month surge in Bloom’s stock, raising questions about whether the current valuation is reflective of future growth potential or if the market has already priced in several years of anticipated gains.

Valuation Insights

Currently, the prevailing market narrative suggests that Bloom Energy is approximately 40.8% overvalued, with analysts estimating a fair value of $111.18 per share, significantly lower than its recent closing price. This discrepancy points to a potential valuation gap that investors must consider. Analysts have set a consensus price target of $34.57 for Bloom Energy, taking into account projections for future earnings growth, profit margins, and various risk factors. Disagreement among analysts is evident, with the most optimistic forecasting a target of $48.00, while the most pessimistic predicts a low of $10.00.

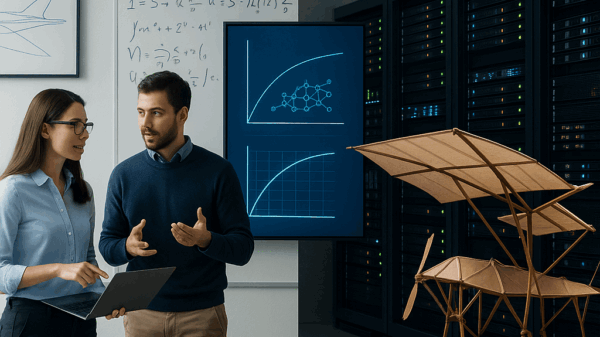

For those looking to understand the underlying assumptions propelling this higher fair value, it’s essential to assess the revenue curves and margin profiles that analysts are utilizing. The narrative surrounding Bloom Energy’s valuation hinges on a specific growth trajectory and the perceived quality of its earnings—a combination that investors may or may not agree with.

However, the bullish narrative surrounding Bloom Energy could falter if zero-emission competitors manage to undercut the cost of natural gas-based fuel cells or if the company’s expanded manufacturing capacity sees low demand and utilization.

For those interested in exploring different perspectives, there are tools available to construct a tailored narrative based on individual analyses and assumptions. A valuable starting point includes reviewing Bloom Energy’s financials, which outline two key rewards and four significant warning signs that could influence investment decisions.

As the market continues to evolve, the implications of Bloom Energy’s recent contract and its sustained stock performance on investor sentiment will remain a focal point. The interplay between technological advancements in AI and the energy sector underscores the need for vigilant analysis among investors seeking to navigate this complex landscape.

As this narrative develops, it is crucial for investors to remain informed about the broader market dynamics and potential opportunities that lie ahead. For a deeper dive into Bloom Energy’s financial condition, fair value estimates, risks, and insider trades, investors can access detailed analysis that aims to simplify the complexities of valuation in this rapidly changing sector.

This article serves as a general commentary based on historical data and analyst forecasts, and is not intended as financial advice. It does not constitute a recommendation to buy or sell any stock, nor does it take into account individual financial objectives or situations. To learn more about Bloom Energy, visit their official site at Bloom Energy.

See also Meta Platforms Announces $135 Billion AI Investment, Signaling Industry Growth

Meta Platforms Announces $135 Billion AI Investment, Signaling Industry Growth BoodleBox and NVIDIA Launch AI Tools for 800,000 Students, Revolutionizing Classroom Learning

BoodleBox and NVIDIA Launch AI Tools for 800,000 Students, Revolutionizing Classroom Learning AI News Demands ‘Nutrition’ Labels; Tech Firms Must Compensate Publishers, IPPR Urges

AI News Demands ‘Nutrition’ Labels; Tech Firms Must Compensate Publishers, IPPR Urges Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT