Recent corruption investigations involving senior public officials in Malaysia have shaken public confidence in the nation’s institutions. These scandals, each with its own complexities, highlight a pervasive governance challenge. Fraud and corruption within the public sector often stem not merely from individual misconduct but from systemic issues in oversight, accountability, and risk management. To address these vulnerabilities, Malaysia requires not only ethical leadership but also enhanced governance systems underpinned by modern, data-driven auditing practices.

Good governance hinges on the responsible stewardship of public resources. It necessitates transparency in decision-making, clear authority allocation, effective internal controls, and credible assurance mechanisms. When these elements are robust, the scope for fraud diminishes. Conversely, weak governance—especially in high-value areas like procurement, defense spending, and major infrastructure projects—creates fertile ground for corruption. Recent scandals involving high-ranking army officials in Malaysia serve as a case study, underscoring how governance gaps can lead to abuses of power.

Auditing is a cornerstone of effective governance but the traditional focus on retrospective compliance checks is increasingly inadequate in a landscape marked by intricate transactions and digital systems. International research consistently indicates that audit quality improves when auditors employ risk-based strategies supported by data analytics. Rather than merely sampling transactions, auditors can now analyze entire datasets—payments, contracts, payroll records, and asset registers—to identify anomalies that may signal potential fraud risks.

Data analytics empowers auditors to uncover red flags such as split procurements designed to avoid approval thresholds, repeated awards to related vendors, unusual pricing patterns, and discrepancies between contract terms and actual deliveries. Moreover, when integrated with historical data, analytics offer insights into emerging risk patterns across different ministries or agencies, allowing auditors to focus on high-risk areas before losses accumulate. This proactive approach transforms auditing from a reactive task into a preventive function.

Artificial intelligence (AI) further enhances auditing capabilities. Machine learning algorithms can analyze past fraud cases to refine risk scoring, identifying transactions or entities that deviate from normative behavior. Network analysis, meanwhile, can reveal hidden connections among suppliers, officials, and intermediaries that manual reviews might miss. Continuous auditing systems powered by AI enable near real-time monitoring, minimizing the lag between irregular activities and corrective actions—a crucial factor in deterring fraudulent behavior.

Malaysia’s public audit institutions have begun to embrace these technological advancements. The National Audit Department has publicly affirmed its commitment to technology-driven, data analytics-based auditing to boost efficiency, accuracy, and impact, alongside quicker reporting and more robust follow-ups on audit findings. These initiatives reflect an acknowledgment that modern public-sector challenges demand innovative assurance tools, especially as public funds increasingly flow through digital platforms.

However, technology is not a panacea. Research indicates that data analytics and AI are not standalone solutions; rather, they enhance the governance framework’s underlying strength. When governance structures are sound, these tools augment oversight and early detection. In contrast, if governance is weak, these technologies may merely highlight existing deficiencies without rectifying them. For digital audit tools to be effective, they must be integrated within robust institutional frameworks.

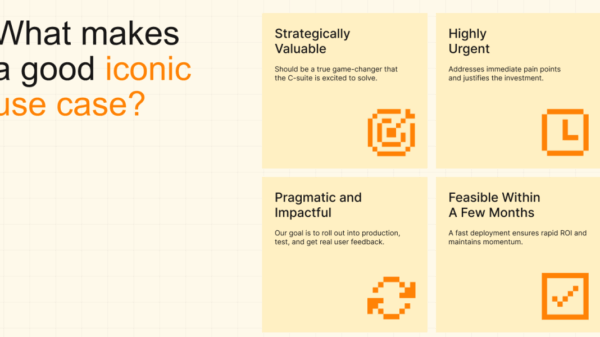

Consequently, several policy directions warrant urgent attention. Audit planning should focus explicitly on risk, particularly in high-discretion and high-value activities. Investments in analytics and AI must be accompanied by efforts to enhance auditor competence, professional judgment, and ethical training. Furthermore, integrating data across procurement, finance, human resources, and asset management systems is critical for reliable analytics. Audit findings must also be paired with enforceable follow-up and consequences, ensuring that identified issues lead to corrective actions rather than mere documentation. Above all, strong leadership commitment is essential for fostering an organizational culture that does not tolerate corruption.

Ultimately, the fight against fraud and corruption in Malaysia’s public sector is not just a technical issue but a governance challenge. By aligning robust governance principles with risk-based auditing and responsible use of data analytics and AI, Malaysia can transition from reactive responses to scandals towards a proactive, resilient integrity system. Such an approach may not entirely eliminate corruption, but it will significantly raise the stakes for wrongdoing and contribute to restoring public trust in the institutions responsible for managing the nation’s resources.

*Noor Adwa Sulaiman is an Associate Professor at the Department of Accounting, Faculty of Business and Economics, Universiti Malaya and may be reached at [email protected]

*This is the personal opinion of the writer or publication and does not necessarily represent the views of Malay Mail.

See also AI Transforms Health Care Workflows, Elevating Patient Care and Outcomes

AI Transforms Health Care Workflows, Elevating Patient Care and Outcomes Tamil Nadu’s Anbil Mahesh Seeks Exemption for In-Service Teachers from TET Requirements

Tamil Nadu’s Anbil Mahesh Seeks Exemption for In-Service Teachers from TET Requirements Top AI Note-Taking Apps of 2026: Boost Productivity with 95% Accurate Transcriptions

Top AI Note-Taking Apps of 2026: Boost Productivity with 95% Accurate Transcriptions