Commodity markets have faced a significant downturn, with metal prices plummeting and reversing gains for numerous producers listed on the FTSE 100. Major mining companies such as Fresnillo and Antofagasta, alongside oil giants BP and Shell, have seen their stock values decline as investor sentiment weakens and earnings outlooks dim due to the rapid drop in commodity prices.

Gold prices have fallen by 21% from a peak of $5,594 per ounce on January 29 to an intraday low of $4,403. Silver has experienced an even steeper decline, down 32% from its year-to-date high recorded less than a week ago. Likewise, values for copper and oil have also decreased sharply.

Many investors flocked to gold and silver as a hedge against geopolitical volatility, only to find that these assets can also display significant price fluctuations. Over the past year, a considerable number of investors have purchased funds that track gold and silver mining companies, banking on the notion that the miners’ values would increase more than the rise in metal prices. However, this principle works in reverse during downturns, as evidenced by past performance; between March and November 2022, when gold dropped by around 20%, the S&P Commodity Producers Gold Index lost nearly 40%. Similarly, from October 2024 to year-end, a 6% decrease in gold correlated with an 18% drop in the basket of gold miners.

The reasons behind the recent significant declines in gold and silver prices are varied. One theory suggests that metal prices surged too rapidly and are now correcting towards more sustainable levels. Concerns surrounding the Federal Reserve’s independence have also played a role, particularly after former President Trump nominated Kevin Warsh as the new Fed chair. Warsh, known for his hawkish views, is unlikely to endorse drastic interest rate cuts, thereby bolstering the US dollar. A stronger dollar makes gold more expensive for buyers using other currencies, which could reduce its demand.

The derivatives marketplace operator CME has also raised margins on gold and silver futures, necessitating higher collateral from traders. This policy change could drive out speculators unable to meet the new requirements, prompting further sell-offs and contributing to the current market exit.

The sell-off in gold and silver assets is expected to strain global investor sentiment, compounded by a shift in the technology sector. Major US tech stocks, previously responsible for market gains, have become sources of concern regarding overspending. Wall Street futures suggest a challenging day ahead for the tech-heavy Nasdaq index as US markets prepare to open.

As gold and silver assets fail to serve as reliable havens and tech stocks lose momentum, many investors are now seeking refuge in defensive stocks. Consumer goods companies like Unilever and Reckitt, as well as healthcare specialist Haleon and various Coca-Cola bottling entities, are gaining traction as their products may continue performing well regardless of broader market fluctuations.

AI / Technology: Nvidia, OpenAI, Oracle

In the tech sphere, the competition for AI chips is intensifying. Nvidia has enjoyed a dominant market position, but emerging custom-made chips for its major hyperscale clients have stirred speculation about its future supremacy. Nvidia’s CEO Jensen Huang has dismissed concerns, arguing that the company’s robust investment in research and development, alongside its scale and expertise, presents formidable barriers to competitors. Huang’s comments suggested a casual acknowledgment of the competition’s efforts to develop custom chips.

This narrative adds pressure ahead of Nvidia’s upcoming quarterly earnings report, with the company’s stock showing little movement since last November’s third-quarter results. Concerns have also emerged regarding Nvidia’s previously announced $100 billion agreement with OpenAI for training and deploying AI models. Insiders at Nvidia are reportedly apprehensive about the relationship, especially in light of increasing competition threatening OpenAI’s dominance with its flagship product, ChatGPT.

These trepidations could influence OpenAI’s anticipated IPO this year, potentially impacting perceptions of Oracle as well. While many tech firms are investing heavily in AI infrastructure, Oracle is accumulating debt for its ventures, which has led to a surge in the cost of insuring against potential defaults on its borrowings. As Oracle’s fortunes become more entwined with OpenAI’s success, anxiety surrounding both companies’ outlooks appears poised to persist.

See also NVIDIA’s Earth-2 Delivers 15-Day Weather Forecasts in Minutes, Revolutionizing Meteorology

NVIDIA’s Earth-2 Delivers 15-Day Weather Forecasts in Minutes, Revolutionizing Meteorology Google’s Project Genie Reveals AI’s Potential to Revolutionize Game Design and NPC Behavior

Google’s Project Genie Reveals AI’s Potential to Revolutionize Game Design and NPC Behavior India’s Economic Survey Urges Creation of AI Economic Council to Mitigate Labor Market Disruption

India’s Economic Survey Urges Creation of AI Economic Council to Mitigate Labor Market Disruption Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

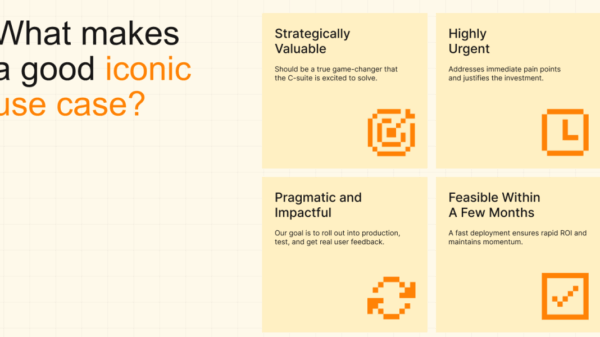

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT