GFT Technologies is emerging as a pivotal player in the financial services sector by modernizing decades of banking IT through a focus on AI and a cloud-first strategy. This German firm has established itself as a vital technology partner, helping conservative and highly regulated institutions transition into an AI-native and cloud-native future without compromising their critical systems.

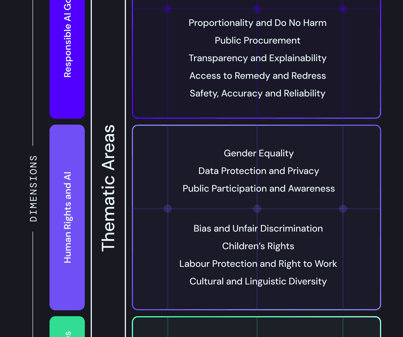

In an era where fintech companies and large tech platforms are encroaching upon traditional banking territories, incumbent banks and insurers face mounting pressure to modernize. They are tasked with migrating outdated COBOL-era core systems to the cloud and integrating generative AI into both front- and back-office operations while navigating complex regulations across Europe, the Americas, and Asia. GFT Technologies is strategically positioned to address these challenges, offering a comprehensive suite of services that include consulting and software engineering.

Unlike firms that provide a one-size-fits-all solution, GFT Technologies prides itself on being an end-to-end digital transformation partner, particularly for the financial services sector. Its deep domain expertise in capital markets and banking allows it to effectively bridge the gap between legacy infrastructure and next-generation technologies, including generative AI and advanced cloud architectures. This unique positioning has made it a leader in developing innovative solutions tailored to the regulatory landscape governing financial institutions.

At the core of GFT Technologies’ offerings is a focus on several key solution areas. The first is digital banking platforms and core modernization, where the company has invested significantly in blueprint architectures for digital banks. These solutions cover various functions from customer onboarding and KYC to payments and wealth management, typically leveraging cloud-native reference architectures that can be deployed on major hyperscalers such as AWS, Microsoft Azure, and Google Cloud. GFT’s close partnership with Thought Machine’s Vault core banking engine underscores its role as a specialist integrator in the evolving landscape of core banking-as-code.

On the legacy systems side, GFT Technologies has developed a proven method for dismantling monolithic mainframe systems into microservices-based platforms. By creating abstraction layers and APIs, GFT enables banks to innovate without the need for an entirely new core system, a crucial advantage for clients hesitant to undertake a full-scale replacement.

Generative AI is another area where GFT Technologies is making strides. The company is developing practical applications of this technology, including AI-driven copilot assistants for relationship managers and natural language interfaces that enhance customer and employee interactions. Typical implementations include AI tools that provide contextual insights and recommendations during client engagements, as well as advanced document processing for regulatory compliance.

Moreover, GFT Technologies does not develop its own large language models; instead, it orchestrates the best models from various cloud providers and AI firms, ensuring they are governed and integrated effectively with existing data and workflows. This orchestration, combined with its understanding of risk and compliance, sets GFT apart in the marketplace.

GFT Technologies is also focused on cloud transformation and high-performance computing. As banks increasingly require elastic compute resources for risk management and analytics, GFT combines multi-cloud strategy advisory with hands-on engineering. Its expertise encompasses everything from security hardening to application replatforming, which is essential for modern capital markets and insurance clients needing robust risk engines and complex pricing models.

Data and analytics form another critical aspect of GFT’s strategy. The firm develops modern data platforms that support real-time risk assessment, regulatory reporting, and fraud detection. The integration of robust data engineering is crucial for deploying AI technologies in regulated environments, an area where GFT Technologies excels.

While GFT is firmly rooted in financial services, it has expanded its reach into sectors such as insurance and manufacturing. This diversification not only mitigates risks associated with cyclical banking expenditures but also broadens its addressable market for AI and cloud solutions.

The growing adoption of cloud and AI technologies in banking has led institutions to seek partners like GFT that possess both engineering prowess and regulatory expertise. This combination has positioned GFT Technologies as an attractive option for banks and insurers embarking on large-scale digital transformations.

GFT Technologies faces competition from specialized IT consultancies and systems integrators, such as Endava, Globant, and Accenture, which offer similar services. Endava focuses on agile digital engineering for financial services, while Globant emphasizes design-heavy digital platforms. Accenture, on the other hand, provides a broader scale of cloud and AI services. Each competitor has a unique approach, but GFT’s specialization in complex, regulated environments gives it a competitive edge.

As the market for banking IT continues to evolve, GFT Technologies is not only focused on technical solutions but also on maintaining a strong stock narrative. GFT Aktie, its publicly traded share, reflects investor interest in digital transformation trends and AI initiatives within the financial sector. The company’s consistent revenue growth, driven by its robust cloud and AI pipeline, enhances its appeal to investors.

Overall, GFT Technologies exemplifies a quiet yet powerful force in modernizing essential financial systems. As banks increasingly prioritize AI and cloud adoption, GFT’s role as a trusted partner for both technology and regulatory compliance positions it well for future growth in a highly competitive landscape.

See also Bank of America Warns of Wage Concerns Amid AI Spending Surge

Bank of America Warns of Wage Concerns Amid AI Spending Surge OpenAI Restructures Amid Record Losses, Eyes 2030 Vision

OpenAI Restructures Amid Record Losses, Eyes 2030 Vision Global Spending on AI Data Centers Surpasses Oil Investments in 2025

Global Spending on AI Data Centers Surpasses Oil Investments in 2025 Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge

Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge Investors Must Adapt to New Multipolar World Dynamics

Investors Must Adapt to New Multipolar World Dynamics