Singapore’s financial institutions are among the world’s leaders in readiness for artificial intelligence (AI) and technological transformation, while Hong Kong ranks as one of the most AI-prepared financial markets, according to a recent survey by Finastra. The Financial Services State of the Nation 2026 report highlights that Singaporean respondents scored above global averages across various metrics related to AI readiness, adoption, cloud utilization, and overall technological preparedness.

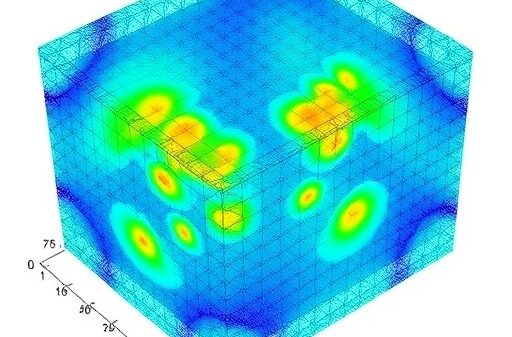

In Singapore, 64% of surveyed institutions reported actively deploying AI across key business functions, with an additional 35% engaged in piloting or researching AI technologies. Notably, there were no respondents indicating plans to forgo AI adoption entirely. This strong inclination towards AI is bolstered by a robust self-assessment of core technology infrastructures; 71% of Singaporean respondents rated their systems as ahead of their competitors, attributing this to ongoing modernization efforts focusing on scalability, data foundations, and integration.

Security and reliability emerged as another area of confidence, with 71% asserting they are ahead of peers in these domains, a result attributed to a strong emphasis on controls, resilient architectures, and adherence to regulatory requirements. Moreover, 69% of institutions felt their customer experience and personalization capabilities surpassed those of competitors, while only 8% considered themselves lagging. Looking ahead, 83% plan to invest in initiatives aimed at enhancing customer experience and personalization, such as real-time payments and 24/7 chatbot services.

Cloud adoption in Singapore is notable yet varies by operational model. The survey revealed that 55% of institutions primarily utilize cloud hosting, while 30% operate in hybrid environments, and 13% remain predominantly on-premise. When it comes to acquiring new technology, 55% reported developing internally, 32% opted for a blended approach with fintech partners, and 9% primarily rely on partnerships.

On organizational readiness, a significant 84% of Singaporean respondents expressed confidence in their ability to handle technological and cultural changes, with only 7% feeling unprepared. Chris Walters, CEO of Finastra, noted that the findings indicate a shift where AI has moved into core operational practices. “Singapore institutions are showing what AI execution at scale really looks like,” he stated. “This is not about isolated pilots. It is about embedding AI into core operations, supported by modern infrastructure, strong data foundations, and disciplined governance. That combination enables institutions to move faster, while strengthening security, trust, and customer experience – the foundations of long-term competitive advantage.”

In contrast, Hong Kong’s financial sector is evolving from AI experimentation to execution, with sustained investments in technology modernization. The survey found that nine in ten institutions are either actively deploying or piloting AI technologies. Common applications include customer service automation, risk management, fraud detection, workflow automation, credit underwriting, and marketing intelligence.

Survey respondents identified several objectives for their AI initiatives, including improving accuracy, reducing errors, lowering operational costs, reinforcing compliance and regulatory processes, and enhancing risk management frameworks. The data indicated high organizational readiness, with 80% of respondents stating they are prepared or fully prepared for technological transformation. Cloud adoption in Hong Kong rated higher than in Singapore, with 86% utilizing cloud solutions, and 50% reported running the majority of their software stack in the cloud. Many institutions have also made strides in modernizing significant portions of legacy infrastructure.

Security and reliability received commendable ratings, as 72% of respondents stated their security posture is ahead or significantly ahead of their competitors. Recent areas of investment included enhancements in Security Information and Event Management (SIEM) and Security Orchestration, Automation, and Response (SOAR), fraud detection, multi-factor authentication, and disaster recovery upgrades. Expectations for security investments are anticipated to rise further by 2026.

On the customer experience front, 65% of Hong Kong institutions reported that their capabilities in this area are ahead of their peers. Focus areas included real-time payments, personalized recommendations, and 24/7 virtual assistants linked to environmental, social, and governance (ESG) preferences. Overall, the survey captured a positive sentiment, with 90% of respondents expressing excitement about the pace of technological and cultural change within the financial services sector.

Walters emphasized that the results demonstrate scaled AI deployment across the market. “Hong Kong institutions are demonstrating what disciplined AI execution looks like at scale,” he commented. “With modern infrastructure and a clear commitment to responsible innovation, they are turning AI from pilot projects into measurable business impact, while maintaining the highest standards of security, trust, and customer experience.”

See also Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed

Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights

Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September

Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users

BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025

MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025