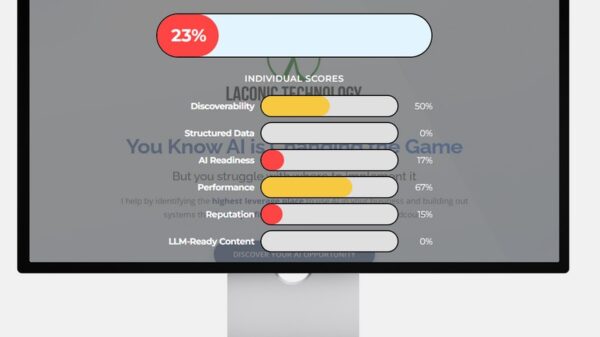

Investors are grappling with the implications of AI advancements as market volatility rises, leading to fears of significant sector displacement and the obsolescence of businesses deemed resistant to artificial intelligence.

In a week marked by heightened uncertainty, a prevailing sentiment among investors suggests that the concept of an “AI-resistant” industry is rapidly fading. As stock markets react to the latest signals of AI disruption, the distinction between beneficiaries and victims of these technologies is becoming increasingly blurred.

The concern centers on the notion that AI may not provide a universal uplift to corporate America. In contrast to the adage that a rising tide lifts all boats, the emergence of generative AI is likened to a violent storm that threatens to dismantle established enterprises across various sectors including software, logistics, and accounting.

As investors observe recent stock market fluctuations, it’s evident that not all businesses will benefit equally from AI advancements. While some may find pathways to increased efficiency and profitability, others might face severe threats to their viability.

Market reactions appear to reflect a dichotomy of perspectives on AI’s role in the future economy. Depending on their recent engagements with AI-related content, some investors may view the current jitters as justified, while others suspect that the market’s response may be an overreaction. The struggle to discern which viewpoint holds more merit is emblematic of the broader uncertainty permeating financial markets.

A key observation from DataTrek’s Nick Colas underscores the difficulty in predicting AI’s trajectory. “Investors are uniquely attuned to disruptive innovation’s impact on markets/returns but are clearly struggling to anticipate AI’s ‘punchline,'” Colas noted. He referenced historical precedents like Napster and Craigslist that reshaped industries, illustrating the potential for AI to catalyze similar transformations.

As AI technology continues to advance, businesses face increasing pressure to demonstrate resilience against potential obsolescence. The volatility witnessed in recent market sessions reflects a growing awareness among investors of how rapidly legacy companies can become vulnerable to new entrants that leverage AI capabilities to improve operational efficiency and reduce costs.

With high fees and labor costs acting as prime candidates for AI intervention, the current climate of investor sensitivity may be interpreted as both a reaction to irrational fears and a broader recognition of AI’s transformative potential. This duality suggests that heightened volatility is likely to persist as markets navigate the complexities of AI’s integration into various business models.

The essential takeaway is that clarity is paramount. While fears of upheaval abound, rational analyses can temper these anxieties. For instance, the arrival of a new AI-empowered logistics player need not threaten established freight carriers if the latter can adapt and leverage AI for their own advantages.

Despite individual assessments, it is crucial to remember that market consensus may not always align with personal convictions. The recent fluctuations reflect a collective questioning of whether the current AI hype might be underappreciated rather than overstated.

As industries like software, real estate, and logistics grapple with these changes, the imperative for established companies to assure investors of their resilience against AI disruption becomes clearer. Businesses are now tasked with demonstrating that they can not only coexist with AI but utilize it as a tool for enhanced productivity.

In conclusion, as the dialogue around AI’s impact on the economy evolves, both investors and companies must navigate the uncertainties ahead. The details that will clarify AI’s long-term implications for various sectors remain to be fully understood, but the stakes are undeniably high.

See also Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed

Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights

Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September

Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users

BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025

MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025