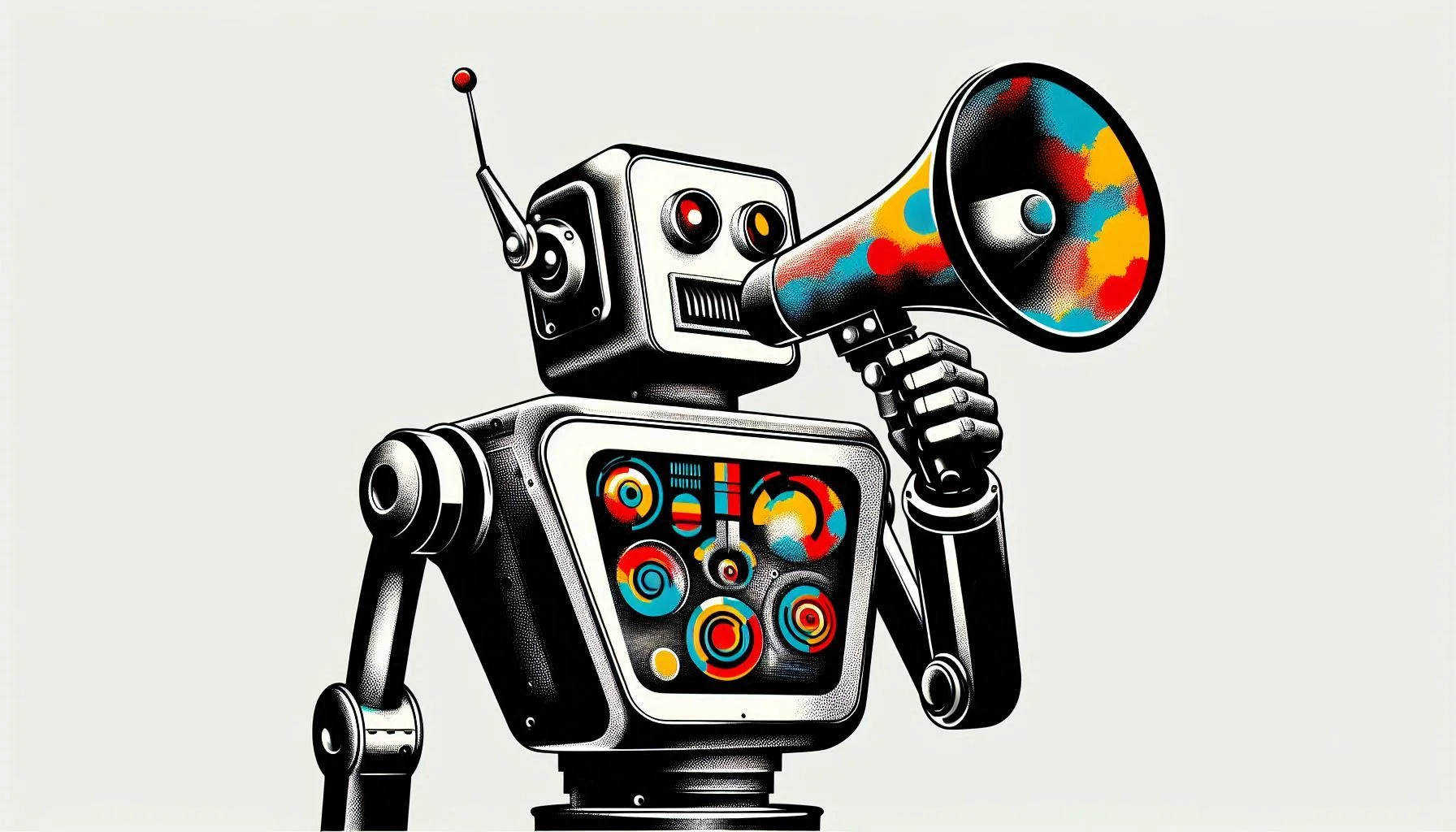

Series A founders in 2026 are encountering a paradox: despite having access to powerful go-to-market (GTM) automation tools, a staggering majority still fail to achieve $10 million in revenue, much less the $25 million threshold that signifies true enterprise scale. The technology itself is not at fault. AI-driven GTM platforms such as Clay, Gong, 6sense, and Persana AI have proven transformative, enabling founders to reach broader audiences, target with precision, and personalize messaging at an unprecedented speed. However, the critical issue lies in the messaging that founders amplify through these sophisticated tools.

The phenomenon, dubbed the “megaphone paradox,” illustrates the limitations of these automation tools. While they significantly increase outreach capabilities, they merely amplify existing narratives. For many Series A startups aiming for that initial $25 million, the foundation of their positioning and messaging often lacks the sophistication required for enterprise-level engagement. This leads to a predictable outcome: companies inundate vertical markets with content that garners clicks and likes but fails to convert into actual revenue.

Research indicates that fewer than 0.4% of startups reach $10 million in annual recurring revenue, with an even smaller percentage achieving $25 million. Among those that surpass $1 million, less than 10% advance to the next milestone. These statistics highlight a grim reality for founders; often, the primary issue is not product-market fit but rather the execution of GTM strategies. Many startups approach GTM with a traditional SaaS playbook, assuming that enterprise buyers already comprehend the problems they address and possess budgets for their solutions.

This assumption falls flat for disruptive startups, particularly those in AI and deep tech. Buyers often lack the vocabulary to articulate the issues these new solutions tackle, and procurement teams may not have the criteria to adequately compare competing options. Consequently, even the most advanced AI automation tools can devolve into mere background noise.

For enterprise buyers, the evaluation of new solutions is less about the product itself and more about minimizing uncertainty. When faced with options from early-stage, disruptive vendors, buyers seek validation from various sources. These include advocacy from industry peers, relevant case studies, analyst insights, media coverage, and recognizable reference customers. Without these credibility signals, personalized outreach, regardless of how well-crafted, often goes ignored.

Market Shaping as a Strategic Foundation

Market shaping emerges as a crucial strategy for startups aiming to effectively engage enterprise buyers. This deliberate approach involves crafting the narrative around the problem, establishing evaluation criteria, and generating the necessary credibility signals for acceptance. It goes beyond mere thought leadership; it is about cultivating an environment wherein buyers can confidently endorse disruptive solutions.

Key elements of market shaping include developing a category point of view, which clearly explains why traditional solutions falter and what new approaches will prevail. Startups must establish positioning that withstands scrutiny, moving beyond simplistic claims of being “faster” or “cheaper.” Establishing proof points, such as early enterprise wins and measurable outcomes, enables buyers to relay these narratives internally with credibility.

Furthermore, messaging should align across various stakeholders, addressing the different concerns of CFOs, CIOs, CROs, and COOs. Buyers need to see how new solutions impact financial outcomes, integration, and operational efficiency. The integration of third-party validation from analysts and trusted industry voices can further bolster credibility. Equally important is providing sales teams with the tools to address objections and communicate implementation realities effectively.

When these foundational elements are in place, AI GTM automation serves its intended purpose—acceleration. Startups can test diverse messages without compromising coherence, scale outreach without losing relevance, and create sufficient touchpoints to secure mindshare while competitors are still defining their value propositions. However, if startups fail to fortify their GTM strategies with market shaping, they risk generating mere noise rather than establishing a viable pipeline.

Ultimately, if founders are investing in AI GTM automation, they must critically assess the quality of the narrative they are amplifying. If the messaging comprises largely generic content lacking substantiated proof points, the effort is unlikely to yield traction. The pitfalls of automating outreach without a solid market-shaping foundation can be detrimental, resulting in ignored communications, unqualified leads, and rising customer acquisition costs.

By combining effective market shaping with AI amplification, startups can transform their outreach into a potent growth strategy. This synergy enables them not only to extend their reach but also to reshape market perceptions, resulting in sales conversations that focus on implementation rather than justification. In an increasingly competitive landscape, the marriage of strategic market shaping and advanced automation technologies is not just advantageous—it is essential for sustainable growth.

See also Vixiv CEO Aaron Chow Launches AI-Driven Lattice Generation to Revolutionize Manufacturing

Vixiv CEO Aaron Chow Launches AI-Driven Lattice Generation to Revolutionize Manufacturing monday.com Reports Strong Q4 Earnings but Issues Cautious 2026 AI Revenue Guidance

monday.com Reports Strong Q4 Earnings but Issues Cautious 2026 AI Revenue Guidance Check Point Reveals Four-Pillar AI Security Strategy with Key Acquisitions to Enhance Protection

Check Point Reveals Four-Pillar AI Security Strategy with Key Acquisitions to Enhance Protection AI Transforms Health Care Workflows, Elevating Patient Care and Outcomes

AI Transforms Health Care Workflows, Elevating Patient Care and Outcomes Tamil Nadu’s Anbil Mahesh Seeks Exemption for In-Service Teachers from TET Requirements

Tamil Nadu’s Anbil Mahesh Seeks Exemption for In-Service Teachers from TET Requirements