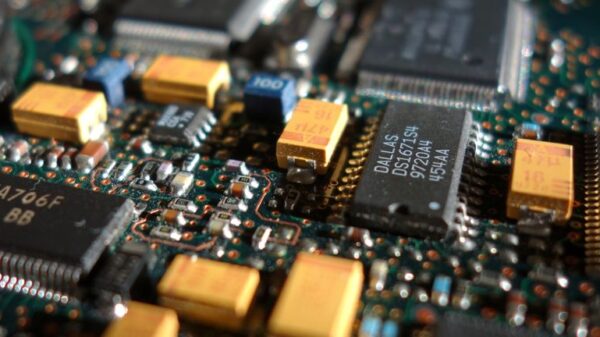

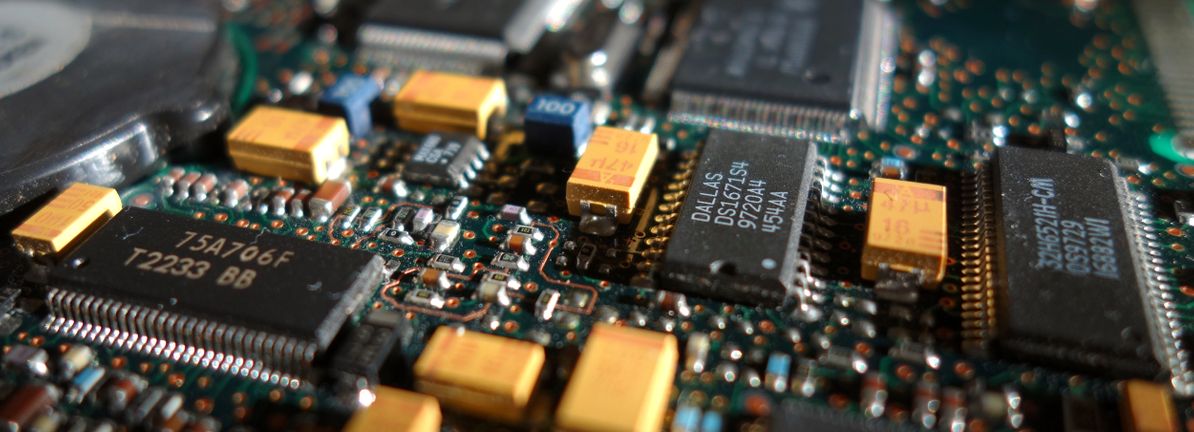

Allegro MicroSystems has unveiled the ACS37017 Hall-effect current sensor, enhancing its high-performance portfolio aimed at meeting the growing demands of speed, power density, and accuracy in power electronics for sectors like AI data centers, electrified vehicles, and clean energy systems. This introduction comes as part of Allegro’s strategic focus to provide ultra-precise current sensing solutions, particularly critical for stabilizing high-voltage power conversion.

The ACS37017 features integrated high-voltage isolation and a factory-calibrated architecture, boasting a typical sensitivity error of just 0.55% over its lifetime and across varying temperatures. This level of accuracy is positioned to bolster Allegro’s competitive advantage in an increasingly technology-driven landscape.

As Allegro integrates the ACS37017 into its product offerings, the implications for the company’s investment narrative are noteworthy. Investors must recognize that owning shares in Allegro necessitates a belief in the rising demand for precise power and current sensing across automotive, data center, and clean energy applications. Additionally, there is an expectation that the company can translate its product innovations into lasting design wins despite facing a premium valuation and significant dependence on the automotive sector.

Recent leadership changes at Allegro might provide further support for this narrative. The promotions of Ian Kent to Senior Vice President of Operations and Jamie Haas to Vice President and Chief Technology Officer signal a commitment to enhancing operational discipline and focused technology leadership. These transitions are particularly pertinent as Allegro seeks to expand its new sensor family across rapidly growing markets.

Nonetheless, the company must navigate a challenging environment characterized by rising competition and persistent price pressures, particularly given its concentrated exposure to automotive markets and manufacturing in China. Observers are urged to consider how these factors may interact with Allegro’s premium valuation and overall market positioning.

Looking ahead, Allegro MicroSystems projects revenues of $1.2 billion and earnings of $249.0 million by 2028, necessitating a robust annual revenue growth rate of 17.3% and a substantial earnings recovery from its current deficit of $68.6 million. Analysts suggest that achieving these targets could yield a fair value estimate of approximately $38.42, indicating a potential 9% downside from the current price levels.

Some analysts maintain a more optimistic outlook, projecting revenues could reach as high as $1.4 billion with earnings nearing $154.0 million. They emphasize that supply chain localization could serve as a key advantage for Allegro. However, the recent sensor launch and leadership shifts may either reinforce or challenge this bullish perspective, making it essential for investors to match these forecasts against their own assessments.

For those considering an investment in Allegro MicroSystems, examining individual narratives is crucial. The opportunity to construct a personalized investment thesis in under three minutes is available, reinforcing the idea that exceptional returns often arise from independent analysis rather than consensus thinking.

Investors looking for robust analytical resources can access a comprehensive report detailing one key reward that could significantly influence investment decisions, along with a fundamental analysis summarized visually using the Snowflake method, which facilitates an at-a-glance evaluation of Allegro’s financial health.

As markets continue to evolve, identifying emerging opportunities remains critical. Investors are encouraged to act swiftly, as promising stocks may soon lose their appeal. Given the dynamic nature of the technology sector, maintaining awareness of potential shifts is vital for strategic investment planning.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology. The article is not intended to be financial advice and does not constitute a recommendation to buy or sell any stock. It does not take account of individual financial situations or objectives. Simply Wall St has no position in any stocks mentioned.

See also Mistral AI Invests $1.4B in Nordic Data Centers to Enhance Europe’s A.I. Independence

Mistral AI Invests $1.4B in Nordic Data Centers to Enhance Europe’s A.I. Independence SPAR International Integrates Veesion’s AI Loss-Prevention Tech to Enhance Global Retail Security

SPAR International Integrates Veesion’s AI Loss-Prevention Tech to Enhance Global Retail Security China’s AI Governance: Mixed Stakeholder Model Challenges Top-Down Stereotypes

China’s AI Governance: Mixed Stakeholder Model Challenges Top-Down Stereotypes Microsoft’s Mustafa Suleyman Announces Shift to AI Self-Sufficiency, Aims for Superintelligence

Microsoft’s Mustafa Suleyman Announces Shift to AI Self-Sufficiency, Aims for Superintelligence Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere