In a dramatic shift in the software market, nearly $300 billion in value evaporated in a single trading day earlier this month, triggered by Anthropic‘s unveiling of Claude Cowork and its open-source plugins that enable AI agents to execute complex tasks autonomously. The live demonstrations of these capabilities, including end-to-end legal research and drafted filings, unsettled investors, leading to sharp declines in stocks related to software, data services, and IT outsourcing. Despite the upheaval, the narrative that artificial intelligence will render traditional software obsolete is likely an oversimplification.

While AI is indeed transforming how code is created and tasks are executed, this evolution is reshaping the software landscape rather than signaling an end to it. Investors are now tasked with distinguishing between software companies that possess durable competitive advantages and those that are more susceptible to disruption. The concern among investors about the obsolescence of traditional software overlooks a critical distinction: performing a task is not synonymous with managing a business system.

The software most likely to withstand this AI wave is what industry professionals refer to as a “system of record.” These platforms serve as the official sources for critical data—such as financial transactions, customer histories, payroll, and compliance records—which are deeply integrated into daily operations and store extensive structured information. Furthermore, these systems anchor complex workflows, coordinating multi-step processes across departments, from approval chains to billing and reporting. The costs, risks, and operational disruptions associated with replacing such systems create significant switching costs.

Moreover, enterprise systems manage permissions, approvals, audit trails, and regulatory requirements that generic AI models cannot autonomously handle. While AI can automate tasks within these systems, it remains reliant on them for secure data management, workflow control, and governance. In many scenarios, AI serves to enhance core software rather than replace it entirely.

As the market reevaluates, investors should focus on segments where AI acts as an accelerator or where specialized domain knowledge provides a competitive moat. Sectors such as Vertical SaaS—companies providing tailored Software as a Service—are positioned for resilience. These companies incorporate industry-specific expertise and regulatory compliance into their products. For example, Veeva Systems, which is down 20% year-to-date, caters specifically to pharma and life sciences, while Guidewire, a core system for insurers, has seen a 32% decline in the same period.

Another sector poised for growth is Cybersecurity. As AI evolves, it not only assists defenders but also empowers attackers with more sophisticated threats. This dual-edge nature of AI sustains a consistent demand for cybersecurity solutions. Companies like Palo Alto Networks and CrowdStrike, both down about 5% year-to-date, along with Zscaler, which has fallen 20%, are becoming increasingly vital as the threat landscape expands.

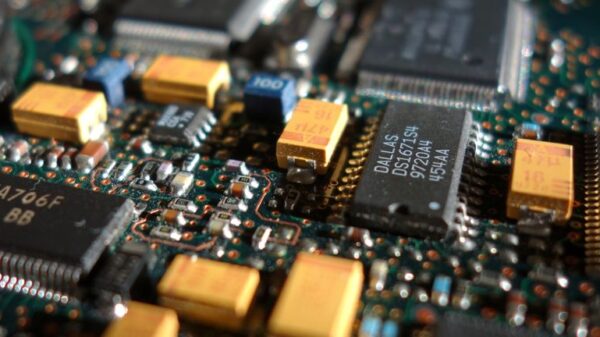

The Data Infrastructure sector also holds promise, as AI models require vast amounts of organized and accessible data to function effectively. Companies that provide essential platforms for managing corporate data, such as Snowflake and Oracle, are integral to the broader AI ecosystem and have seen declines of 16% and 18% year-to-date, respectively.

On the flip side, certain business models are at heightened risk from AI disruption. For instance, Wrapper Applications, which primarily offer a user interface built on top of existing AI models, can quickly become obsolete as foundational providers enhance their own offerings. Similarly, companies that depend on seat-based pricing in sectors where AI can significantly boost productivity face challenges. As AI automates basic tasks, fewer human employees may be needed, leading to reduced software license purchases and directly impacting revenues.

Additionally, Commoditized Knowledge Platforms, such as those in the EdTech space, are increasingly challenged by free, powerful AI models capable of providing instant information. Overall, while the software sector is indeed transitioning, it is not ending. Value is shifting from generic tools that support human productivity toward platforms that govern critical data and manage complex, regulated workflows. Investors should prioritize companies that own proprietary data and address intricate, high-stakes business challenges beyond the capabilities of general-purpose AI.

For a comprehensive analysis of how these developments impact investor strategies, ongoing vigilance in the software market will be crucial as the dynamics evolve in response to AI advancements.

See also Google DeepMind CEO Demis Hassabis: AI to Drive New Era of Medical and Energy Breakthroughs by 2038

Google DeepMind CEO Demis Hassabis: AI to Drive New Era of Medical and Energy Breakthroughs by 2038 Alphabet and Amazon Accelerate AI Capex Race to Build Sovereign Data Centers Amid Global Demand

Alphabet and Amazon Accelerate AI Capex Race to Build Sovereign Data Centers Amid Global Demand Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT