The recent fluctuations in the artificial intelligence (AI) sector underscore the complexity of investing during periods of rapid technological evolution. Investors who initially back the potential of AI may find themselves grappling with unexpected market reactions, as evidenced by the selloff following the release of Anthropic’s latest model. This turbulence is reminiscent of the dot-com boom, where many potential winners emerged, but far more entities failed to thrive in the shifting landscape.

The launch of Anthropic’s new model sparked a notable decline in software stocks, as investors reevaluated their competitive positions in a rapidly changing environment. For instance, the iShares Expanded Tech-Software ETF (IGM) experienced a sharp downturn, illustrating how even those who are conceptually aligned with long-term AI growth can be caught off guard. Profiting from such volatility typically requires a strategy like short selling, which is not feasible for most investors due to its complexity and expense.

In the weeks following Anthropic’s Claude model release, the disparity in performance among European AI-themed funds was striking. The Polar Capital Artificial Intelligence S Acc GBP outperformed the Fineco AM MarketVector Artificial Intelligence ESG ETF (AI4U I) by 14 percentage points, highlighting the significant implementation risks that can accompany a sound structural thesis.

Lessons for AI Investors From the Dot-com Boom

Historical parallels drawn from the late-1990s internet boom are instructive for today’s investors. Companies like Amazon.com gained prominence through the transformative potential of the internet to disrupt traditional retail. In hindsight, the path to investment success appears clear, yet it was fraught with uncertainty. For example, at that time, Walmart was a major player in retail and appeared to be a likely victim of the e-commerce surge. Instead, it adapted effectively, investing in technology and logistics to remain a key player in the market.

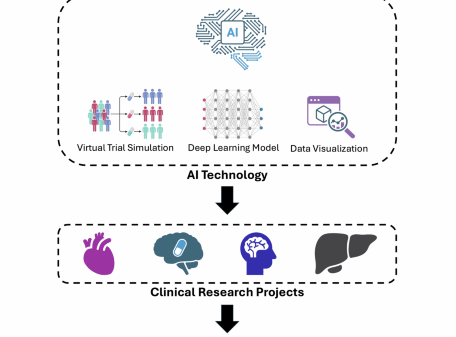

This theme of adaptation is relevant in today’s AI landscape. While periods of uncertainty may prompt investors to indiscriminately sell off software stocks, the ultimate outcomes will depend significantly on how well companies integrate AI into their operations. Not all firms will fare poorly; some will find innovative ways to utilize AI, positioning themselves for growth even amidst market volatility.

Identifying profitable players in the AI sector remains a daunting task. The DeepSeek incident of 2025 serves as a cautionary tale, wherein the emergence of a competitive Chinese large language model caused investors to rethink reliance on raw computational power. Leading hardware manufacturers like Nvidia and Broadcom faced substantial declines, while certain software firms remained relatively insulated. This episode illustrated how quickly market narratives can shift, leaving even established companies vulnerable to shifts in technological assumptions.

Moreover, the ongoing AI revolution is distinguished by the scale of financial commitment being made. Investment in AI infrastructure is projected to surge by approximately 60% this year, exceeding half a trillion dollars. This represents a significant, leveraged gamble from some of the world’s largest corporations, with uncertain returns. The resultant market volatility is unprecedented for companies of this magnitude, with rapid developments triggering sharp price swings.

As the landscape continues to evolve, investors must navigate these complexities with caution. While today’s AI advancements promise transformative potential, the ultimate value distribution remains unclear. Historical precedents indicate that overconfidence in selecting specific winners can lead to substantial losses. A diversified and patient investment strategy that acknowledges both the disruptive capabilities of AI and the surrounding uncertainties is likely to prove more effective in the long term.

Looking forward, the rapid pace of technological advancement will continue to shape the investment landscape. The lessons learned from past technological revolutions can guide investors as they venture into the current AI boom, but the need for a thoughtful approach remains paramount.

See also Bank of America Warns of Wage Concerns Amid AI Spending Surge

Bank of America Warns of Wage Concerns Amid AI Spending Surge OpenAI Restructures Amid Record Losses, Eyes 2030 Vision

OpenAI Restructures Amid Record Losses, Eyes 2030 Vision Global Spending on AI Data Centers Surpasses Oil Investments in 2025

Global Spending on AI Data Centers Surpasses Oil Investments in 2025 Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge

Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge Investors Must Adapt to New Multipolar World Dynamics

Investors Must Adapt to New Multipolar World Dynamics