Nvidia (NVDA) and Advanced Micro Devices (AMD) have recently unveiled their quarterly results, providing investors with insights into how these leading chipmakers are benefiting from the booming semiconductor and artificial intelligence (AI) markets. With the numbers now clear, a pivotal question arises: which stock presents a better investment opportunity—Nvidia or AMD?

Nvidia’s Strong Q3 Performance

Nvidia’s Q3 earnings have underscored a continuing surge in AI demand, with the company reporting a remarkable 62% revenue growth for Q3 FY26 and anticipating a further 65% increase in Q4. Adjusted earnings reached $1.30 per share, reflecting a year-over-year rise of 60%.

A standout contributor to Nvidia’s success has been its Data Center segment, which achieved $51.2 billion in revenue, up 66% from the previous year. This growth can be attributed to escalating AI infrastructure investments as data centers and cloud platforms operate near full capacity. Nvidia projects approximately $500 billion in product visibility through 2026, indicating a prolonged cycle of investment.

Is Nvidia Still a Strong Buy?

Following its impressive Q3 results, analysts on Wall Street have reaffirmed their bullish sentiments toward Nvidia, issuing Buy ratings and adjusting their price targets upward. Evercore ISI’s five-star analyst Mark Lipacis has set a target of $352, suggesting a potential upside of nearly 95%. Lipacis emphasized Nvidia’s leadership in AI chips and the accelerating demand for its new Blackwell lineup.

Similarly, Stacy Rasgon from Bernstein has raised his price target from $225 to $275, indicating an upside of over 50%. He highlighted Nvidia’s substantial $65 billion revenue outlook for Q4 as a clear indicator of strong demand and visibility.

AMD’s Q3 Results Exceed Expectations

AMD also posted a strong performance in Q3, reporting earnings of $1.20 per share, surpassing the consensus estimate of $1.17. Revenue climbed to $9.2 billion, a year-over-year increase of 35.6%, exceeding expectations of $8.76 billion.

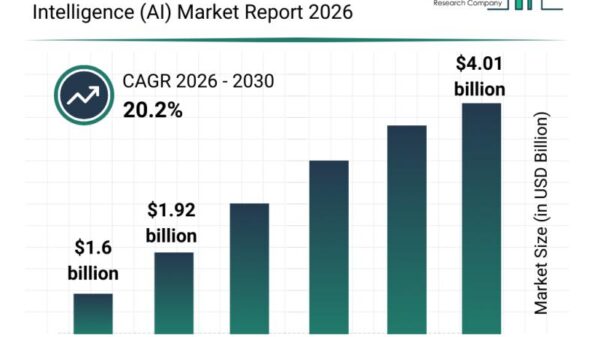

Data center growth has been a focal point for AMD as well, with its Data Center revenue rising 22% year-over-year to reach $4.3 billion. At its recent Analyst Day held on November 11, AMD emphasized its AI strategy and long-term ambitions in a market projected to be worth $1 trillion by 2030. The company announced plans for new “Helios” rack-scale systems featuring MI450 GPUs, set to launch in Q3 2026, alongside intentions to grow its CPU market share against competitors such as Nvidia and Intel (INTC).

Assessing AMD’s Investment Potential

The response from Wall Street analysts regarding AMD has been more mixed. Analyst Jay Goldberg of Seaport expressed optimism about AMD’s five-year roadmap but cautioned that even a projected $100 billion goal would represent only about 10% of the anticipated $1 trillion chip market by 2030. He noted the potential risk of AMD’s near-term growth being reliant on major customers like OpenAI, resulting in a Hold rating for the stock.

Conversely, Rasgon assigned a Hold rating to AMD with a price target of $200, indicating a projected downside of around 1%. In contrast, Simon Leopold from Raymond James initiated coverage with a Buy rating and a target of $377, viewing AMD as a strong competitor in the merchant GPU market with promising developments in AI accelerators and rack systems.

Nvidia vs. AMD: Which Has Higher Potential?

According to the TipRanks’ Stock Comparison Tool, Nvidia currently holds a Strong Buy rating with an average price target of $257.33, suggesting a 44% upside from current levels. In comparison, AMD carries a Moderate Buy consensus among analysts, with an average price target of $284.67, indicating an upside of nearly 40%.

Year-to-date, Nvidia’s stock has risen approximately 34%, while AMD has seen a more substantial increase of 68%.

Conclusion

Both Nvidia and AMD stand to gain from the ongoing AI boom, albeit in different capacities. Nvidia is firmly established as a leader with significant demand, strong pricing power, and record data center revenues. Meanwhile, AMD is making substantial strides with a growing AI product lineup and increasing momentum, though it continues to play catch-up.

In the short term, Nvidia appears to be the more robust choice for investors seeking exposure to immediate AI demand, while AMD may attract those focused on potential long-term competitive advantages and valuation improvements.

Nokia Joins Open Compute Project as Platinum Member to Enhance AI Data Centers

Nokia Joins Open Compute Project as Platinum Member to Enhance AI Data Centers Bae Jae-kyu Advocates Long-Term Tech ETF Investments Amid AI Bubble Concerns

Bae Jae-kyu Advocates Long-Term Tech ETF Investments Amid AI Bubble Concerns Coforge Launches Forge-X Platform for AI-Driven Engineering Lifecycle Transformation

Coforge Launches Forge-X Platform for AI-Driven Engineering Lifecycle Transformation UK Government Announces £24bn Investment to Establish AI Growth Zones and Boost Innovation

UK Government Announces £24bn Investment to Establish AI Growth Zones and Boost Innovation AI Companions Surge in Use, Prompting New Privacy Regulations in New York and California

AI Companions Surge in Use, Prompting New Privacy Regulations in New York and California