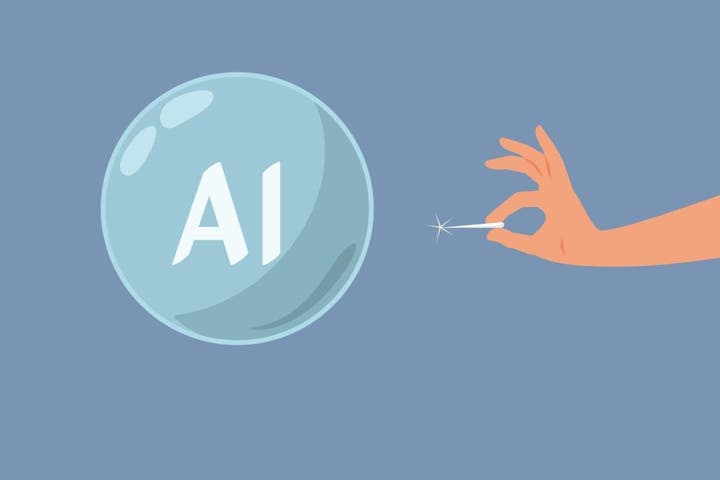

In a recent discussion on CNBC’s Closing Bell Overtime, Wedbush analyst Dan Ives reiterated his belief that the artificial intelligence (AI) market is in its early growth stages, countering fears of a bubble. “This is just the start,” Ives said, predicting a continued tech bull market for at least another two years.

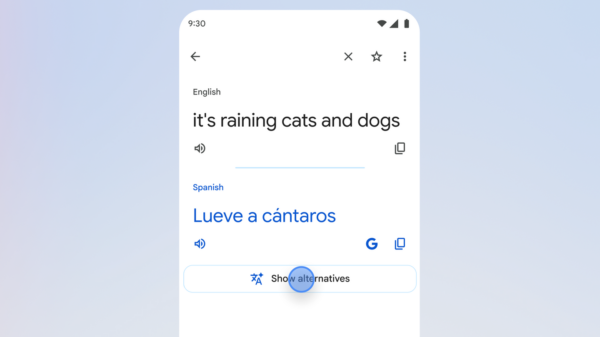

Ives pointed to Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) as a prime example, emphasizing how the company has transformed despite initial skepticism from investors. “The reality is AI is a tailwind for them,” he stated, noting the momentum also seen in Broadcom, Inc. (NASDAQ:AVGO), particularly within the chip sector.

As of now, Alphabet’s Class A shares have surged by 70.74% year-to-date, with Class C shares also experiencing significant gains of 69.77%, according to data from Benzinga Pro. Ives also highlighted Apple Inc.’s (NASDAQ:AAPL) collaboration with Google as a critical element of its AI strategy, suggesting that the partnership with Google’s Gemini would be pivotal for Apple’s future in AI.

During the segment, Ives expressed his strong endorsement of Microsoft Corp. (NASDAQ:MSFT), calling it a “table-pounder” pick due to its dominant position in cloud and enterprise AI services. Microsoft recently reported a robust first-quarter revenue of $77.7 billion, an 18% increase year-over-year that surpassed analysts’ expectations of $75.3 billion. The company’s cloud revenue reached $49.1 billion, up 26% year-over-year, with Azure and other cloud services growing an impressive 40% annually. Microsoft shares have also risen 13.95% in 2023.

Ives did not shy away from mentioning Palantir Technologies, Inc. (NASDAQ:PLTR), addressing concerns about its valuation while maintaining that the company is at the “epicenter” of real-world AI applications. “I get the valuation worries, but that is really, I think, right at the epicenter of what we’re seeing,” he commented.

In addition to individual companies, Ives discussed the recent establishment of the Genesis Mission, a government-backed AI initiative aimed at consolidating federal data, high-performance computing, and advanced AI technologies. This comprehensive platform is designed to accelerate advancements in fields such as medicine, defense, and energy. Ives noted that this initiative marks a significant moment, stating, “For the first time in 30 years, [the] U.S. is ahead of China when it comes to tech.”

The growing interest in AI is generating excitement among investors, further fueled by the current technological landscape. Companies like Microsoft, Alphabet, and Apple are not just navigating this shift; they are at the forefront of it, driving innovations that are reshaping the industry. As the AI market continues to evolve, analysts like Ives will be closely monitoring developments, especially given the strong historical performance of tech stocks in this arena.

See also World Leaders Establish Groundbreaking Global AI Regulation Pact for Safety Standards

World Leaders Establish Groundbreaking Global AI Regulation Pact for Safety Standards DeepSeek Produces 27% Insecure Code on CCP-Sensitive Prompts, Says CrowdStrike Report

DeepSeek Produces 27% Insecure Code on CCP-Sensitive Prompts, Says CrowdStrike Report Milestone and DCAI Launch EU’s Compliant AI for Smart Cities Using Gefion Supercomputer

Milestone and DCAI Launch EU’s Compliant AI for Smart Cities Using Gefion Supercomputer AI in Bioinformatics Market Projected to Surge 60% by 2032 Amid Major Tech Innovations

AI in Bioinformatics Market Projected to Surge 60% by 2032 Amid Major Tech Innovations Meta Enters Talks with Google for $72B TPU Deal, Challenging Nvidia’s Market Dominance

Meta Enters Talks with Google for $72B TPU Deal, Challenging Nvidia’s Market Dominance