Investments in artificial intelligence are set to enter a significant new phase, with analysts at Wedbush forecasting a major monetization cycle beginning in 2024. The firm noted a recent uptick in deal activity among cloud providers, highlighting that approximately 20% of AI-related projects it monitors at hyperscalers have accelerated in recent weeks.

The analysts predict that 2026 will mark another robust year for the technology sector, positioning the ongoing AI revolution as a central theme. They expect that the infrastructure developed throughout 2025 will pave the way for “transformational monetization opportunities into 2026 and beyond,” as enterprises increasingly define AI’s role within their organizations.

Despite the promising outlook, Wedbush described enterprise AI adoption as still being in its nascent stages. They assert that as more Chief Information Officers (CIOs) clarify AI’s applications, spending could enter a new deployment cycle. The analysts anticipate a substantial increase in capital expenditure from major technology companies, projected to range between $550 billion and $600 billion in the coming year. This figure is expected to be bolstered by additional investments in AI from governments, Global 2000 companies, and buyers located in Asia and the Middle East.

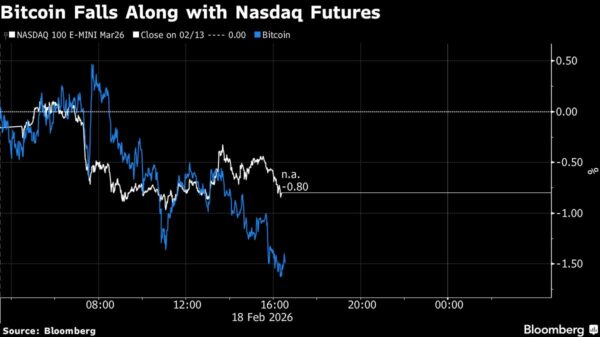

Wedbush’s forecasts indicate that tech stocks could experience an approximate 20% rise in 2026 as monetization processes mature, with large U.S. technology firms identified as primary beneficiaries. In their report, the analysts also addressed recent volatility in AI markets and concerns about potential overheating, stating, “We get the AI Bubble talk worries loud and clear.” However, they distinguish the current environment from previous speculative episodes.

The analysts underscored several factors supporting ongoing growth, including low enterprise penetration rates, the emergence of autonomous and robotics applications, and the early-stage consumer AI cycle. They firmly concluded, “This is NOT an AI Bubble in our view,” suggesting that the current investment cycle is indicative of a multi-year buildout, with Wedbush estimating that the market is now in Year 3 of a projected 10-year AI adoption curve.

In conjunction with their outlook, Wedbush adjusted its “IVES AI 30” list, removing companies such as SoundHound, ServiceNow, and Salesforce Inc (NYSE:CRM, XETRA:FOO), while adding CoreWeave, Iren Ltd (NASDAQ:IREN), and Shopify Inc (TSX:SH., NYSE:SHOP). This reshuffling reflects the analysts’ commitment to tracking the evolution of AI investment opportunities as the landscape continues to change.

Ultimately, Wedbush’s analysts assert that the AI revolution is just beginning, predicting that future advancements will reshape industries and create new market dynamics. As organizations increasingly integrate AI technologies, the potential for innovation and economic growth appears substantial, marking a pivotal moment in the technology sector.

See also AI-Powered Shopping Tools Boost Holiday Sales Forecast to $73 Billion, Up 22% from Last Year

AI-Powered Shopping Tools Boost Holiday Sales Forecast to $73 Billion, Up 22% from Last Year Topps Tiles Reports Record £295.8M Sales with 28% Trade Growth, Faces Market Challenges

Topps Tiles Reports Record £295.8M Sales with 28% Trade Growth, Faces Market Challenges AI-Driven Shopping Surges to $11.8B on Black Friday; ETFs Like IYW and AIQ Set to Gain

AI-Driven Shopping Surges to $11.8B on Black Friday; ETFs Like IYW and AIQ Set to Gain Dechert Advises Cognita Imaging on Acquisition by Mosaic Clinical Technologies to Enhance Radiology AI

Dechert Advises Cognita Imaging on Acquisition by Mosaic Clinical Technologies to Enhance Radiology AI Geotab Reveals 2026 Predictions: AI and Quality Data Key to Business Survival

Geotab Reveals 2026 Predictions: AI and Quality Data Key to Business Survival