HSBC has issued EUR 1.25 billion in senior unsecured notes, featuring a 3.608% interest rate and maturing in 2033. The notes are set to list on the London Stock Exchange, marking another significant financial move for the bank as it navigates a complex economic landscape.

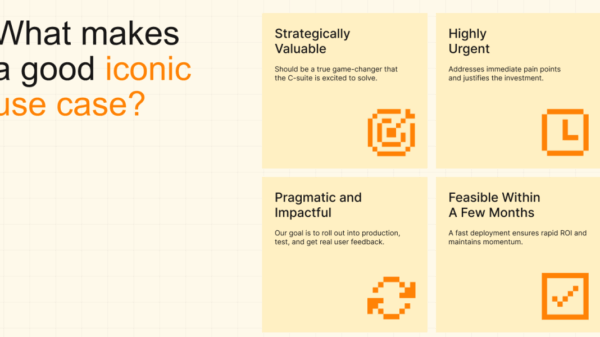

In conjunction with this issuance, HSBC has entered into a partnership with Mistral AI, aiming to leverage generative artificial intelligence to enhance automation and improve client services. The partnership will focus on areas such as financial analysis, translation, and risk assessment, all while seeking to elevate employee efficiency within the organization. This collaboration underscores HSBC’s commitment to integrating advanced technologies to meet the evolving needs of its clientele.

Amid these developments, HSBC is also undergoing a strategic restructuring led by CEO Georges Elhedery. This initiative includes staff reductions and a reorganization of various divisions, which are seen as necessary responses to external pressures. The bank is currently facing challenges such as tariffs imposed on Asian clients and rising taxation in the U.K., factors that have compelled HSBC to revisit its operational framework.

The issuance of the senior unsecured notes represents a calculated strategy to bolster liquidity as HSBC adapts to shifting market dynamics. By securing funding at a relatively low-interest rate, the bank is positioning itself to maintain its competitive edge in a tightening financial environment. The London Stock Exchange listing is expected to attract interest from institutional investors seeking stable returns amid ongoing economic uncertainties.

HSBC’s partnership with Mistral AI aligns with a broader trend in the financial sector, where banks are increasingly turning to artificial intelligence to enhance service offerings and operational efficiency. Generative AI, in particular, has shown promise in automating complex tasks, thus allowing financial institutions to better allocate resources and focus on client interactions. As the technology matures, its applications in financial services are likely to expand, potentially reshaping how banks operate.

The restructuring efforts under Elhedery reflect a proactive approach to navigating the challenges posed by a volatile global marketplace. The strategic decisions being made now are crucial for HSBC as it aims to streamline operations and reduce costs without compromising service quality. As the bank adjusts to these external pressures, it remains focused on maintaining a robust financial position that can weather economic fluctuations.

Overall, the combination of the EUR 1.25 billion notes issuance, the partnership with Mistral AI, and the ongoing restructuring efforts illustrate HSBC’s multifaceted strategy to adapt to current market conditions. The bank is poised to leverage new technologies while addressing operational inefficiencies, setting the stage for a more resilient future.

See also AWS Invests $50 Billion to Revolutionize Federal AI Infrastructure by 2026

AWS Invests $50 Billion to Revolutionize Federal AI Infrastructure by 2026 AWS Transform Launches AI Agents to Accelerate Code Modernization Across Platforms

AWS Transform Launches AI Agents to Accelerate Code Modernization Across Platforms 10 Critical Risks of Neglecting AI Ethics: Avoid Legal Nightmares and Enhance Trust

10 Critical Risks of Neglecting AI Ethics: Avoid Legal Nightmares and Enhance Trust AI Revolutionizes U.S. Pathology: Boosting Diagnostic Precision and Patient Outcomes

AI Revolutionizes U.S. Pathology: Boosting Diagnostic Precision and Patient Outcomes OpenAI Acquires Stake in Thrive Holdings to Streamline AI in Corporate Operations

OpenAI Acquires Stake in Thrive Holdings to Streamline AI in Corporate Operations