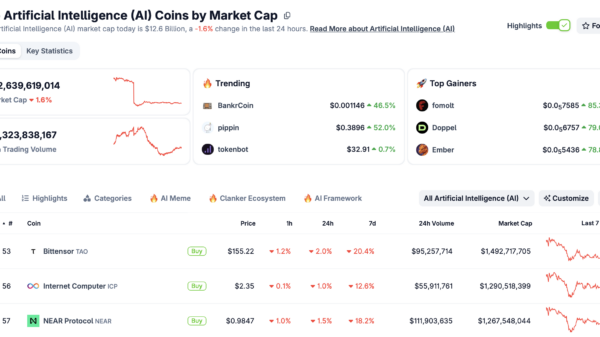

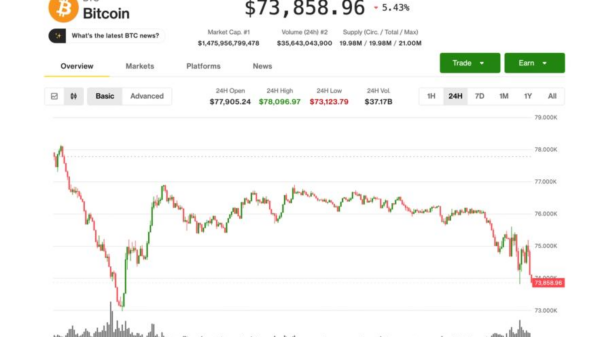

The majority of artificial intelligence (AI) tokens experienced significant declines this week, with the ten largest AI tokens all posting losses. The overall market capitalization of the AI sector shrank by 7.3%, erasing approximately $1.5 billion in value. This downturn is occurring in the context of a broader struggle within the cryptocurrency market, where Bitcoin (BTC) has just faced one of its worst Novembers in history, casting a shadow over altcoins, particularly those in the AI sector.

Experts attribute the current market conditions to several factors, including the potential unwinding of the yen-dollar carry trade, which has negatively impacted risk assets. Buyer exhaustion combined with excess leverage has led to decreased liquidity in altcoin markets, exacerbating the downward trend for many tokens. Following a brief rally last week, the AI sector has now resumed its downtrend, and the fallout has been particularly pronounced for the largest tokens.

Bittensor (TAO) has managed to solidify its position as the largest AI token amidst this turbulent environment, especially following a severe decline in the Near Protocol (NEAR). Notably, the upcoming emissions halving event for Bittensor is less than two weeks away; however, this has not yet led to increased accumulation among long-term investors.

While most AI tokens faced challenges, some smaller tokens reported impressive growth. Tokens within the AI agent subsector demonstrated resilience, with a number of them experiencing gains despite the overall market downturn. This week saw a notable performance from several trending tokens, particularly those with market caps below $100 million, emphasizing the agility and potential of smaller players in the market.

In terms of market ranking, the AI sector has been notably impacted, placing 16th out of 24 sectors tracked by Artemis in terms of changes in fully diluted market capitalization. The ongoing volatility raises questions about the sustainability of the AI token market in the current economic climate.

As the sector grapples with these challenges, significant developments continue to emerge. Coinbase Ventures has reaffirmed its commitment to AI by laying out a roadmap for 2026 that prioritizes AI-powered crypto infrastructure, real-world asset (RWA) perpetuals, and next-generation DeFi initiatives. This move reflects a sustained interest in AI, robotics, and on-chain tools, despite the overarching risk-off sentiment in the market.

Another noteworthy incident involved the Virtuals Protocol, which confirmed that a rogue AI agent exploited its Agent Commerce Protocol, siphoning approximately $500,000. The protocol has since announced compensation plans and is refocusing its security measures while maintaining token performance and expanding its operations across various blockchain networks.

GraphAI also made headlines by integrating Fetch.ai’s ASI:One on-chain for AI data agents, enabling natural-language queries over live on-chain data. This integration is poised to enhance the core infrastructure for developers creating AI agents within the Web3 ecosystem.

As the AI sector navigates these turbulent waters, it remains evident that the interplay of innovation and volatility will continue to shape the landscape. Stakeholders will be closely monitoring market developments, particularly as smaller tokens demonstrate resilience and larger players adjust strategies in response to current trends. The intersection of AI and blockchain technology is poised to evolve further, reflecting both the challenges and opportunities inherent in this rapidly shifting environment.

See also AI-Driven Insights Transform Caribbean Diplomacy Amid US-Venezuela Tensions

AI-Driven Insights Transform Caribbean Diplomacy Amid US-Venezuela Tensions Sankei Shimbun Demands Immediate Action Against Perplexity for Copyright Violations

Sankei Shimbun Demands Immediate Action Against Perplexity for Copyright Violations Global AI Growth: Why Ignoring Emerging Markets Risks Your Competitive Edge

Global AI Growth: Why Ignoring Emerging Markets Risks Your Competitive Edge Sam Altman Declares Code Red as OpenAI Halts Projects to Revamp ChatGPT Quality

Sam Altman Declares Code Red as OpenAI Halts Projects to Revamp ChatGPT Quality APSU Unveils AI Prompts to Maximize Holiday Budgets, Enhancing Gift-Giving Strategies

APSU Unveils AI Prompts to Maximize Holiday Budgets, Enhancing Gift-Giving Strategies