In the competitive landscape of decentralized artificial intelligence, two projects stand out: Bittensor (TAO) and Internet Computer (ICP). Both are prominent players in the DePIN sector, yet they present markedly different investment profiles. A comparative analysis reveals key insights as discussed by trader @DamiDefi.

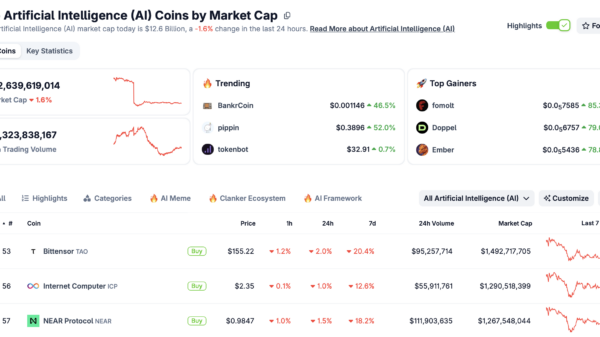

Bittensor has emerged as the “cleanest AI beta play,” largely due to its superior liquidity. The project boasts a weekly trading volume exceeding $1.18 billion, significantly outpacing ICP’s $638 million. This liquidity is a crucial factor for investors looking for immediate action in the market.

Additionally, TAO benefits from a clear narrative, particularly with a significant catalyst on the horizon: a halving event scheduled for mid-December 2025, which will reduce new token issuance by 50%. This anticipated supply shock is likely to attract investor attention and further boost market performance.

With a market capitalization of $2.97 billion, TAO still has ample room for growth, especially if the interest in AI technologies continues to flourish. Furthermore, its daily revenue stands at $78,000, and the continuous expansion of its AI subnets signals robust health for the project.

On the other hand, Internet Computer represents a different investment narrative, focusing on a potential comeback. The project is currently down 99.52% from its all-time high, suggesting immense rebound potential. Its holder base is significantly larger, with 1.6 million holders compared to TAO’s 427,000. This broader audience could create considerable momentum if market sentiment shifts positively.

Investing in ICP requires a belief in long-term adoption and execution capabilities of its team, rather than relying on an imminent catalyst. Although the valuation of $1.93 billion is less than TAO’s, ICP’s moderate annual inflation rate of 5-7% presents a relatively stable outlook. However, it will need compelling narrative momentum to drive its performance higher.

Notably, ICP was reported as the fastest blockchain in November, showing the largest increase in new developers, a promising indicator for its future prospects.

The decision between TAO and ICP ultimately hinges on the investor’s strategy. TAO is poised as the choice for those seeking clarity and short-term momentum, driven by an impending halving and more favorable market dynamics. In contrast, ICP appeals to contrarian investors looking for a long-term bet on technology with substantial recovery potential.

As analysts suggest, while TAO currently appears to be the more straightforward trade, ICP could be an intriguing opportunity for patient investors willing to navigate its complexities.

DISCLAIMER

This article is for informational purposes only and should not be considered investment advice. It is the reader’s responsibility to verify the compliance of these services with local regulations before using them.

Bittensor and Internet Computer are two noteworthy projects in the evolving space of decentralized AI technologies.

See also Anthropic Signs $200M Deal with Snowflake to Enhance AI Deployment for Enterprises

Anthropic Signs $200M Deal with Snowflake to Enhance AI Deployment for Enterprises VEON Leverages Local AI Sovereignty with Google for Competitive Edge in Ukraine’s Digital Market

VEON Leverages Local AI Sovereignty with Google for Competitive Edge in Ukraine’s Digital Market Vinod Khosla: AI’s Rise Could Transform India’s Economy, Shape Global Geopolitics by 2030

Vinod Khosla: AI’s Rise Could Transform India’s Economy, Shape Global Geopolitics by 2030 Grok Fails to Recognize New Economic Order, Highlighting AI’s Blind Spots in Global Discourse

Grok Fails to Recognize New Economic Order, Highlighting AI’s Blind Spots in Global Discourse