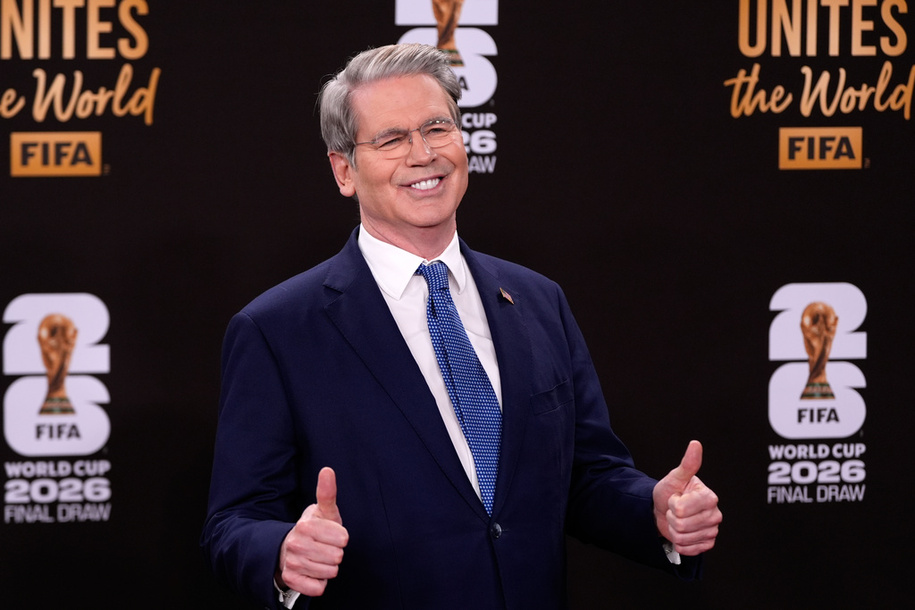

Scott Bessent, the new secretary of the U.S. Treasury, is proposing significant changes to the financial regulatory landscape, specifically targeting the Financial Stability Oversight Council (FSOC). Established in the wake of the 2008 financial crisis to prevent a repeat of that downturn, the FSOC’s role has been redefined under Bessent’s leadership to diminish its oversight and regulatory functions.

Bessent’s vision for the FSOC suggests a pivot away from monitoring and regulating the financial sector. Instead, he proposes that the council “work with and support member agencies in considering whether aspects of the U.S. financial regulatory framework impose undue burdens and negatively impact economic growth, thereby undermining financial stability.” This shift raises critical questions about the administration’s commitment to maintaining a stable financial system.

Critics perceive this approach as a part of a larger effort by the Trump administration to redefine “financial stability” in terms that prioritize economic growth over the safeguards established to protect consumers and the economy. The administration’s narrative suggests that regulations are obstacles that must be removed to foster economic expansion, potentially risking a repeat of the reckless practices that led to the 2008 crisis.

In a notable departure from its original mission, the FSOC under Bessent is set to include an artificial intelligence working group. This group aims to create a platform for public-private dialogue to address perceived regulatory impediments to the integration of AI technologies within the financial services sector. This shift emphasizes a trend where technological advancement is prioritized over stringent regulatory oversight.

Bessent has also indicated a commitment to ensuring that regulations do not impose undue costs on credit markets. Traditionally, financial regulations are designed to create necessary friction to safeguard against systemic risks. However, the new administration’s approach appears to advocate for a more laissez-faire financial environment, where the absence of regulation might lead to unforeseen consequences.

This move to deregulate is occurring alongside significant staffing cuts across key regulatory bodies, including the Federal Reserve, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency. These reductions have raised concerns about the agencies’ capacities to address risk effectively. Advocates for financial stability highlight that diminished regulatory oversight could lead to increased vulnerability within the financial system.

The Consumer Financial Protection Bureau, once a robust entity designed to protect consumers, has also seen its authority severely curtailed. Reports indicate that the bureau has taken only two regulatory actions in the current year, a stark contrast to its previous operational capacity.

This push toward deregulation aligns with the administration’s broader aim of minimizing regulatory constraints on AI technology. However, the implications of allowing AI to operate with little oversight in the financial sector are significant, raising concerns about the potential for unchecked algorithms to affect consumers’ financial well-being.

As the administration continues to reshape the regulatory landscape, the consequences of these decisions will likely resonate throughout the financial sector. The balance between fostering innovation and ensuring consumer protection remains a contentious debate. While proponents of deregulation argue that it will spur growth and efficiency, critics warn that such a trajectory could ultimately undermine the very stability the system seeks to protect.

See alsoAI Supply Chain: U.S.-China Rivalry Fuels Tech Cold War, Reshaping Global Power Dynamics

3 Billion Lack Internet Access Amid AI Governance Debate, Threatening $3.5 Trillion Economic Boost

3 Billion Lack Internet Access Amid AI Governance Debate, Threatening $3.5 Trillion Economic Boost Broadcom Doubles AI Chip Forecast to Capture $181B Market, Boosts Q4 Revenue by 44%

Broadcom Doubles AI Chip Forecast to Capture $181B Market, Boosts Q4 Revenue by 44% Massachusetts Courts Embrace AI for Efficiency, Facing Ethical and Reliability Challenges

Massachusetts Courts Embrace AI for Efficiency, Facing Ethical and Reliability Challenges