On December 12, 2025, Broadcom surprised the technology sector by doubling its forecast for AI chip production, a significant move disclosed alongside its Q4 financial results. This announcement places the company in a strategic position within the rapidly expanding AI market, which is projected to reach $181 billion by 2025. Investors are keenly observing the potential impacts on Broadcom’s stock (AVGO), which is a vital part of the company’s evolving market strategy.

Broadcom’s revised AI chip forecast underscores its aggressive expansion into the AI sector, acknowledging the increasing demand for advanced AI capabilities across various industries, including cloud computing and autonomous vehicles. This strategic pivot is expected to enhance Broadcom’s influence in the semiconductor space, particularly against key competitors like NVIDIA and Intel. As AI-driven technologies gain traction, the company is positioning itself to capitalize on the lucrative opportunities that lie ahead.

The company’s financial report for Q4 reflects a strong alignment with its renewed focus on AI. Broadcom reported a revenue growth of 43.98% for the fiscal year, despite facing declines in operating income and net income, mirroring broader industry challenges. Following the announcement, Broadcom’s stock closed at €366.45, a slight decrease from previous highs. Analysts, however, have set a target price of €472, indicating potential for future growth. This demonstrates a solid foundation for the company amidst fluctuations in the sector, with analysts maintaining a consensus rating of “Buy.”

The announcement has sparked notable activity surrounding Broadcom’s stock. Currently priced at €366.45, AVGO reflects the heightened market volatility following the news, which saw the stock dip by 11.26%. Nevertheless, over the past year, the stock has surged by 100.32%. Trading volumes escalated to 34.82 million, significantly exceeding the average of 22.87 million, indicating substantial investor interest and speculation regarding Broadcom’s strategic repositioning. Analysts project a median target of €400, suggesting a positive outlook for the company.

The timing of Broadcom’s decision to double its AI chip forecast appears strategic, aligning with the anticipated exponential growth of the AI market by 2030. As AI chips become increasingly foundational to technological advancements, Broadcom’s extensive technology portfolio is well-positioned to leverage this trend. This move supports broader industry shifts towards automation and smart technology integration, enhancing Broadcom’s standing as a key supplier of essential AI components.

In the broader context, the implications of Broadcom’s AI chip forecast boost are significant. The company’s proactive stance not only showcases its commitment to leading in a high-growth sector but also reflects a strategic agility in navigating market challenges. The Q4 financial performance, coupled with the optimistic forecast, underscores Broadcom’s potential to become a dominant player in the semiconductor industry, particularly within the AI landscape.

In conclusion, Broadcom’s unexpected increase in its AI chip forecast is a bold maneuver that aligns with its ambitions in a rapidly evolving sector. The company’s robust financial results signal resilience and strategic foresight, suggesting promising opportunities ahead for AVGO. With analysts projecting a target high of €472, Broadcom may represent an attractive option for investors seeking growth in the semiconductor market. The ongoing expansion into AI integrated technologies illustrates the potential rewards of strategic innovation and responsiveness to market demands.

For investors, keeping abreast of Broadcom’s strategic moves and financial health will be critical. Platforms like Meyka can provide real-time insights and predictive analytics, assisting in informed decision-making. Broadcom’s journey in the AI sector highlights the intersection of technological advancement and investment opportunity.

FAQs

How did Broadcom’s Q4 financials perform?

Broadcom reported a 43.98% revenue growth for the fiscal year, though operating and net income faced some declines, reflecting a resilient performance amid market challenges.

What is Broadcom’s stock price target?

Analysts have set a high target of €472, with a consensus rating of ‘Buy,’ indicating confidence in Broadcom’s growth potential and strategic positioning.

Why is Broadcom focusing on AI chips?

Broadcom aims to capitalize on the exploding AI market, expected to reach significant growth by 2030. AI chips are central to this evolution, and Broadcom’s enhanced forecast positions it strongly within this emerging landscape.

See alsoDisclaimer:

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.

Massachusetts Courts Embrace AI for Efficiency, Facing Ethical and Reliability Challenges

Massachusetts Courts Embrace AI for Efficiency, Facing Ethical and Reliability Challenges Authors Seek to Amend Meta AI Copyright Suit After Discovery of Torrent Evidence

Authors Seek to Amend Meta AI Copyright Suit After Discovery of Torrent Evidence US Businesses Must Act Now on AI Compliance as State Laws Gain Momentum

US Businesses Must Act Now on AI Compliance as State Laws Gain Momentum DeepSeek AI Reveals 2025 Price Projections for XRP, Solana, and Dogecoin Amid Market Recovery

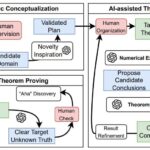

DeepSeek AI Reveals 2025 Price Projections for XRP, Solana, and Dogecoin Amid Market Recovery AI-Enhanced Theorem Proving Accelerates Mathematical Discovery and Rigor in Research

AI-Enhanced Theorem Proving Accelerates Mathematical Discovery and Rigor in Research