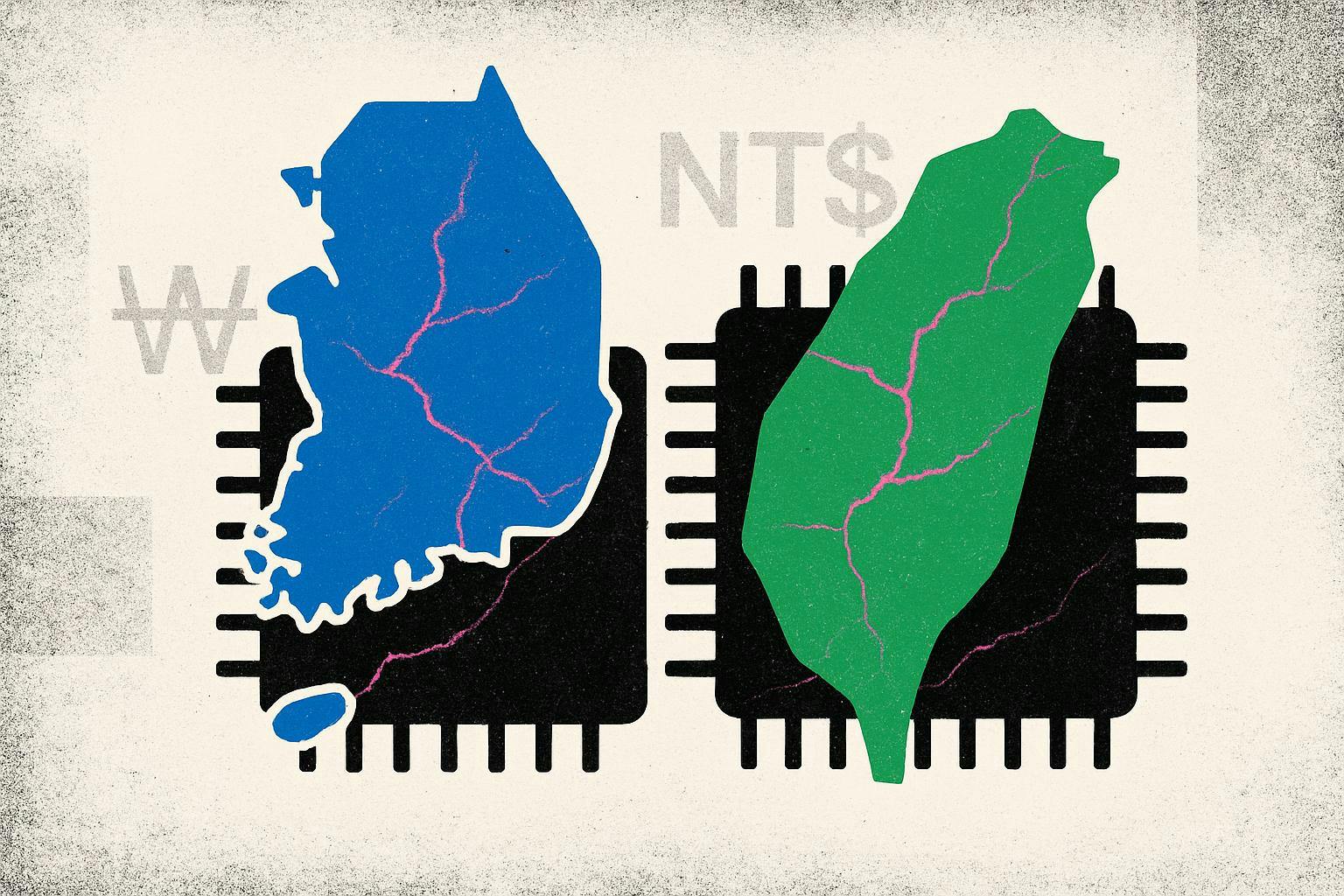

Asian markets faced a wave of uncertainty as investor sentiment shifted, with Taiwan’s markets falling by 0.2% ahead of an anticipated central bank decision to maintain interest rates. This cautious stance comes despite the resilience of the country’s AI-driven exports. Broader regional inclinations revealed a downtrend from the Philippines to Indonesia, where the rupiah weakened despite an unchanged rate policy. In Thailand, a series of market declines prompted the central bank to implement a rate cut to counteract currency volatility. Analysts from Capital Economics have cautioned that if the current fluctuations in U.S. technology stocks lead to a significant sell-off, Asian markets could experience significant turbulence.

For markets: The tech sector is experiencing a reality check.

Investors are expressing skepticism over lofty projections made by tech industry leaders, leading to a pullback from growth stocks and significant corrections in major players like Samsung Electronics and LG Energy Solution. In response to these jitters, policymakers have implemented rate adjustments and issued stern warnings. The swift market movements underscore the interconnectedness of these regions, particularly when the tech narrative falters.

The bigger picture: International policies and partnerships are taking on increased significance.

Asia’s economic landscape remains heavily reliant on global tech demand, making it particularly sensitive to shifts in international policies and cross-border investments. As both Japan and the United States pursue deeper financial ties, and as India opens its insurance market, new regulations could reshape regional prospects. Furthermore, the recent arms package from the U.S. to Taiwan serves as a reminder of the intricate relationship between geopolitics and economics, emphasizing that adaptability in policy will be essential as the booming AI rally transitions into a more stabilized phase.

As the tech sector grapples with these market dynamics and external pressures, investors and policymakers alike will be closely monitoring developments to navigate the evolving landscape.

See also Google Launches Gemini 3 Flash as Default AI Model with Enhanced Features

Google Launches Gemini 3 Flash as Default AI Model with Enhanced Features Google DeepMind Invests $8M in India’s AI, Accelerating Scientific Discovery and Human Capability

Google DeepMind Invests $8M in India’s AI, Accelerating Scientific Discovery and Human Capability Empowering Students: Strategies for Navigating AI’s Global Impact in Education

Empowering Students: Strategies for Navigating AI’s Global Impact in Education Getty Images Revives Copyright Case Against Stability AI in Landmark Ruling

Getty Images Revives Copyright Case Against Stability AI in Landmark Ruling