Investment firm BTIG recently initiated coverage on Amplitude (NASDAQ: AMPL) with a positive rating, underscoring the company’s position as a leader in product analytics. The firm highlighted Amplitude’s increasing traction with larger enterprise customers and its advancements in AI-driven capabilities. This coverage comes on the heels of notable progress in Amplitude’s AI platform and strategic acquisitions that expand its product suite, thereby reducing clients’ reliance on separate point solutions and bolstering confidence in its platform-centric approach.

To invest in Amplitude, stakeholders must believe in the company’s AI-focused product analytics platform as a vehicle for converting growing enterprise interest into sustainable, high-value recurring contracts, while simultaneously narrowing existing losses. BTIG’s optimistic initiation reinforces this AI and enterprise narrative, yet it does not eliminate short-term risks associated with unmonetized AI products, escalating infrastructure costs, and an increasing dependence on a small number of large customers. These factors could potentially impact revenue quality and margin progress in the near term.

Among Amplitude’s recent announcements, the open beta of its AI Agents and the accompanying MCP server are particularly noteworthy. This development aligns with BTIG’s assertion that generative AI can enhance Amplitude’s role within large organizations by simplifying complex analytics, thus potentially supporting more substantial contract values over time. The emphasis now lies in how swiftly Amplitude can transition from experimentation and closed beta phases to generating meaningful AI-driven revenue while managing the associated data and compute costs.

However, investors should remain vigilant about the company’s growing reliance on a limited number of very large enterprise customers, which could pose additional challenges. Recent analyses from the Simply Wall St Community indicate a wide valuation range for Amplitude, from approximately US$8.37 to US$33.28, reflecting varying opinions on the stock’s prospects. In this context, the pivotal question is whether Amplitude’s expanding AI product lineup and enterprise engagement can mitigate uncertainties regarding the monetization of its AI capabilities.

Projections for Amplitude forecast revenues of $466.6 million and earnings of $61.1 million by 2028, with estimates suggesting a fair value of $15.67, indicating a potential upside of 36% from the current price. This narrative builds on a foundation that posits significant growth as the company enhances its offerings and solidifies its enterprise relationships.

While BTIG’s positive outlook contributes to Amplitude’s investment narrative, contrasting views present a more nuanced picture. Investors are encouraged to explore various perspectives, particularly as the company navigates the complexities of its AI initiatives and the broader market landscape. The ability of Amplitude to monetize its AI-driven products efficiently will be crucial for sustaining investor confidence and driving long-term growth.

In summary, while the optimism surrounding Amplitude’s capabilities and market position is palpable, the company faces substantial challenges that warrant careful consideration. Stakeholders must weigh the potential rewards against the inherent risks as they chart their investment strategies in the evolving landscape of product analytics and AI technology.

For more insights on Amplitude and its market positioning, visit their official website at amplitude.com.

For continuous updates on industry trends, consider following platforms like Reuters and Bloomberg.

Note that this article does not constitute financial advice and is intended for informational purposes only. Always consult with a financial advisor before making investment decisions.

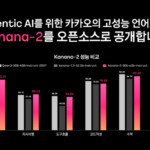

See also Kakao Unveils Kanana-2 Language Model on Hugging Face with Enhanced Tool Calling Features

Kakao Unveils Kanana-2 Language Model on Hugging Face with Enhanced Tool Calling Features AI and Global Regulation Challenge Anonymization: Key Strategies for Compliance and Risk Management

AI and Global Regulation Challenge Anonymization: Key Strategies for Compliance and Risk Management Doosan Bobcat Unveils AI-Driven Jobsite Solutions at CES 2026 to Transform Construction Efficiency

Doosan Bobcat Unveils AI-Driven Jobsite Solutions at CES 2026 to Transform Construction Efficiency Trump Administration Reviews Nvidia’s H200 Chip Exports to China Amid Security Concerns

Trump Administration Reviews Nvidia’s H200 Chip Exports to China Amid Security Concerns Google DeepMind and DOE Launch Genesis Mission to Transform U.S. Scientific Research with AI

Google DeepMind and DOE Launch Genesis Mission to Transform U.S. Scientific Research with AI