NEW YORK (AP) — Stocks on Wall Street gained ground for a second consecutive day on Friday, recovering from losses experienced earlier in the week. Technology stocks were once again pivotal to the market’s performance, particularly companies with a focus on artificial intelligence. The S&P 500 and the Nasdaq both closed the week with gains, despite facing several challenges earlier in the week.

The S&P 500 climbed 59.74 points, or 0.9 percent, to finish at 6,834.50, ending the week with a modest 0.1 percent gain. The Dow Jones Industrial Average increased by 183.04 points, or 0.4 percent, to close at 48,134.89. However, the technology-heavy Nasdaq experienced the most significant movement, rising 301.26 points, or 1.3 percent, to close at 23,307.62, marking a 0.5 percent gain for the week.

Among the standout performers, Nvidia significantly drove the market upward with a 3.9 percent increase, while Broadcom surged by 3.2 percent. The technology sector has been a key driver of Wall Street’s performance throughout the year, with high-value companies like Nvidia exerting significant influence on the market. However, these elevated stock prices have come under scrutiny, as investors contemplate their sustainability.

In another notable development, Oracle saw its shares rise 6.6 percent following the announcement of a new TikTok U.S. joint venture. Along with partners Silver Lake and MGX, Oracle will hold a 15 percent stake in the popular social media platform, allowing it to continue operations in the U.S.

Market participants were closely monitoring company earnings and performance amid ongoing tariffs and inflation. Nike faced a significant setback, plunging 10.5 percent as the impact of tariffs overshadowed an otherwise strong quarterly profit report. Similarly, Lamb Weston, a frozen potato maker, dropped 25.9 percent despite surpassing Wall Street’s profit and revenue expectations.

Conversely, Winnebago Industries surged 8.4 percent after reporting profits and revenues that exceeded analysts’ estimates. Homebuilder stocks, however, declined following a report indicating that home sales had slowed compared to the previous year for the first time since May, with KB Home falling 8.5 percent.

Consumer sentiment saw slight improvement in December, according to a University of Michigan survey, although it remains considerably lower than a year ago. “Despite some signs of improvement to close out the year, sentiment remains nearly 30 percent below December 2024, as pocketbook issues continue to dominate consumer views of the economy,” noted Joanne Hsu, Director of Surveys of Consumers.

Weaker consumer confidence has been a persistent trend throughout the year, driven by ongoing inflationary pressures and a slowing job market. Retail sales are also declining, with businesses and consumers expressing concern over the repercussions of a protracted U.S.-led trade war that has affected key partners, including China and Canada.

The most recent inflation updates revealed unexpected price stabilization in November, with the Labor Department reporting a 2.7 percent rise in the consumer price index. However, economists cautioned that this data may be misleading due to a delay caused by the 43-day federal shutdown.

Mark Hackett, chief market strategist at Nationwide, commented, “The wave of economic data did little to provide clarity for investors this week, keeping the market in the trading range it has been in since September.” Despite the recent inflation findings, the rate remains above the Federal Reserve’s target of 2 percent. The central bank cut its benchmark interest rate at its last meeting, concerned that a slowing job market could further hinder economic growth. However, rate cuts could exacerbate inflationary pressures.

Moving forward, the Fed is expected to maintain a cautious approach to interest rate policy as it heads into 2026, with market analysts largely anticipating that rates will remain unchanged at the upcoming January meeting.

Treasury yields rose in the bond market, with the yield on the 10-year Treasury increasing to 4.15 percent from 4.11 percent late Thursday. In Japan, stocks also saw gains after the Bank of Japan raised its benchmark interest rate to its highest level in 30 years. The Nikkei 225 rose by 1 percent, leading gains across Asia’s key markets, while European markets also experienced upward movement.

See also Purdue Launches Initiative to Transform AI Discoveries with Enhanced Dataset Accessibility

Purdue Launches Initiative to Transform AI Discoveries with Enhanced Dataset Accessibility Mistral AI Launches OCR 3, Achieving 74% Accuracy Improvement in Document Parsing

Mistral AI Launches OCR 3, Achieving 74% Accuracy Improvement in Document Parsing Disney and OpenAI Launch AI Video Streaming Revolution with $1 Billion Partnership

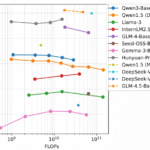

Disney and OpenAI Launch AI Video Streaming Revolution with $1 Billion Partnership TeleAI Launches Pioneering ‘Information Capacity’ Metric to Transform AI Model Efficiency Evaluation

TeleAI Launches Pioneering ‘Information Capacity’ Metric to Transform AI Model Efficiency Evaluation Mistral AI Launches OCR 3, Reducing Costs to $1 per 1,000 Pages with Enhanced Accuracy

Mistral AI Launches OCR 3, Reducing Costs to $1 per 1,000 Pages with Enhanced Accuracy