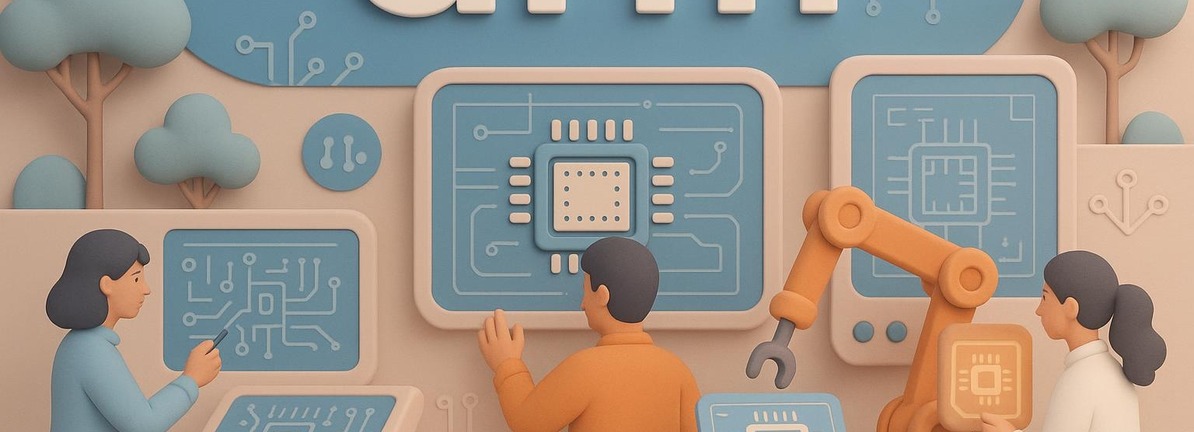

Arm Holdings (NasdaqGS:ARM) has announced the formation of a new division dedicated to Physical AI, aimed at enhancing its capabilities in robotics, autonomous vehicles, and other hardware-intensive AI applications. This strategic move comes as part of a broader reorganization into three key segments: Cloud and AI, Edge, and Physical AI, designed to better align the company’s chip designs with the evolving demands of next-generation computing.

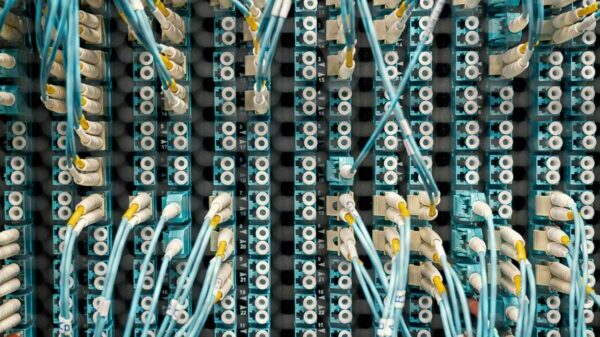

The company is currently collaborating with significant partners, including SoftBank and Broadcom, on the development of AI XPU ASICs and a bespoke server CPU intended for major cloud customers. This shift underscores Arm’s commitment to diversifying its revenue streams beyond traditional markets like smartphones and personal computers.

As of now, Arm’s share price stands at $116.07. The company has experienced a mixed performance recently, reporting a 9.7% return over the past week and 5.3% over the past month, though it has only seen a 1.2% increase year to date. Notably, the stock has declined by 28.6% over the past year, adding an extra layer of context to this significant business reset for investors observing how Arm plans to position itself across data centers, edge devices, and physical AI systems.

For investors, a critical question emerges regarding how this new organizational structure and various partnerships could reshape Arm’s future revenue landscape across cloud, edge, and robotics sectors. The focus on Physical AI and custom server CPUs may prove pivotal in altering perceptions of Arm’s role in AI infrastructure as these initiatives unfold.

Arm’s recent commentary has framed the company as a central player in the semiconductor ecosystem, particularly regarding AI accelerators, automotive applications, and edge computing. Analysts have highlighted the potential impact of its AI-centric XPU and custom server CPU projects as transformative for the company’s trajectory. This reorganization into Cloud and AI, Edge, and Physical AI aligns seamlessly with that narrative, providing investors with a clearer framework to assess how AI-related design wins may manifest in Arm’s future financial reports.

However, risks accompany these opportunities. Analysts note that Arm’s efficient architecture and royalty-based revenue model may benefit from rising AI demand across data centers and robotics. The company’s emphasis on high-royalty projects, including Neoverse-based platforms and custom CPUs, could increase its exposure to large cloud customers. Conversely, the stock’s high price-to-earnings ratio of 146.05—compared to an industry average of 112.6—and a 43% decline from its peak suggest that investor sentiment is highly sensitive to the company’s performance on these AI initiatives. Furthermore, increased short interest and concerns regarding SoftBank’s margin loan against Arm shares introduce additional layers of risk for investors to monitor.

Looking ahead, investors should keep an eye on design wins and revenue contributions from Arm’s AI XPU ASICs, its custom server CPU initiatives, and engagements with Physical AI customers. The evolution of analyst perspectives as these projects transition from conception to large-scale production will be crucial. Engaging with community discussions can also provide insights into how investors are interpreting Arm’s AI strategies, its valuation, and the broader semiconductor narrative as it develops.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using an unbiased methodology, and our articles are not intended to serve as financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. We aim to deliver long-term focused analysis driven by fundamental data. Note that our analysis may not incorporate the latest price-sensitive company announcements or qualitative material. Simply Wall St holds no position in any stocks mentioned.

See also Bank of America Warns of Wage Concerns Amid AI Spending Surge

Bank of America Warns of Wage Concerns Amid AI Spending Surge OpenAI Restructures Amid Record Losses, Eyes 2030 Vision

OpenAI Restructures Amid Record Losses, Eyes 2030 Vision Global Spending on AI Data Centers Surpasses Oil Investments in 2025

Global Spending on AI Data Centers Surpasses Oil Investments in 2025 Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge

Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge Investors Must Adapt to New Multipolar World Dynamics

Investors Must Adapt to New Multipolar World Dynamics