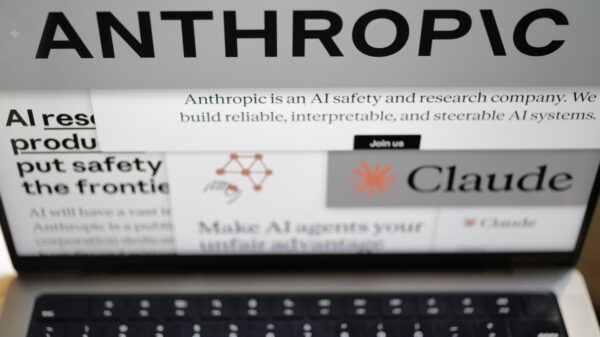

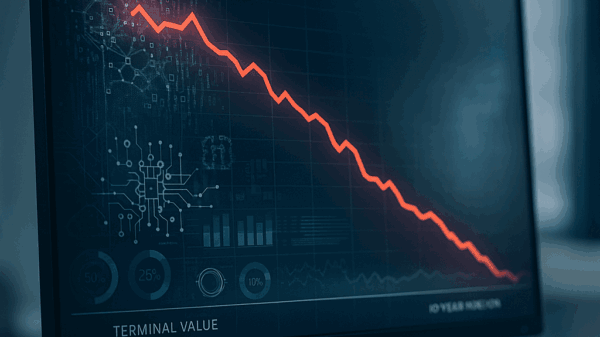

In a notable shift within the enterprise software landscape, KeyBanc Capital Markets has issued an “Underweight” rating on ServiceNow (NYSE: NOW), a leader in IT Service Management (ITSM). This downgrade, announced in early January 2026, diverges from the broader Wall Street consensus and underscores increasing concerns about the long-term sustainability of traditional Software-as-a-Service (SaaS) models amid the rapid adoption of artificial intelligence.

The repercussions of this report have already impacted trading, as ServiceNow’s valuation—previously considered robust due to its consistent growth exceeding 20%—is now under scrutiny, particularly regarding its reliance on “seat-based” pricing. KeyBanc has assigned a post-split price target of $155.00, prompting market participants to question whether a software giant founded on human-driven workflows can endure a technological revolution that aims to minimize human involvement.

Jackson Ader, a KeyBanc analyst, led the downgrade, which was detailed in the firm’s “Enterprise Software 2026 Outlook” report. The bearish sentiment follows a timeline that began with ServiceNow’s 5-for-1 stock split on December 17, 2025. While the split aimed to enhance accessibility for retail investors, KeyBanc’s findings shifted the narrative from accessibility to potential structural vulnerabilities. The report highlights a troubling trend in IT employment data, suggesting that the AI tools marketed by ServiceNow to boost productivity might inadvertently erode its revenue streams by decreasing the need for IT personnel at large organizations.

Further complicating ServiceNow’s situation is its recent $7.75 billion cash acquisition of Armis, aimed at expanding its presence in cybersecurity and asset management. While the company framed the acquisition as a strategic move, KeyBanc has characterized it as a “strategic drift,” indicating that ServiceNow is resorting to costly, inorganic growth to obscure a slowing core business. This substantial cash expenditure raises additional concerns about the firm’s balance sheet flexibility, particularly in light of persisting interest rate uncertainties affecting corporate expenditures.

The market response has been characterized by a mix of defensive selling and cautious scrutiny. Despite maintaining a strong gross margin of approximately 78%, the “Underweight” rating—essentially a “Sell” recommendation—has compelled institutional investors to reassess their holdings. A central issue lies in the competitive landscape of the “AI Orchestration” market, where ServiceNow is no longer the indisputable leader, facing competition from both legacy technology giants and agile startups vying for dominance as the central “AI Control Tower” for modern enterprises.

Microsoft (NASDAQ: MSFT) appears to be the primary beneficiary of ServiceNow’s perceived vulnerabilities. KeyBanc’s report explicitly cautioned that ServiceNow may “cede ground” to Microsoft in 2026. The Azure ecosystem, bolstered by Microsoft’s integrated Copilot services, presents a seamless orchestration layer that many IT departments find more cost-effective compared to sustaining a premium ServiceNow subscription. As organizations seek to streamline their technology stacks to reduce expenses, Microsoft’s ability to bundle AI services gives it a significant edge.

In contrast, ServiceNow finds itself on the defensive, with traditional IT consulting firms and staffing agencies potentially emerging as “losers” in this evolving landscape. If KeyBanc’s “seat count pressure” thesis holds true, companies dependent on the complexity of legacy ITSM systems may see their billable hours diminish as AI technologies take over routine tasks such as ticket resolution and system monitoring. Salesforce (NYSE: CRM) faces similar challenges, as the “death of SaaS” narrative surrounding seat-based pricing is not exclusive to ServiceNow, posing risks to any platform reliant on customer workforce size for revenue.

Specialized AI-native startups focused on “agentic workflows,” operating without the constraints of traditional seat-based models, are emerging as potential winners. Firms that offer consumption-based pricing—where clients pay for AI-driven work rather than the number of users accessing the system—are increasingly viewed as the future of the industry. This paradigm shift places immense pressure on ServiceNow to transform its financial architecture towards a model based on value or consumption, a transition historically fraught with challenges for established public companies.

The KeyBanc downgrade serves as a microcosm of a broader industry trend, signaling that the concept of “productivity” is becoming a deflationary force for software vendors. The SaaS sector has traditionally thrived on the assumption that increased software usage leads to higher revenue. However, the rise of Generative AI disrupts this correlation; one AI-enhanced employee might accomplish the work previously performed by five, drastically altering the demand for ServiceNow licenses. This “efficiency trap” represents a significant regulatory and strategic challenge for the software sector in 2026.

Looking ahead, ServiceNow is expected to focus heavily on its “Pro Plus” and AI-driven offerings to justify higher per-seat pricing. The company aims to mitigate potential user count decline by charging a premium for AI capabilities. Investors will closely monitor these metrics during forthcoming quarterly earnings calls. If ServiceNow can increase its Average Revenue Per User (ARPU) sufficiently to counteract any user base contraction, it may defy KeyBanc’s negative outlook.

Ultimately, the success of ServiceNow’s integration of the Armis acquisition will be critical. The company must establish itself as a comprehensive “platform of platforms” spanning IT, HR, and cybersecurity. The ability to convince Chief Information Officers (CIOs) of ServiceNow’s role as an essential enterprise “nervous system,” rather than merely a sophisticated ticketing tool, will be pivotal.

In conclusion, the KeyBanc “Underweight” rating underscores a crucial juncture for the entire enterprise software sector, highlighting the paradox of the AI era—where the pursuit of efficiency could jeopardize the very metrics that have historically underpinned software valuations. ServiceNow remains a formidable player, yet the shift from a user-based to an efficiency-driven model may redefine its operational landscape. As the market evolves, attention will pivot from “how many people use the software” to “how much work does the software perform,” marking a significant transition in valuation paradigms for the remainder of the decade.

See also AI Factories Revolutionize Enterprise Efficiency: NVIDIA Partners with Lenovo for Gigawatt-Scale Production

AI Factories Revolutionize Enterprise Efficiency: NVIDIA Partners with Lenovo for Gigawatt-Scale Production South Africa Leads AI Adoption in Africa with 21% Adoption Rate by 2025, Followed by Kenya

South Africa Leads AI Adoption in Africa with 21% Adoption Rate by 2025, Followed by Kenya Google Launches AI Mode Checkout with Universal Commerce Protocol and Business Agent

Google Launches AI Mode Checkout with Universal Commerce Protocol and Business Agent McKinsey Reveals 40% of Its 65,000 Workforce are AI Agents, Driving Industry Transformation

McKinsey Reveals 40% of Its 65,000 Workforce are AI Agents, Driving Industry Transformation