Modal Labs, a startup focused on infrastructure for AI inference, is in the process of raising a new funding round that could value the company at approximately $2.5 billion, according to sources familiar with the matter. This potential valuation marks a significant increase from the $1.1 billion valuation reported less than six months ago. General Catalyst is reportedly in discussions to lead this funding round, although negotiations are still in their early stages and terms remain subject to change.

Modal Labs’ annual recurring revenue (ARR) is estimated at around $50 million. The company’s strategy centers on enhancing inference—the process by which AI models generate responses to user queries. By improving the efficiency of this process, Modal aims to reduce computational costs and minimize latency, ultimately delivering faster responses to users.

Investor interest in the inference sector has surged, with Modal being one of the few companies capturing significant attention. Competing firm Baseten recently announced a funding round that raised $300 million, pushing its valuation to $5 billion. This new figure notably surpasses its previous valuation of $2.1 billion. In another instance, Fireworks AI, which provides cloud services for inference, successfully raised $250 million at a valuation of $4 billion last month.

Earlier this year, the team behind the open-source inference project, vLLM, transitioned to a more ambitious venture named Inferact, which secured $150 million in a seed funding round led by Andreessen Horowitz, achieving a valuation of $800 million. Another emerging player, previously known as SGLang, has rebranded as RadixArk and, according to sources, received seed financing at a valuation of $400 million led by Accel.

Founded in 2021 by Erik Bernardsson, who previously held the position of Chief Technology Officer for data processing at Spotify and Better.com, Modal Labs seeks to capitalize on the growing demand for efficient AI solutions. Initial backers include Lux Capital and Redpoint Ventures.

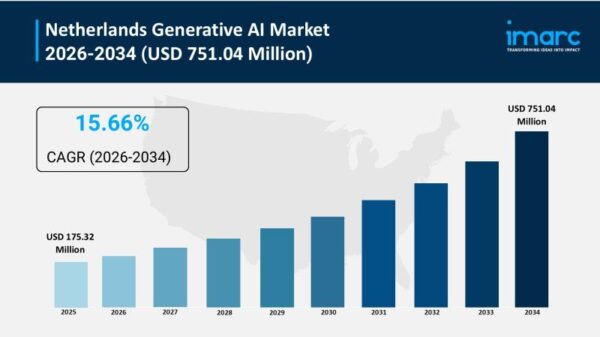

Inference Market Prospects

The inference market continues to attract venture capital, as demonstrated by the recent funding rounds for Baseten, Fireworks AI, and other related projects. These developments underscore a rising demand for solutions that offer cost savings in computational resources and quicker AI responses, further supporting the prospect of additional funding for Modal and similar companies in the sector.

While negotiations with General Catalyst are ongoing, both Modal and the venture firm have refrained from commenting publicly. Nonetheless, the current momentum indicates increasing investor interest in inference-focused technologies, suggesting a likely rise in valuations among similar enterprises in the near future. As the demand for efficient AI solutions expands, Modal Labs could be well-positioned for continued growth and innovation in this competitive landscape.

See also Bank of America Warns of Wage Concerns Amid AI Spending Surge

Bank of America Warns of Wage Concerns Amid AI Spending Surge OpenAI Restructures Amid Record Losses, Eyes 2030 Vision

OpenAI Restructures Amid Record Losses, Eyes 2030 Vision Global Spending on AI Data Centers Surpasses Oil Investments in 2025

Global Spending on AI Data Centers Surpasses Oil Investments in 2025 Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge

Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge Investors Must Adapt to New Multipolar World Dynamics

Investors Must Adapt to New Multipolar World Dynamics