The Mexico Cybersecurity Solutions Market is poised for significant growth, driven by increasing cyber threats and the rapid digital transformation of businesses and government entities. As organizations invest heavily in securing their digital infrastructure, the market size is projected to increase from USD 3.6 billion in 2024 to USD 8.7 billion by 2033, marking a compound annual growth rate (CAGR) of 9.20%. This expansion is fueled by a surge in cyberattacks, accelerated adoption of cloud technologies, and a growing demand for AI-powered security solutions.

Ransomware incidents, phishing attacks, and data breaches are pushing enterprises to prioritize their cybersecurity spending. In parallel, evolving regulatory frameworks and data protection policies are instigating stronger compliance measures across various sectors. With the increasing frequency and sophistication of cyber threats, organizations recognize the urgency of implementing advanced security measures.

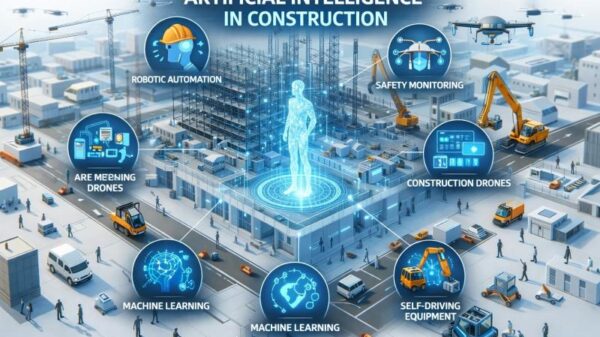

As digitalization spreads across industries, the demand for cloud security and endpoint protection is escalating. The integration of artificial intelligence and automation into cybersecurity platforms is becoming vital for effective risk management. Notably, government entities are also placing greater emphasis on developing national cybersecurity frameworks, reflecting a broader commitment to safeguarding digital assets.

In the context of Mexico’s expanding digital economy, opportunities and vulnerabilities coexist. The rapid adoption of e-commerce, fintech services, and remote work models is increasing the attack surface for cybercriminals. As businesses move toward hybrid and multi-cloud environments, solutions such as threat detection, identity management, encryption, and network monitoring are emerging as essential components of IT strategies. AI-driven analytics and machine learning-based threat intelligence systems are enhancing real-time incident response capabilities, positioning organizations to respond more effectively to evolving threats.

Market forecasts suggest that the growth trajectory will be bolstered by various factors, including the expansion of digital banking and fintech services, increasing enterprise cybersecurity budgets, and the adoption of zero-trust security models. Furthermore, the rise of Security Operations Centers (SOCs) and managed security services is indicative of a market adapting to the complexities of contemporary cyber threats. Small and medium-sized enterprises (SMEs) are also becoming increasingly significant players, leveraging cost-effective cloud-based cybersecurity solutions.

Key Developments and Trends

One of the key trends shaping the Mexico cybersecurity landscape is the rise of AI-driven threat detection systems. These systems are enhancing predictive threat identification and enabling automated responses, a critical capability in a landscape marked by sophisticated attacks. As organizations migrate to the cloud, there is an accelerating demand for cloud-native security platforms to protect sensitive data and applications.

The adoption of zero-trust architecture is another critical trend, as companies seek to strengthen internal and external access controls. With a growing shortage of cybersecurity professionals, many businesses are turning to managed security services to outsource their security operations, allowing them to focus on core business functions.

The urgency for regulatory compliance is also driving cybersecurity investments. Stricter data protection regulations compel enterprises to upgrade their cybersecurity infrastructure and practices, ensuring that they meet legal requirements while safeguarding customer data. This regulatory environment presents both challenges and opportunities for businesses navigating the cybersecurity landscape.

Despite the promising growth potential, the market faces challenges, including a significant shortage of skilled professionals and the high cost of implementing advanced security infrastructures. Additionally, the rapid evolution of cyberattack techniques poses an ongoing threat to organizations, particularly those with limited cybersecurity awareness, such as smaller businesses.

On the horizon, opportunities abound with the expected expansion of AI-powered cybersecurity tools and the growth of cloud-based security solutions. The increasing demand from fintech and e-commerce sectors further underscores the market’s potential. Collaborative public-private partnerships aimed at enhancing cybersecurity infrastructure will likely play a vital role in addressing these challenges.

The competitive landscape is characterized by a mix of global cybersecurity providers, regional technology firms, and managed service providers. Key players are focusing on integrating AI and machine learning, forming strategic partnerships and acquisitions, and expanding their managed security service offerings. In this context, innovation, scalability, and compliance expertise will serve as critical differentiators in the marketplace.

The Mexico cybersecurity market is segmented by components, deployment types, user types, and industry verticals, revealing a comprehensive landscape driven by diverse needs across sectors like IT, retail, banking, healthcare, and government. As organizations continue to adopt advanced digital technologies, the role of cybersecurity solutions in securing national digital infrastructure will become even more critical, enabling safe innovation and supporting sustainable economic growth through 2033.

See also Anthropic’s Claims of AI-Driven Cyberattacks Raise Industry Skepticism

Anthropic’s Claims of AI-Driven Cyberattacks Raise Industry Skepticism Anthropic Reports AI-Driven Cyberattack Linked to Chinese Espionage

Anthropic Reports AI-Driven Cyberattack Linked to Chinese Espionage Quantum Computing Threatens Current Cryptography, Experts Seek Solutions

Quantum Computing Threatens Current Cryptography, Experts Seek Solutions Anthropic’s Claude AI exploited in significant cyber-espionage operation

Anthropic’s Claude AI exploited in significant cyber-espionage operation AI Poisoning Attacks Surge 40%: Businesses Face Growing Cybersecurity Risks

AI Poisoning Attacks Surge 40%: Businesses Face Growing Cybersecurity Risks