(Bloomberg) — Debt investors are increasingly concerned that major technology firms will continue to borrow aggressively in their pursuit of advanced artificial intelligence capabilities. This anxiety has revitalized the market for credit derivatives, where banks and investors hedge against the risks associated with over-leveraged borrowers. A year ago, credit derivatives linked to high-grade tech companies were virtually nonexistent, but they have now become among the most actively traded contracts in the U.S. market, outside of financial sectors, according to data from Depository Trust & Clearing Corp.

Contracts linked to companies like Oracle Corp. have seen heightened activity for months, while trading for Meta Platforms Inc. and Alphabet Inc. has surged recently. Currently, approximately $895 million of Alphabet debt is tied up in these contracts, while Meta has about $687 million in similar arrangements. With estimates suggesting that investments in artificial intelligence could exceed $3 trillion—much of it funded through debt—demand for hedging continues to grow as some of the world’s wealthiest tech firms become significantly more indebted.

Gregory Peters, co-chief investment officer at PGIM Fixed Income, noted, “This hyperscaler thing is just so ginormous and there’s so much more to come that it really begs the question of ‘do you want to really be nakedly exposed here?’” He emphasized that traditional credit derivatives indexes, which provide general default protection, may not be adequate in this evolving landscape.

The number of dealers quoting credit default swaps (CDS) for Alphabet has expanded from one last July to six by the end of 2025, while Amazon.com Inc. has seen its CDS dealers increase from three to five, based on DTCC data. Some service providers are even offering baskets of hyperscalers’ CDS, mirroring the cash bond baskets that are rapidly emerging in the market.

Interest in these instruments surged last fall as the financial requirements for these tech giants became increasingly evident. A Wall Street dealer reported that their trading desk is now able to quote markets for $20 million to $50 million of these names regularly, a stark increase from the previous year when such trades were rare.

Despite the rising concerns, hyperscalers have not faced significant challenges in financing their ambitions. Alphabet’s recent $32 billion debt issuance across three currencies received orders vastly exceeding the amount available within just 24 hours. Notably, the company managed to sell 100-year bonds, a remarkable feat in an industry characterized by rapid obsolescence.

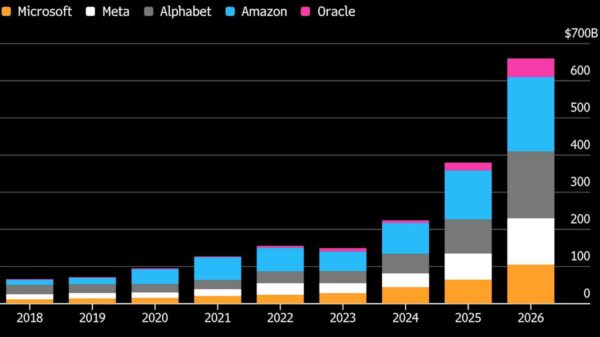

According to Morgan Stanley, borrowing by these massive tech firms, commonly referred to as hyperscalers, is projected to reach $400 billion this year, up from $165 billion in 2025. Alphabet anticipates capital expenditures as high as $185 billion this year to fund its AI initiatives, a figure that is contributing to investor unease. For instance, the London-based hedge fund Altana Wealth previously purchased protection against Oracle’s potential default, with costs soaring from approximately 50 basis points annually for five years to about 160 basis points.

Banks that underwrite hyperscaler debt have also become significant buyers of single-name CDS in recent months. The rapid pace and scale of deals, particularly for data centers and other projects, have prompted underwriters to hedge their own risks until they can distribute the associated loans. Matt McQueen, head of credit, securitized products and municipal banking at Bank of America Corp., noted, “Expected distribution periods of three months could grow to nine to 12 months.” This extended timeline is likely to drive further hedging activity in the CDS market.

Wall Street dealers are responding to this heightened demand for protection. Paul Mutter, formerly of Toronto-Dominion Bank, stated, “Appetite for newer basket hedges can be expected to grow,” hinting at the increasing complexity of credit markets. Some hedge funds view banks’ and investors’ thirst for protection as an opportunity for profit. Andrew Weinberg, a portfolio manager at Saba Capital Management, described many CDS buyers as “captive flow” clients such as bank lending desks.

For the most part, leverage remains low at the major tech companies, while bond spreads are only slightly tighter than the corporate index average. This stability encourages hedge funds to sell protection, according to Weinberg. “If there’s a tail risk scenario, where will these credits go? In a lot of scenarios, the big companies with strong balance sheets and trillion-dollar market caps will outperform the general credit backdrop,” he said. However, some traders express concern that the frenzied bond selling exhibits signs of complacency and mispriced risk.

Rory Sandilands, a portfolio manager at Aegon Ltd., cautioned, “The sheer amount of potential debt suggests that these companies’ credit risk profiles could come under some pressure.” He stated that he has increased his CDS trades compared to a year ago, reflecting the growing unease surrounding the financial health of these tech giants.

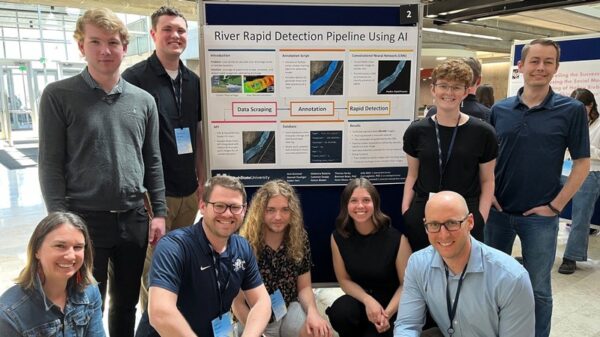

See also Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed

Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights

Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September

Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users

BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025

MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025