FRESNO, Calif. (KFSN) — As artificial intelligence (AI) tools increasingly automate routine tasks, families are embracing these technologies to enhance both personal and professional efficiency. Matt Britton, bestselling author of “Generation AI” and CEO of the enterprise consumer research platform Suzy, asserts that digital tools have transitioned from optional to essential in modern society. He highlights the growing integration of AI into everyday services, including banking.

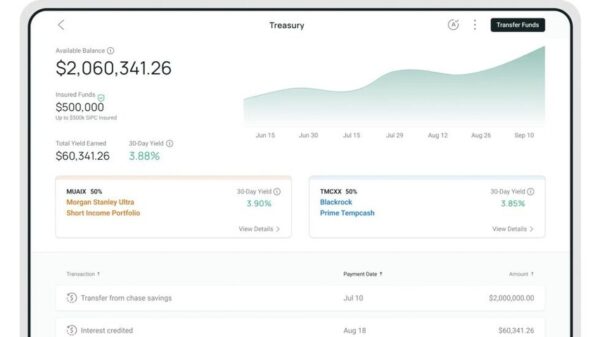

“We’ve kinda left the phase where you can not be digital in this society and I think over time it’ll be a trade-off; the more you trust AI, the more you’ll get out of it,” Britton said. This sentiment reflects a broader transformation in how families manage their finances, with AI-powered tools now providing insights that were once difficult for consumers to access independently.

Britton elaborates on the potential benefits of AI in financial management, stating, “AI is going to make it easier for families to understand how they’re spending money, how it stacks up against other people in their income class. It’ll show insights into maybe where you’re overspending or over budget in certain months.” Numerous applications now offer AI-driven financial assistance, allowing users to track spending, manage expenses, and even navigate tax complexities.

Despite these advantages, Britton warns that growing concerns regarding data privacy could deter some individuals from fully embracing these tools. “I think understanding what the risks are, what the opportunity and benefits are, will help future-proof yourself and what I think is going to be a new realm of societal evolution,” he said. He cautions against an over-reliance on AI, particularly concerning financial decision-making.

Consumers are encouraged to conduct thorough research not only on the applications they choose to use but also on the financial advice provided by these platforms. “I think the same with healthcare advice, financial advice is the same in you have to be your own best advocate,” Britton noted, emphasizing the importance of informed decision-making.

As AI becomes increasingly embedded in personal finance, parents face new challenges regarding how to teach financial literacy to their children. This is particularly relevant as algorithms may serve as the first financial advisers for many young individuals. Britton believes that the focus should remain on fundamental principles rather than the technicalities of these new tools.

“It’s really more about realizing the value of a dollar, the value of saving, the value of compound interest, the value of budgeting vs maybe the technicality of it,” he explained. In this rapidly evolving landscape, the balance between leveraging AI for financial management and maintaining personal oversight may define how future generations approach their finances.

The integration of AI in personal finance not only reshapes individual financial behaviors but also prompts a societal reevaluation of money management practices. As families navigate these changes, the ability to critically assess AI’s role in their financial decisions will be crucial for fostering long-term financial literacy and stability.

For news updates, follow Vanessa Vasconcelos on Facebook, X, and Instagram.

Copyright © 2026 KFSN-TV. All Rights Reserved.

See also Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed

Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights

Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September

Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users

BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025

MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025