Your smartphone buzzes with an alert: your budgeting app has detected an unusual spending pattern, recommending a $50 transfer from your savings to your checking account. Later, a robo-advisor automatically rebalances your investment portfolio. This scenario highlights the transformative impact of artificial intelligence (AI) on personal finance, reshaping how individuals manage their money.

AI-powered tools are revolutionizing financial management, making it more accessible than ever. Apps now automatically categorize transactions, while others provide conversational financial advice through text messages. These services can monitor credit scores, suggest budget adjustments, and even negotiate lower bills for utilities like cable and internet. The investing landscape has seen similar changes, with robo-advisors leveraging algorithms to create diversified portfolios, automatically adjust holdings, and implement strategies aimed at minimizing tax liabilities.

Moreover, educational tools powered by AI simplify complex financial concepts through interactive games and straightforward question-and-answer formats, enhancing financial literacy. However, while the technology excels in number-crunching, it faces inherent limitations. AI lacks the ability to truly understand what matters most to individuals, such as the preference for sustainable investing over maximum returns. It can’t grasp the emotional nuances involved in saving for a child’s education versus planning for early retirement.

When life throws challenges, such as an unexpected illness or a job change, AI’s inability to provide context and empathy can leave users wanting for guidance during crucial moments. While technology can efficiently analyze data, it cannot replace human judgment, experience, or ethical considerations. For investors with intricate financial needs, such as estate planning or complex tax strategies, the one-size-fits-all approach of robo-advisors may fall short.

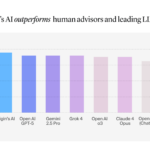

This gap highlights the continued importance of human financial advisors who offer insights that technology cannot replicate. They provide long-term perspectives, helping clients maintain focus during market volatility, coordinate competing financial priorities, and keep track of goals that may have been forgotten over time. Moreover, these advisors offer emotional support and wisdom when clients face significant financial decisions. Research from Edward Jones and Morning Consult indicates that individuals who regularly collaborate with financial advisors and follow a robust financial strategy tend to feel more optimistic about their financial futures compared to those who manage their finances independently.

The future of personal finance likely lies in a hybrid approach that marries AI-driven insights with the human touch of financial advisors. This model envisions AI as a sophisticated calculator, while financial advisors act as mathematicians who know which equations to apply based on individual circumstances. As technological advancements continue to unfold, it is crucial to view AI as a tool rather than a definitive guide.

Individuals should remain curious about the capabilities of technology in managing their finances while critically evaluating its limitations. Ultimately, the most significant elements of one’s financial life are personal and can only be defined by the individual. In this evolving landscape of financial management, the integration of AI with human-centered advice may very well set the course for future successes in personal finance.

Jason Richardson is a Financial Advisor with Edward Jones in Mesquite, specializing in retirement planning, wealth preservation, and financial goals for families, individuals, and business owners. He can be contacted at (435) 635-3353.

This article was prepared by Edward Jones for use by local Edward Jones Financial Advisors.

Edward Jones, Member SIPC, emphasizes that its employees and financial advisors cannot provide tax or legal advice; individuals should consult their attorney or qualified tax advisor regarding specific situations.

See also Origin Launches SEC-Regulated AI Financial Advisor Scoring 98.3% on CFP® Exam

Origin Launches SEC-Regulated AI Financial Advisor Scoring 98.3% on CFP® Exam GCC Banks Set to Leverage AI and Embedded Finance for $340B Value by 2026

GCC Banks Set to Leverage AI and Embedded Finance for $340B Value by 2026 Nvidia Sees 1% Stock Rise Amid 2M Orders for H200 AI Chips from China

Nvidia Sees 1% Stock Rise Amid 2M Orders for H200 AI Chips from China HONESTAI Secures $10M Funding to Enhance AI-Powered Banking-as-a-Service Platform

HONESTAI Secures $10M Funding to Enhance AI-Powered Banking-as-a-Service Platform Benchmark Raises Broadcom’s Price Target to $485 Amid 76% Surge in AI Chip Revenue

Benchmark Raises Broadcom’s Price Target to $485 Amid 76% Surge in AI Chip Revenue