The competition between KB Financial Group and Shinhan Financial Group is intensifying as both companies embark on strategic reshuffles aimed at solidifying their standings in a rapidly evolving financial landscape. With artificial intelligence (AI) emerging as a crucial catalyst for change, industry observers are closely monitoring developments following the management workshops held by the two institutions last week.

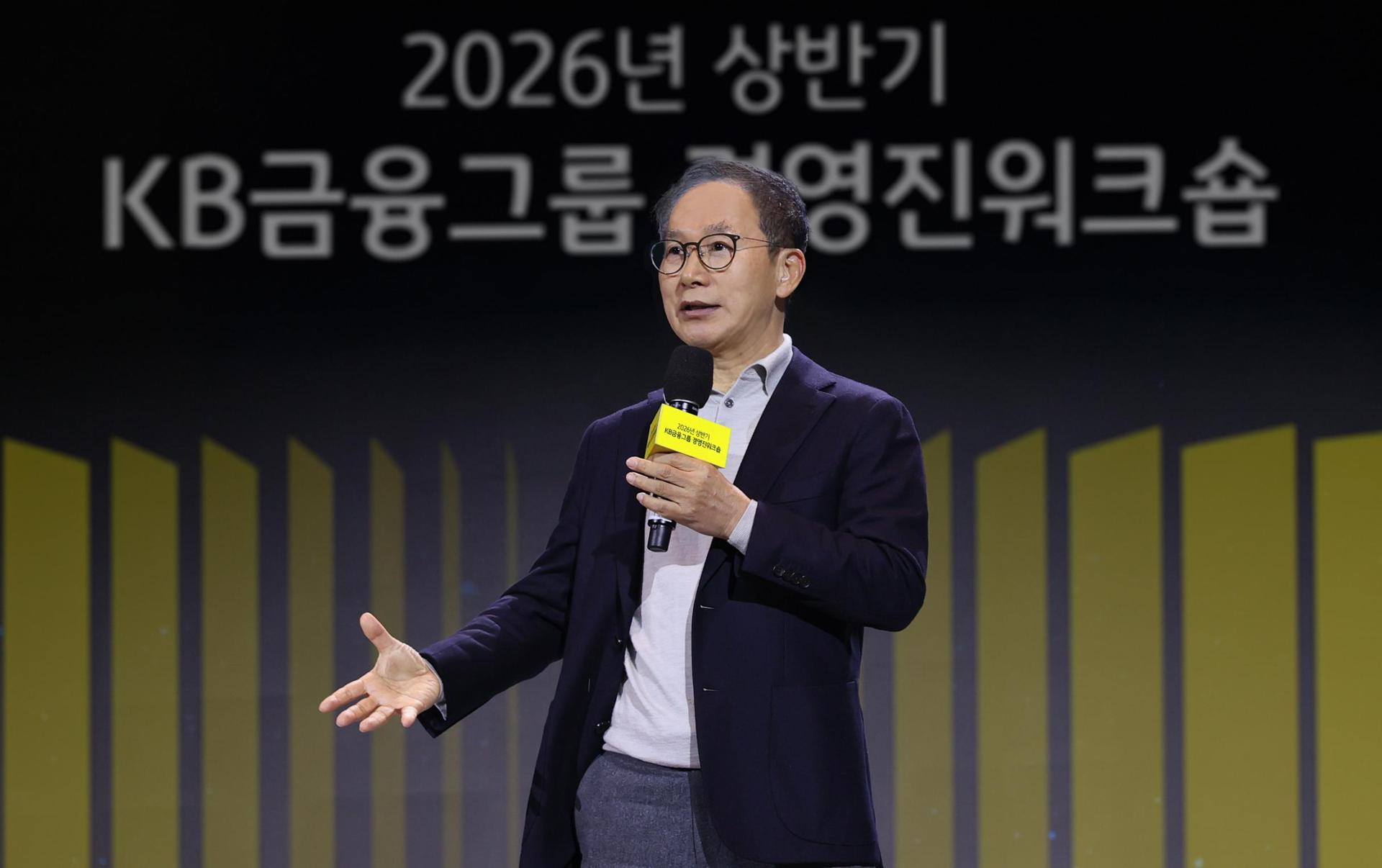

During a management workshop at the Grand Walkerhill Seoul on Friday, KB Financial Group Chairman Yang Jong-hee emphasized the need for company executives to evolve into “strategists and innovators.” He urged them to leverage AI as a strategic asset to drive transformation and expand into new markets. The workshop, titled “Transition and Expansion,” drew the entire executive leadership to review business strategies in the context of today’s low-growth environment.

Yang noted that the financial sector is experiencing a “paradigm shift at both the national and societal levels,” largely driven by AI’s potential to reshape financial markets. The newly launched future strategy division aims to integrate AI, data, and digital innovation, reinforcing KB’s commitment to an AI-led transformation this year.

In contrast, Shinhan Financial Group, which lost its leading position to KB in 2023, hosted a three-day management strategy conference over the weekend at its training center in Yongin, Gyeonggi Province. Approximately 250 executives participated, marking a strategic effort to reclaim the top spot. This year’s conference was extended by a day compared to previous years, indicating a serious resolve among leaders to focus on improving innovation and execution.

Chairman Jin Ok-dong, who recently secured another term, led the sessions without a moderator, encouraging participants to think independently and take full ownership of driving innovation. In his remarks, Jin identified AI as a central priority for the next three years, underscoring its critical role in shaping the future landscape of the financial industry.

“It is critical for CEOs to consider how AI will influence the financial industry, identify the issues leaders must address, and anticipate how the future landscape will evolve,” Jin stated in December. He highlighted that early preparation will be vital for long-term success, stating that trust is essential for any organization aiming to thrive.

Shinhan has also restructured its organization to establish a future innovation group focused on driving comprehensive internal change. This group aims to prioritize medium- to long-term initiatives that include enhancing senior wealth management, broadening its foreign customer base, and strengthening capabilities in digital assets.

As both financial groups push forward, the ongoing rivalry is expected to heighten as they each pursue innovation and adaptation strategies centered around AI and digital transformation. The financial industry is at a pivotal moment, with balancing the traditional aspects of banking while embracing technology becoming crucial for future relevance.

In the coming months, stakeholders will be watching closely as both KB and Shinhan implement their strategies, navigating a landscape that demands agility and foresight in response to evolving technologies. The outcomes of these initiatives could define the trajectories of both financial giants in an increasingly competitive sector.

See also Financial Services Scale AI Adoption with 79% Prioritizing Governance for Success

Financial Services Scale AI Adoption with 79% Prioritizing Governance for Success Meta Signs Multi-Gigawatt Nuclear Power Deals to Fuel AI Data Center Expansion

Meta Signs Multi-Gigawatt Nuclear Power Deals to Fuel AI Data Center Expansion Cheers Financial Launches AI-Powered Credit-Building Tool, Averages 21-Point Score Increase

Cheers Financial Launches AI-Powered Credit-Building Tool, Averages 21-Point Score Increase Blueberry Markets Reveals 2026 Broker Review: Regulatory Insights and Trading Conditions

Blueberry Markets Reveals 2026 Broker Review: Regulatory Insights and Trading Conditions Pagaya Engages Investors at Major Conferences, Boosts 2023 Guidance Following Strong Results

Pagaya Engages Investors at Major Conferences, Boosts 2023 Guidance Following Strong Results