Origin’s AI financial advisor has achieved a remarkable 98.3% average score on the Certified Financial Planner® (CFP®) exam, a significant leap from its previous 96% and far exceeding the typical human pass rate of around 85%. This advancement underscores the AI’s enhanced reasoning and mathematical capabilities, which have been bolstered by architectural upgrades, precision verification through live code execution, and improved security measures.

The impressive performance stems from a strategic pivot to OpenAI models from Google, allowing Origin to scale effectively and adapt swiftly to advancements in large language models (LLMs). The AI’s multi-agent architecture utilizes over 200 proprietary tools managed through an Anthropic-partnered abstraction layer, enabling efficient operations by mitigating context rot—an issue that occurs when processing excessive information. Furthermore, stringent zero-data-retention agreements and a strong security framework ensure that personal identifiable information (PII) is never at risk of exposure.

Designed for context-aware financial advising, Origin combines the capabilities of various LLMs, including Claude 4.1 Opus, OpenAI GPT, Gemini 2.5 Flash, and Perplexity Sonar Pro. Each financial query is routed to specialized agents that leverage real-time market data and the user’s financial history, ensuring that responses are personalized and timely. A robust compliance system checks each output against over 100 fiduciary and privacy standards, making it the first AI platform capable of delivering advisor-grade responses consistently within regulated financial environments.

The architecture features a Core Router that classifies queries to delegate tasks to specialized agents focusing on different financial aspects, such as budgeting, investment analysis, and long-term planning. This automation mimics the collaborative approach of traditional advisory teams, making elite financial services broadly accessible.

Core components of the system include a range of specialized LLMs. Claude 4.1 Opus serves as the primary reasoning agent capable of complex analysis, while OpenAI GPT acts as the technical backbone, integrating with 150+ proprietary tools for enhanced accuracy. Gemini 2.5 ensures rapid access to market data, essential for real-time analysis, and Perplexity Sonar Pro aids in contextual linking and retrieval-augmented generation.

Each user interaction follows a structured pipeline that begins with secure context retrieval and progresses through agent routing, collaborative reasoning, compliance checks, and logging for audit purposes. This meticulous structure fosters confidence in the AI’s outputs, ensuring they are both personalized and auditable—qualities that are critical in the financial sector.

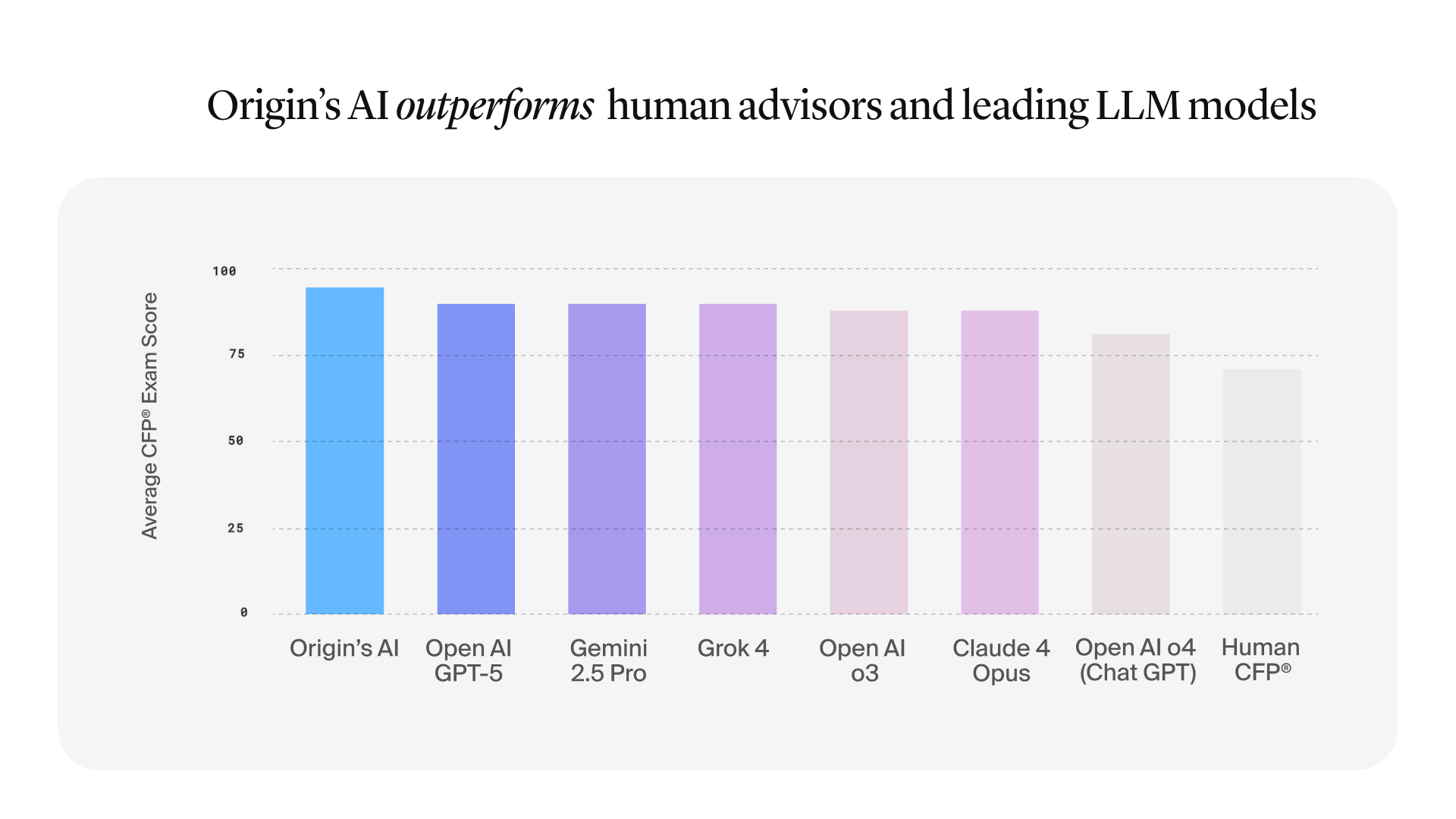

Benchmark results highlight Origin’s superior performance against not only human financial advisors but also leading LLMs. With the system scoring an average of 98.3%, it outstripped human advisors, who averaged 79.5%, and even advanced AI models like GPT-5 and Gemini 2.5, which scored 93.8% and 93.1% respectively. The robustness of Origin’s performance was consistent across multiple exam modules, showcasing the reliability of its financial reasoning capabilities.

Origin’s architecture thrives on continuous improvement, as each model upgrade contributes to a more powerful ensemble. The capability to integrate multiple specialized agents and enforce compliance measures ensures that Origin remains at the forefront of AI applications in finance. This hybrid system not only enhances the accuracy of financial advice but also sets a new standard in the industry.

As the financial landscape evolves, the ability to offer personalized, timely, and compliant advice on a large scale could redefine client engagement in financial planning. The implications of Origin’s advancements suggest that the convergence of AI and finance is not only feasible but poised to enhance the quality of advisory services available to a broader audience.

See also GCC Banks Set to Leverage AI and Embedded Finance for $340B Value by 2026

GCC Banks Set to Leverage AI and Embedded Finance for $340B Value by 2026 Nvidia Sees 1% Stock Rise Amid 2M Orders for H200 AI Chips from China

Nvidia Sees 1% Stock Rise Amid 2M Orders for H200 AI Chips from China HONESTAI Secures $10M Funding to Enhance AI-Powered Banking-as-a-Service Platform

HONESTAI Secures $10M Funding to Enhance AI-Powered Banking-as-a-Service Platform Benchmark Raises Broadcom’s Price Target to $485 Amid 76% Surge in AI Chip Revenue

Benchmark Raises Broadcom’s Price Target to $485 Amid 76% Surge in AI Chip Revenue Elon Musk’s Grok AI Under Fire for Sexualized Images of Women and Minors

Elon Musk’s Grok AI Under Fire for Sexualized Images of Women and Minors