Financial institutions are increasingly pressured to navigate complex accounting standards such as IFRS 9, IFRS 17, and US GAAP while providing real-time insights into risk, profitability, and capital efficiency. The deployment of SAP S/4HANA for Financial Products Subledger (FPSL) on the Google Cloud Platform (GCP) is emerging as a transformative solution, enabling intelligent, cloud-native multi-GAAP accounting. By leveraging granular subledger processing and advanced derivation frameworks, FPSL reshapes regulatory compliance into a strategic advantage for predictive accounting and capital optimization.

Modern financial institutions operate at the critical nexus of regulation, risk, and advanced analytics. Accounting standards like IFRS 9 and IFRS 17 necessitate the integration of probability-based risk models and forward-looking assumptions into accounting outcomes. Traditional ledger-centric platforms often fall short of accommodating the necessary granularity and computational intensity required by these standards. As transaction volumes surge and financial instruments grow more sophisticated, organizations must embrace cloud-enabled architectures that facilitate real-time valuation and analytics-ready data structures. SAP S/4HANA FPSL represents a significant advancement in this direction, particularly when coupled with the scalability and analytical prowess of cloud solutions like GCP.

Research highlights three dominant trends shaping contemporary financial accounting: first, risk-integrated accounting as mandated by IFRS 9, which necessitates expected credit loss (ECL) calculations based on forward-looking risk parameters; second, granular contract-level reporting under IFRS 17 that requires detailed measurement of insurance liabilities, thus heightening data volume and processing complexities; and third, a technology-driven approach to compliance, emphasizing system architecture and automation over reliance on manual controls. Industry literature underscores the role of cloud platforms in enabling large-scale valuation runs, stress testing, and scenario analysis, which are impractical within traditional on-premise environments.

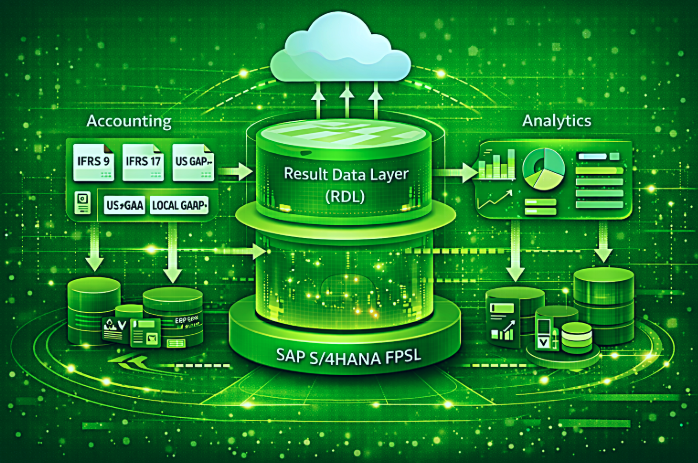

The architecture of SAP FPSL features a dedicated accounting subledger designed explicitly for financial instruments, centered around the Result Data Layer (RDL). This granular, immutable repository maintains accounting results at both contract and portfolio levels and supports parallel valuations across various accounting principles. The RDL not only enhances operational efficiency but also facilitates the comprehensive auditability required by regulators.

Subledger Posting Derivation (SLPD) within FPSL is crucial as it defines the transformation of operational and valuation data into detailed subledger journal entries. This process involves the configuration of financial product attributes, counterparty, portfolio, and currency dimensions, as well as key valuation metrics like amortized cost and fair value. Such granularity enables a rich dataset for analytics and AI-driven applications.

In parallel, General Ledger Posting Derivation (GLPD) governs the aggregation and posting of FPSL results to the SAP S/4HANA Universal Journal (ACDOCA). This separation of subledger intelligence from general ledger summarization allows institutions to retain detailed accounting logic while simplifying the general ledger’s structure. Deploying FPSL on GCP provides elastic scalability for valuation and period-end processing, enabling seamless integration with analytical services such as BigQuery. This architecture lays the groundwork for AI-enhanced finance capabilities, including predictive credit loss modeling and scenario-based capital analysis.

Implementations of FPSL yield measurable benefits across various domains, leading to significant reductions in regulatory reporting timelines by over 50%, while also facilitating 20–30% reductions in external audit efforts. Monthly or quarterly financial closes can be expedited by 1–2 days, with processing performance seeing improvements of 5× to 10× in valuation and accounting runs. Furthermore, the elimination of spreadsheet-based shadow ledgers promotes data consistency across financial reporting.

Looking to the future, FPSL sets the stage for the next generation of finance capabilities, including AI-driven predictive accounting, real-time integrated finance, and risk-finance convergence that supports strategic decision-making. Autonomous controls will further enhance system-enforced compliance, minimizing manual intervention and operational risk. These trends position FPSL as a vital component of intelligent, cloud-native financial platforms.

In conclusion, the deployment of SAP S/4HANA FPSL on the Google Cloud Platform symbolizes a pivotal transition from static, ledger-centric accounting practices to intelligent, analytics-driven finance architectures. By enabling granular subledger processing, facilitating parallel multi-GAAP reporting, and integrating advanced analytics, FPSL allows financial institutions to transcend mere compliance and unlock predictive insights, capital efficiency, and strategic agility. As regulatory complexities and data volumes continue to escalate, FPSL provides the architectural foundation essential for the evolution of intelligent finance.

See also Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed

Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights

Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September

Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users

BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025

MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025