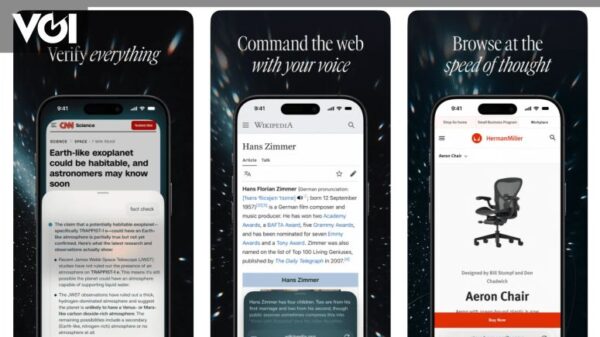

The Sarah Hyland Albert advertisement made its debut during the NFL Playoffs on January 19, 2026, promoting Genius, an AI finance assistant priced at $39.99 per month. For consumer fintech brands, prime-time television exposure is crucial for scaling and establishing trust. Investors are advised to closely monitor metrics such as installs, App Store rankings, free-to-paid conversion rates, and 30-day retention. These indicators will offer insight into whether customer acquisition costs (CAC) from television advertising can be recouped efficiently. Additionally, data on the pricing strategy and churn rates will be essential for assessing pricing power and long-term value (LTV) outlooks.

The NFL Playoffs, known for their national audience and high engagement, provide a strategic platform for introducing the Albert Genius finance assistant to a broader demographic. The decision to feature Sarah Hyland marks the brand’s inaugural celebrity-led campaign, with the aim of leveraging her popularity to enhance brand recall, particularly among Millennials and Gen Z households. Investors should remain vigilant about how this increased awareness translates into effective installs and trials in the days following the ad’s airing.

By utilizing a well-known figure, the Sarah Hyland Albert advertisement seeks to bridge the gap between finance and pop culture, potentially mitigating the perceived risks associated with trying a new money application. The effectiveness of this approach will be gauged through social media mentions, search interest, and app store reviews to ascertain if the campaign fosters lasting trust and intent beyond the initial television exposure.

Success in engaging potential users at the top of the funnel requires a seamless transition to app store pages. It will be vital for the advertisement’s messaging, visuals, and pricing to align with the app’s listings to enhance conversion rates. By clearly communicating the benefits of an AI finance assistant and maintaining transparent pricing of $39.99, the campaign can effectively reduce user friction. Initial download spikes are expected shortly after the ad airs, followed by a potential decline, but sustained improvements in rankings would indicate long-term demand rather than a transient surge.

Post-Campaign Metrics Investors Should Track

Investors are encouraged to track daily rankings in both the Finance categories and overall U.S. app charts. An immediate rise in rankings post-ad can indicate a strong fit between the creative content and market demand. More crucial than the initial spike is the duration for which rankings remain elevated. A normalization of rank above pre-campaign levels for an extended period suggests that the advertisement has successfully broadened the top of the sales funnel. Monitoring the volume and sentiment of app ratings will be essential to confirm genuine user traction rather than mere curiosity-driven clicks.

The $39.99 price tag for Albert Genius establishes a clear revenue target per user. Observing the proportion of new users who commence trials and convert within the first week will provide insights into the campaign’s effectiveness. Steady or increasing conversion rates in the face of TV-driven traffic would indicate strong pricing power, while a decline may necessitate enhanced in-app education or revised value messaging to sustain average revenue per user (ARPU).

Retention metrics will serve as a key validation of product-market fit beyond initial hype. Close attention should be paid to day-7 and day-30 retention rates following the NFL Playoffs advertisement. A rise in refund or cancellation rates could signal low-intent signups, while stable retention, consistent engagement, and growing feature adoption would suggest a healthy LTV, thereby making the television advertising investment more likely to yield returns.

Without granular data on gross rating points (GRP) or spending, analysts will need to infer the campaign’s effectiveness through triangulated metrics. If installs surge, conversion rates hold steady, and 30-day retention remains consistent, the blended CAC is likely within planned expectations. The Sarah Hyland Albert ad could also facilitate reductions in organic CAC through increased word-of-mouth and improved search lift. Observing trends in branded searches and organic install ratios will help determine if television impressions contribute to a lower average acquisition cost over time.

Key factors influencing performance will include user tenure, upgrades, cross-sell opportunities, and reduced pauses in service. For an AI finance assistant, features such as automated savings and budgeting alerts can significantly extend user tenure. Should the Sarah Hyland Albert advertisement attract higher-income customers, there is potential for increased ARPU. Introducing annual billing or family plans may further enhance cash flow and diminish churn, supporting quicker CAC payback.

Pricing power is indicated when conversion rates remain stable, upgrades increase, and churn stays low despite the $39.99 monthly rate. Rising adoption of long-term plans and fewer discounts during acquisition flows will also signal a firm grip on pricing strategy. Creative messaging that emphasizes tangible benefits can help justify the price point. This campaign is significant not only as Albert’s first celebrity endorsement during the NFL playoffs but also as a test of the brand’s pricing elasticity on a larger scale.

In closing, the next four weeks will be critical for assessing the impact of the Sarah Hyland Albert advertisement. Investors should closely monitor App Store rankings, ratings volume, and user sentiment to evaluate top-of-funnel momentum. Additionally, tracking trial starts, free-to-paid conversions, and early churn at the $39.99 price point will illuminate near-term revenue implications. Analysis of week-one and 30-day retention will be key to validating LTV. Should conversion and retention rates remain stable while organic installs increase, the likelihood of improved CAC payback will rise, paving the way for further television campaigns and expanded creative testing. Conversely, a decline in conversion or an uptick in refunds may prompt necessary adjustments to onboarding, pricing strategies, and plan offerings. Timely updates on these metrics will enable investors to assess whether this prime-time investment creates lasting value.

See also Ripple’s Acquisition of Traditional Finance Firms Raises Concerns for XRP’s Future Value

Ripple’s Acquisition of Traditional Finance Firms Raises Concerns for XRP’s Future Value UK Finance Faces AI Risks as 75% of Firms Lack Regulatory Framework, Urges FCA Action

UK Finance Faces AI Risks as 75% of Firms Lack Regulatory Framework, Urges FCA Action Shanghai Unveils 15th Five-Year Plan to Double GDP by 2035, Boost AI and Green Tech

Shanghai Unveils 15th Five-Year Plan to Double GDP by 2035, Boost AI and Green Tech NTT DATA Reveals How Responsible AI Drives Innovation in Banking and Healthcare

NTT DATA Reveals How Responsible AI Drives Innovation in Banking and Healthcare GCC M&A Surges 19% in 2025, with $75B in Renewables and AI Investments Ahead

GCC M&A Surges 19% in 2025, with $75B in Renewables and AI Investments Ahead