ALKHOBAR: Saudi Arabia’s workforce is undergoing a significant transformation as digital fluency merges with financial empowerment, a shift propelled by the Kingdom’s Vision 2030 initiative aimed at economic diversification. Experts assert that the Kingdom’s most valuable resource lies not solely in technology but in individuals adept at navigating both finance and digital tools confidently.

Shereen Tawfiq, co-founder and CEO of Balinca, emphasizes that financial literacy is a foundational element of national growth rather than a mere soft skill. Her company focuses on training individuals and organizations through gamified simulations designed to impart financial logic, risk assessment, and strategic decision-making—skills she describes as “the true language of empowerment.”

“Our projection builds on the untapped potential of Saudi women as entrepreneurs and investors,” Tawfiq noted. “If even 10–15 percent of women-led SMEs evolve into growth ventures over the next five years, this could inject $50–$70 billion into GDP through new job creation, capital flows, and innovation.” Tawfiq, an early player in Saudi Arabia’s banking sector, has also served as an adviser to the Ministry of Economy and Planning on private sector development, contributing to the establishment of the Kingdom’s venture-capital ecosystem—a feat she describes as “a national case study in ambition.”

“Back in 2015, I proposed a 15-year roadmap to build the PE and VC market,” she recalled. “The minister told me, ‘you’re not ambitious enough, make it happen in five.’” Within a few years, Saudi Arabia had developed a robust investment ecosystem that supports startups and non-oil growth.

At Balinca, Tawfiq prioritizes experiential learning over theoretical knowledge. Participants engage in interactive simulations where they can make business decisions and immediately observe the financial consequences. “Balinca teaches finance by hacking the brain, not just feeding information,” she stated. “Our simulations create what we call a ‘business gut feeling’—an intuitive grasp of finance that traditional training or even AI platforms can’t replicate.” While she acknowledges that AI can personalize lessons, she contends that behavioral learning still necessitates human experience.

“AI can democratize access,” she said, “but judgment, ethics, and financial reasoning still depend on people. We train learners to use AI as a co-pilot, not a crutch.” This approach aligns with broader national strategies, including the Financial Sector Development Program and Al Tamayyuz Academy, which aim to elevate financial acumen across various industries. “In Saudi Arabia, financial literacy is a national project,” she asserted. “When every sector thinks like a business, the nation gains stability.”

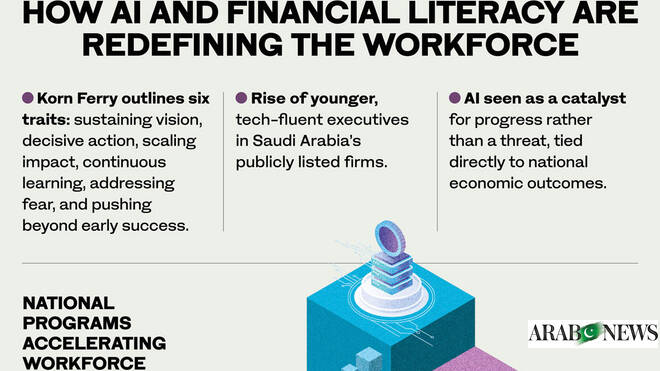

Jonathan Holmes, managing director for Korn Ferry Middle East, sees Saudi Arabia’s digital transformation fostering a new generation of leaders—agile, data-literate, and unafraid of disruption. “What we’re seeing in the Saudi market is that AI is tied directly to the nation’s economic growth story,” Holmes told Arab News. “Unlike in many Western markets where AI is viewed as a threat, here it’s seen as a catalyst for progress.”

Holmes noted that Vision 2030 and the national AI strategy are cultivating “younger, more dynamic, and more tech-fluent” executives who lead with speed and adaptability. Korn Ferry’s CEO Tracker Report highlights a notable increase in first-time CEO appointments in Saudi Arabia’s listed firms, indicating a deliberate generational shift.

Korn Ferry research identifies six traits essential for AI-ready leadership: sustaining vision, decisive action, scaling for impact, continuous learning, addressing fear, and pushing beyond early success. “Leading in an AI-driven world is ultimately about leading people,” Holmes said. “The most effective leaders create clarity amid ambiguity and show that AI’s true power lies in partnership, not replacement.” He believes that Saudi Arabia’s young workforce is uniquely equipped to model this balance. “The organizations that succeed are those that anchor AI initiatives to business outcomes, invest in upskilling, and move quickly from pilots to enterprise-wide adoption,” he added.

The convergence of Tawfiq’s focus on financial empowerment and Holmes’s vision for AI leadership underscores a crucial truth: the Kingdom’s greatest strategic advantage lies in its human capital, which can think analytically and act ethically. “Financial literacy builds confidence and credibility,” Tawfiq stated. “It transforms participants from operators into leaders.” Holmes echoes this sentiment: “Technical skills matter, but the ability to learn, unlearn, and scale impact is what defines true readiness.”

As organizations adopt skills-based models that prioritize matching employees to projects rather than adhering to fixed job titles, flexibility is emerging as the new currency of success. Saudi Arabia’s workforce revolution embodies both cultural and technological advancements, demonstrating that progress accelerates most effectively when inclusion and innovation advance in tandem. Holmes perceives this as a defining opportunity for the Kingdom. “Saudi Arabia can lead global workforce transformation by showing how technology and people thrive together,” he said.

Tawfiq advocates for a similar principle in finance: “Financial confidence grows from dialogue,” she explained. “The more women engage in discussions about money, valuations, and investment, the more they will see themselves as decision-makers who shape the economy.” Together, their visions propose a future where leaders are inclusive, data-savvy, and AI-empowered—a model that may soon establish the global standard for workforce transformation under Vision 2030.

See also King County Finance Committee Approves $506K Juvenile Justice Medical Contract and Budget Adjustments

King County Finance Committee Approves $506K Juvenile Justice Medical Contract and Budget Adjustments Samsung Focuses on AI Innovations, Consumer Finance Growth; Rules Out India IPO

Samsung Focuses on AI Innovations, Consumer Finance Growth; Rules Out India IPO