Zocks has secured $45 million in a new funding round co-led by Lightspeed Venture Partners and QED Investors. Existing investors including Motive Partners, Expanse Venture Partners, Entrée Capital, Illuminate Financial, and 14Peaks Capital also participated in this Series B funding. This latest raise increases the company’s total funding to $65 million, bolstering its efforts to scale its agentic AI model designed for financial advisors.

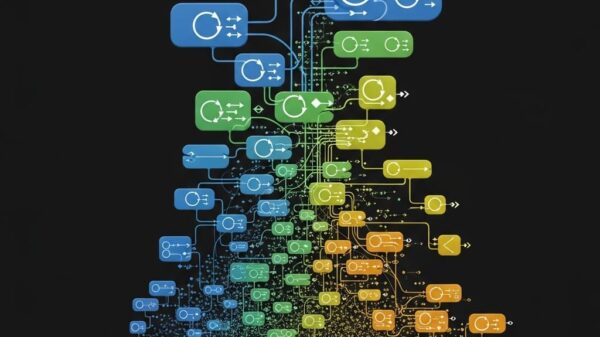

The platform, which automates complex tasks and uncovers new client opportunities, has already demonstrated the ability to save advisors more than ten hours each week. Zocks converts conversations into structured data and integrates seamlessly with a financial advisor’s existing software systems. The company plans to introduce more enterprise features, enhance compliance tools, improve security, and expand its software integrations.

Zocks employs advanced analytics to interpret conversation data, combining it with the connected platforms to generate actionable insights. Financial advisors can query Zocks about various client situations, such as families lacking college savings or clients nearing required minimum distributions (RMDs). In response, the platform suggests next steps, enabling advisors to act with a single click.

Currently, over 5,000 firms, including Ameritas, Carson Group, Kestra Financial, and Osaic, utilize Zocks. The company claims its accuracy leads the industry, offering firms structured data and clear insights derived from actual client interactions. Shannon Spotswood, CEO of RFG Advisory, highlighted that the platform effectively addresses operational challenges, removing bottlenecks and providing insights previously unavailable to advisors. She emphasized that Zocks enhances operational efficiency while allowing advisors to maintain their independence.

The financial advisory sector faces significant capacity challenges, with a projected shortage of 100,000 advisors by 2034. Many advisors primarily depend on referrals for business growth, yet time constraints remain a major obstacle. A report from Cerulli Associates noted that 83 percent of advisors identify limited time as the key barrier to executing referral strategies.

According to Mark Gilbert, CEO of Zocks, client expectations are rapidly evolving. Clients now demand personalized advice and proactive engagement from their advisors. He noted that Zocks has transitioned into a vital tool for both workflow and insight generation within advisory firms. The platform aggregates data to identify revenue opportunities and guides advisors through compliance processes.

Lightspeed first invested in Zocks in 2024, with partner Arif Janmohamed commending the team’s quick execution. He stated that Zocks encompasses comprehensive advisor workflows, leveraging a robust AI architecture that offers a competitive edge through deep integrations. Similarly, Laura Bock, a partner at QED Investors, views Zocks as essential infrastructure that can scale across the wealth management, banking, and insurance sectors, catering to the increasing demand for personalized services.

Founded in 2024, Zocks has experienced notable financial success, with revenue growing eightfold year over year. The company operates on a software-as-a-service (SaaS) model, allowing firms to purchase directly or through enterprise agreements. Zocks’ unique agentic AI capabilities enable it to extract insights from client conversations efficiently, facilitating follow-ups, account openings, form completions, and email drafting, all without storing recordings by default. Instead, the system listens actively and synthesizes information into structured formats.

Advisors can easily request client lists based on specific criteria, such as those with children nearing college age or those without 529 plans, and Zocks will generate actionable suggestions. Gilbert emphasized that Zocks differentiates itself from competitors who primarily focus on note-taking, stating that Zocks anticipates advisor needs and guides them comprehensively through their client portfolios.

With a commitment to the financial services sector, Zocks prioritizes data privacy, recognizing the value embedded in client conversations. As the industry grapples with high manual workloads, Zocks aims to bridge this gap by facilitating greater automation and intelligence from existing systems. The company is preparing for European expansion, building on its established presence in the United States and Canada. As demand for automation and enhanced intelligence in financial advisory services continues to surge, Zocks is well-positioned to meet these evolving needs.

See also Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed

Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights

Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September

Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users

BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025

MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025