As trade tensions escalate, President Trump has issued a stark warning of a potential 100% tariff on Canada, a move that could disrupt cross-border business operations and undermine investor confidence. This threat comes at a time when the risk of a government shutdown looms, adding another layer of uncertainty to the markets. Investors are increasingly concerned about the implications of stalled policy initiatives, leading to a cautious approach that may suppress stock market performance.

The looming tariff and government shutdown have significant implications for major technology players, including Tesla, Microsoft, Meta, and Apple. These companies face learning challenges that could hinder their innovation capabilities and competitiveness in an environment marked by policy fluctuations. As these tech giants navigate regulatory uncertainties, their ability to adapt and thrive may be tested.

Market reactions are already reflecting heightened apprehension due to the potential for increased volatility. Investors are closely monitoring how these evolving policy landscapes could shape the broader economy in the long term. Uncertainties surrounding tariffs and potential government inaction are leading to a more cautious investment climate, which could ultimately affect growth trajectories for various sectors.

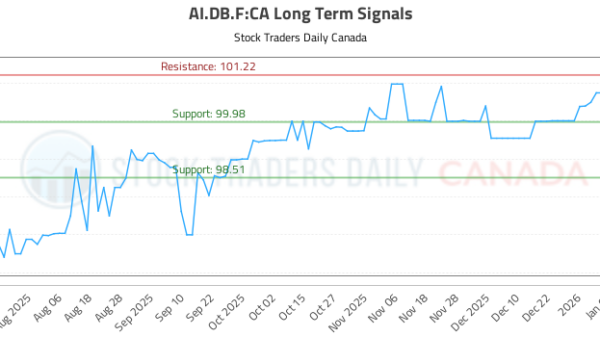

Amid this backdrop, analysts are offering mixed forecasts for Microsoft Corporation. According to Wall Street projections, the average one-year price target for MSFT is set at $631.36, with a low estimate of $500.00 and a high of $678.00. It is important to note that these price targets are inherently subjective and may often lag behind market movements. Therefore, investors are advised to focus on the underlying fundamentals driving analyst rating changes rather than just the numerical targets.

As of the latest reports, MSFT shares are currently priced at $451.14. This represents a significant gap between the current market valuation and analysts’ bullish forecasts, indicating potential upside for the stock if broader market conditions stabilize. Nevertheless, the risks associated with ongoing trade tensions and domestic policy uncertainty could pose challenges for the tech sector.

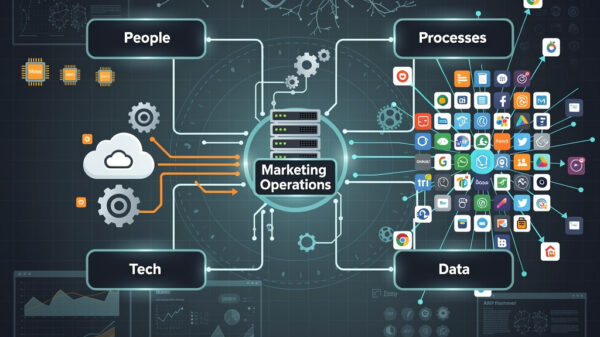

Microsoft is a leading technology firm that develops a wide array of products and services spanning software, devices, and cloud solutions. Its productivity and business processes segment includes offerings such as Microsoft 365, which serves both commercial and consumer markets. On the cloud front, its Intelligent Cloud segment is anchored by Azure, providing public, private, and hybrid server solutions. The company’s more personal computing segment consists of Windows OS and gaming products like Xbox, further diversifying its revenue streams.

In summary, as the potential for a government shutdown and tariff implementation looms, market sentiment appears to be teetering. The challenges faced by tech giants may hinder their growth prospects in an uncertain policy landscape, while the outlook for Microsoft remains cautiously optimistic given analysts’ price targets. Looking ahead, investors will need to stay vigilant as the interplay between trade policies and market dynamics unfolds, potentially reshaping the investment landscape for technology stocks.

See also AI Technology Enhances Road Safety in U.S. Cities

AI Technology Enhances Road Safety in U.S. Cities China Enforces New Rules Mandating Labeling of AI-Generated Content Starting Next Year

China Enforces New Rules Mandating Labeling of AI-Generated Content Starting Next Year AI-Generated Video of Indian Army Official Criticizing Modi’s Policies Debunked as Fake

AI-Generated Video of Indian Army Official Criticizing Modi’s Policies Debunked as Fake JobSphere Launches AI Career Assistant, Reducing Costs by 89% with Multilingual Support

JobSphere Launches AI Career Assistant, Reducing Costs by 89% with Multilingual Support Australia Mandates AI Training for 185,000 Public Servants to Enhance Service Delivery

Australia Mandates AI Training for 185,000 Public Servants to Enhance Service Delivery