CxOs are displaying cautious optimism regarding their efforts in artificial intelligence (AI) and automation, emphasizing the need to transition from proofs of concept to full-scale production. This sentiment is outlined in the findings of Constellation Research’s 2025 CxO Confidence Survey and its accompanying 2025 AI Survey, which highlight the strategic pivot toward innovation as a means of securing competitive advantage in the current business landscape.

According to Constellation Research CEO R “Ray” Wang, the prevailing focus among CxOs is on leveraging automation and AI to differentiate their offerings in the marketplace. The surveys reveal a nuanced perspective on the economic climate, with 52% of CxOs perceiving an improved business environment, while nearly half remain cautious about future developments. This division is also reflected in attitudes toward IT budgets, where nearly half of the respondents anticipate increases.

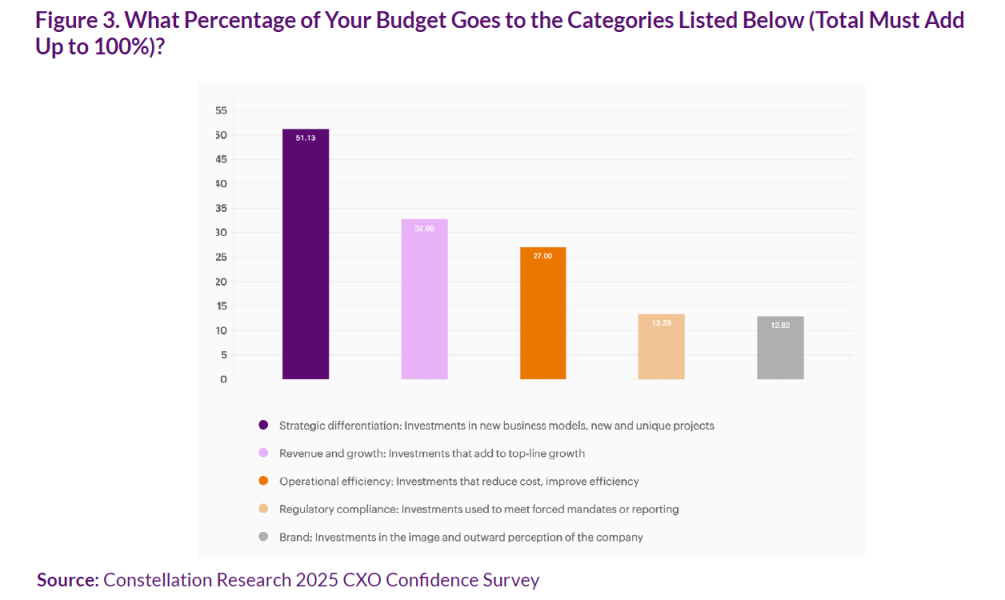

Investment priorities showcase that 52% of IT budgets are allocated toward strategic differentiation, followed by 33% aimed at revenue and growth, and 27% concentrated on operational efficiency. This allocation signals a robust commitment to innovation, as CxOs increasingly turn to emerging technologies to enhance their organizational performance.

The surveys further indicate that 61% of CxOs are either planning or currently executing proofs of concept in AI, with automation initiatives following closely at 46% and analytics initiatives at 33%. This shift illustrates a growing recognition of the potential for AI and automation to drive significant operational improvements, despite the challenges that accompany their implementation.

Among the key players in the technology ecosystem, hyperscalers are emerging as essential partners in co-innovation. AWS, Microsoft, and Google Cloud rank as the top three vendors favored by CxOs, highlighting the pivotal role these companies play in facilitating the development and deployment of AI and automation solutions.

In terms of application development, the 2025 AI Survey reveals that 60% of CxOs are primarily focused on collaborating with vendors or systems integrators to create semi-custom applications tailored to their specific needs. Additionally, half of the respondents are investing in homegrown applications that leverage cloud-based machine learning and AI services, emphasizing a dual approach to technology adoption.

Despite ongoing investments and strategic initiatives, the survey results reveal a mixed return on these AI endeavors. Half of the CxOs report seeing modest returns from their AI efforts, while one in five indicate that their results have met or exceeded initial investment expectations. This disparity underscores the complexity of deriving tangible value from AI technologies, as organizations navigate the intricacies involved in implementation and scaling.

Looking ahead, the cautious optimism among CxOs suggests a commitment to advancing their AI and automation strategies. As organizations continue to explore the capabilities of these technologies, the imperative to move beyond initial trials into fully operational implementations will become increasingly critical. The evolving landscape of AI and automation presents both challenges and opportunities, compelling businesses to innovate or risk falling behind in an ever-competitive environment.

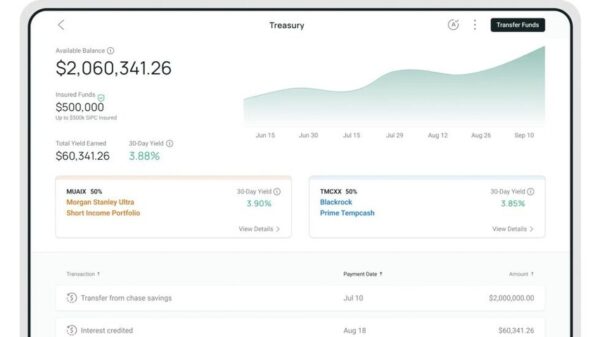

See also Generative AI Agents Automate Key Cash Management Tasks, Boosting Liquidity Efficiency

Generative AI Agents Automate Key Cash Management Tasks, Boosting Liquidity Efficiency Machine Learning Reveals Phase Transition in Zinc Oxide Nanoparticles During Growth

Machine Learning Reveals Phase Transition in Zinc Oxide Nanoparticles During Growth AI Research Shifts Focus from Scaling to Human-Like Learning for Improved Generalization

AI Research Shifts Focus from Scaling to Human-Like Learning for Improved Generalization Amazon Awards 63 Research Grants to 41 Universities Across 8 Countries for AI Innovation

Amazon Awards 63 Research Grants to 41 Universities Across 8 Countries for AI Innovation DeepSeek and Alibaba Endorse China’s AI Regulatory Framework, Call for National Law

DeepSeek and Alibaba Endorse China’s AI Regulatory Framework, Call for National Law