Generative AI agents are proving capable of performing key cash-management tasks without requiring specialized training, according to a recent working paper from the Bank for International Settlements (BIS). As financial institutions invest heavily in artificial intelligence to streamline their operations, this research highlights the potential for AI to enhance cash and liquidity management, particularly in real-time gross settlement (RTGS) payment systems.

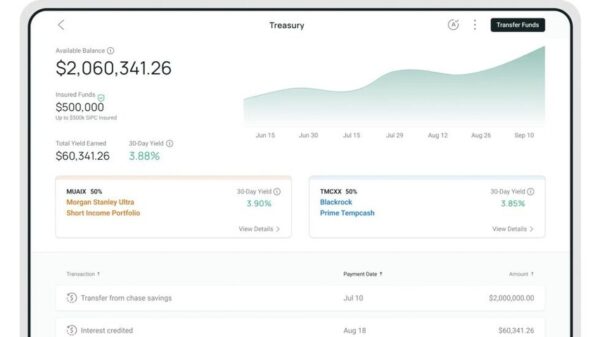

The BIS study explored how Generative AI can support banks in managing liquidity in complex payment scenarios. Researchers conducted prompt-based experiments using ChatGPT’s reasoning model to assess whether AI could effectively execute high-level intraday liquidity management within a wholesale payment framework. The experiments simulated various payment scenarios involving liquidity shocks and competing priorities, testing the AI agent’s ability to maintain precautionary liquidity buffers and optimize payment prioritization under tight constraints.

The findings revealed that the AI agent demonstrated a strong capability to replicate essential cash-management practices. Even in the absence of domain-specific training, it issued calibrated recommendations that preserved liquidity while minimizing payment delays. “These findings suggest that routine cash-management tasks could be automated using general-purpose large language models, potentially reducing operational costs and improving intraday liquidity efficiency,” the BIS report stated.

This development comes at a time when banks are increasingly turning to AI technologies to enhance operational efficiency and respond to evolving market demands. As the financial sector contemplates the broader implications of AI integration, these insights from the BIS underscore the growing viability of utilizing advanced AI models in critical financial processes.

The implications of this research extend beyond immediate liquidity management tasks. By automating routine cash-management functions, banks could unlock significant operational efficiencies, allowing them to realign resources towards more strategic initiatives. This could lead to a future where AI not only supports traditional banking functions but also plays a pivotal role in redefining them.

As AI technologies continue to evolve, the financial industry stands at a crossroads. The integration of generative AI into cash management systems could represent a substantial shift in how banks operate, with a focus on increased efficiency and reduced costs. The ability of AI agents to perform tasks previously thought to require human oversight may catalyze a broader acceptance of AI solutions across various banking operations.

Going forward, it will be essential for banks to navigate the challenges associated with implementing AI technologies, including data privacy and ethical considerations. The promising results from the BIS working paper may encourage further investment in AI-driven solutions, propelling innovation within the industry. As banks seek to enhance their competitive edge, the ongoing exploration of AI’s capabilities will likely inform their strategies in the years to come.

See also Machine Learning Reveals Phase Transition in Zinc Oxide Nanoparticles During Growth

Machine Learning Reveals Phase Transition in Zinc Oxide Nanoparticles During Growth AI Research Shifts Focus from Scaling to Human-Like Learning for Improved Generalization

AI Research Shifts Focus from Scaling to Human-Like Learning for Improved Generalization Amazon Awards 63 Research Grants to 41 Universities Across 8 Countries for AI Innovation

Amazon Awards 63 Research Grants to 41 Universities Across 8 Countries for AI Innovation DeepSeek and Alibaba Endorse China’s AI Regulatory Framework, Call for National Law

DeepSeek and Alibaba Endorse China’s AI Regulatory Framework, Call for National Law Aston University Launches AI Research Platform to Enhance Business Intelligence at AlixPartners

Aston University Launches AI Research Platform to Enhance Business Intelligence at AlixPartners