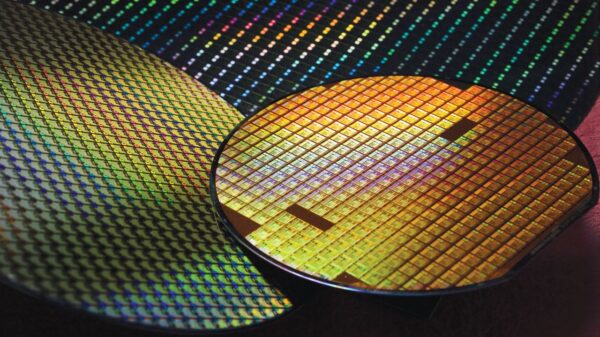

Alphabet Inc.’s quantum computing efforts have gained significant attention after its quantum chip, Willow, completed a benchmark calculation in just five minutes—an achievement estimated to take a traditional computer a staggering 10 septillion years. This technological breakthrough not only underscores Alphabet’s potential to emerge as a leader in the quantum computing space but also highlights its commitment to investing heavily in this nascent field.

The company has pledged between $91 billion and $93 billion in capital expenditures by 2025, with a substantial portion likely earmarked for quantum computing initiatives. This strategic investment is part of Alphabet’s broader focus on enhancing its competitive edge in emerging technologies, even as it continues to concentrate on artificial intelligence (AI) advancements.

Financially, Alphabet appears well-positioned for such ambitious investments. Over the past 12 months, the company generated $74 billion in free cash flow, excluding capital expenditures. This strong financial foundation allows Alphabet to navigate the volatile landscape of quantum computing, where many startups face significant financial hurdles. In contrast, Alphabet’s robust cash flow provides a level of security that appeals to investors seeking indirect exposure to the burgeoning quantum sector.

Despite these advancements, Wall Street analysts have expressed a cautious outlook regarding Alphabet’s stock performance. The average one-year price target for shares of Alphabet is currently set at $313.25, with forecasts ranging from a low of $255.00 to a high of $350.00. Analysts caution that these price targets are often subjective and may lag behind actual market conditions, emphasizing the importance of focusing on the underlying fundamentals that drive stock performance.

As of the latest market data, Alphabet’s stock is trading at approximately $333.16. This figure reflects the current investor sentiment and market realities that may not fully capture the company’s long-term potential in quantum computing and other key segments.

Alphabet’s diverse business model, which includes segments such as Google Services, Google Cloud, and Other Bets, positions it favorably for future growth. The Google Services segment encompasses a wide range of popular products and services, including ads, Android, Chrome, and YouTube, while Google Cloud offers comprehensive infrastructure and platform services tailored for enterprise customers. Additionally, its Other Bets segment is focused on innovative sectors, including healthcare-related services.

The Google Cloud Platform provides valuable solutions, including advanced AI offerings, cybersecurity, and data analytics, further broadening Alphabet’s market reach. These initiatives not only bolster the company’s core business but also serve as a foundation for future developments in quantum computing.

As Alphabet continues to make significant strides in quantum technology, the implications for various industries, from finance to healthcare, could be transformative. The ability to solve complex problems at unprecedented speeds could unlock new capabilities and efficiencies across numerous sectors, potentially changing the landscape of technology as we know it.

In summary, while Alphabet’s foray into quantum computing demonstrates its commitment to innovation and leadership in technology, market analysts remain cautious regarding its stock trajectory. Investors will be watching closely as Alphabet navigates its ambitious investments and the evolving landscape of quantum computing, which could herald a new era of technological advancement.

See also Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity

Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity Affordable Android Smartwatches That Offer Great Value and Features

Affordable Android Smartwatches That Offer Great Value and Features Russia”s AIDOL Robot Stumbles During Debut in Moscow

Russia”s AIDOL Robot Stumbles During Debut in Moscow AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse

AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech

Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech