Alphabet Inc. is emerging as a formidable player in the quantum computing sector, leveraging its vast resources to navigate a market increasingly cautious about artificial intelligence and related technologies. As many companies focused solely on quantum computing have seen their stock values decline, Alphabet remains a steady choice for investors eyeing this rapidly evolving landscape. With a market capitalisation of $3.7 trillion, Alphabet’s stock (GOOG +1.55%, GOOGL +1.47%) has shown resilience, making it a top pick for those interested in quantum advancements for December.

While smaller quantum computing firms may offer higher upside potential, Alphabet’s stability and financial strength set it apart. The tech giant is not solely reliant on quantum computing for its success; rather, it is developing the technology for in-house applications and as a service through Google Cloud. Alphabet’s annual expenditure on hardware for AI and cloud infrastructure reaches tens of billions of dollars, and any stride in reducing future computing costs is a strategic move for the company.

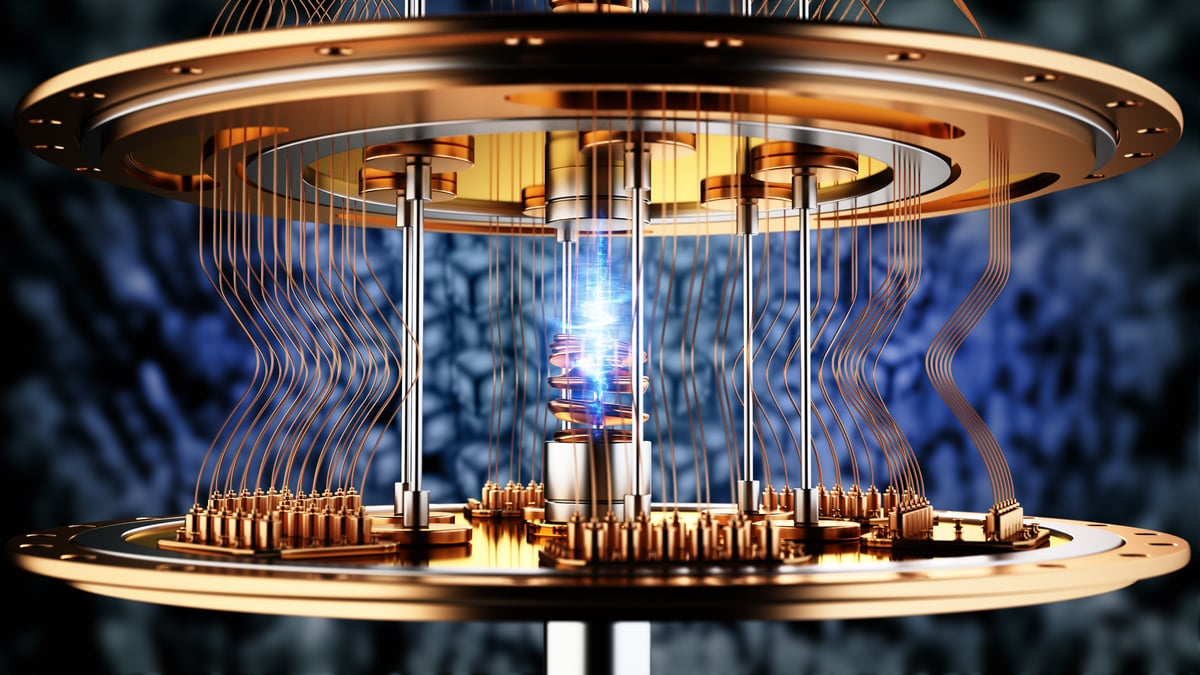

In the AI accelerator realm, Alphabet has already established a strong presence with its Tensor Processing Units, developed in partnership with Broadcom. This experience in custom computing hardware positions Alphabet advantageously as it ventures into the quantum space. In October, Alphabet’s quantum chip, named Willow, demonstrated a significant milestone, achieving a verifiable quantum advantage by executing an algorithm 13,000 times faster than the world’s leading supercomputer. This accomplishment marks a critical step toward commercial viability for its quantum hardware.

As Alphabet continues to invest in its quantum computing efforts, it does so without the pressure faced by smaller firms to consistently announce breakthroughs. These startups, reliant on attracting funding and public interest, often find themselves in precarious situations if they fail to deliver. Alphabet, however, can afford to pursue its research path without external pressures, giving it a distinct competitive edge in a field where many smaller players may falter.

Another compelling aspect of Alphabet’s position is its robust cash flow, allowing for substantial investments across various growth initiatives. Although a considerable portion of its cash flow is directed toward building data centers for AI, the company retains ample resources to support its quantum computing ventures. Investors should monitor Alphabet’s operating and free cash flow metrics as indicators of its financial health and capacity for future investments. The company could feasibly allocate $10 billion or more to its quantum computing unit, an amount that would be out of reach for most pure-play quantum firms.

With its notable achievements in quantum computing and unrivaled financial resources, Alphabet is poised to become a dominant force in the sector as the technology matures. Unlike smaller competitors who face the risk of significant losses if they do not attract a customer base, Alphabet’s diverse revenue streams mitigate that risk, making it a more stable investment choice. As the landscape of quantum computing evolves, Alphabet’s strategic positioning suggests that it will be at the forefront when useful quantum solutions reach the market.

See also Experts Warn of Gaps in AI Job Revolution Predictions Amidst Automation Surge

Experts Warn of Gaps in AI Job Revolution Predictions Amidst Automation Surge Nvidia Reveals Four Key Inversions Shaping GPU Economics and AI Hardware Value

Nvidia Reveals Four Key Inversions Shaping GPU Economics and AI Hardware Value Shanghai Jiao Tong University Unveils LightGen, Breakthrough All-Optical Chip for Generative AI

Shanghai Jiao Tong University Unveils LightGen, Breakthrough All-Optical Chip for Generative AI AI Bubble Fears Rise: $1.4 Trillion OpenAI Investment Faces Profitability Challenges

AI Bubble Fears Rise: $1.4 Trillion OpenAI Investment Faces Profitability Challenges