Several major tech companies have recently reported their earnings and provided estimates for capital expenditures (CapEx) for 2026, with a particular emphasis on investments in artificial intelligence (AI) infrastructure. Wall Street has taken significant note of the combined projected spending, which is estimated to exceed $700 billion (€590 billion) this year, surpassing the nominal GDP of Sweden for 2025, as projected by the IMF.

In addition, global chip sales are anticipated to reach $1 trillion (€842 billion) for the first time this year, according to the U.S. Semiconductor Industry Association. Major banks and consulting firms, including JPMorgan Chase and McKinsey, forecast that total AI CapEx will exceed $5 trillion (€4.2 trillion) by 2030, driven largely by “astronomical demand” for computing power.

CapEx represents the funds a company allocates for building, improving, or maintaining long-term assets such as technology and infrastructure. These investments are intended to enhance operational capacity and efficiency over several years. Notably, these expenditures are not fully deducted in the same year; instead, they are capitalized on the balance sheet and expensed through depreciation, offering insights into a company’s investment strategies.

This year’s surge in spending confirms a significant pivot that began in 2025, when Big Tech reportedly spent around $400 billion (€337 billion) on AI CapEx. As Nvidia’s founder and CEO, Jensen Huang, stated at the World Economic Forum in Davos last month, we are witnessing “the largest infrastructure build-out in human history.”

Leading the charge for 2026 spending is Amazon, which is guiding for a staggering $200 billion (€170 billion). This figure alone exceeds the combined nominal GDP of the three Baltic countries in 2025, according to IMF projections. Alphabet, Google’s parent company, follows closely with a projected $185 billion (€155 billion), while Microsoft and Meta are set to invest $145 billion (€122 billion) and $135 billion (€113 billion), respectively. Oracle has also raised its 2026 CapEx target to $50 billion (€42.1 billion), nearly $15 billion (€12.6 billion) above earlier estimates.

Tesla is planning to double its CapEx, with nearly $20 billion (€16.8 billion) earmarked primarily for scaling its robotaxi fleet and advancing the Optimus humanoid robot. Elon Musk’s xAI is expected to spend at least $30 billion (€25.2 billion) in 2026, including a new $20 billion (€16.8 billion) data center called MACROHARDRR in Mississippi. Governor Tate Reeves noted this is “the largest private sector investment in the state’s history.” xAI is also expanding its Colossus data center cluster in Tennessee, described by Musk as the world’s largest AI supercomputer.

In another noteworthy development, xAI was acquired by SpaceX in an all-stock transaction valued at $1 trillion (€842 billion) for SpaceX and $250 billion (€210 billion) for xAI, resulting in a combined valuation of $1.25 trillion (€1.05 trillion). This merger is reportedly the largest private company valuation in history. Further reports indicate that SpaceX is contemplating an initial public offering (IPO) this year, with Morgan Stanley allegedly in discussions to manage the offering that now includes xAI.

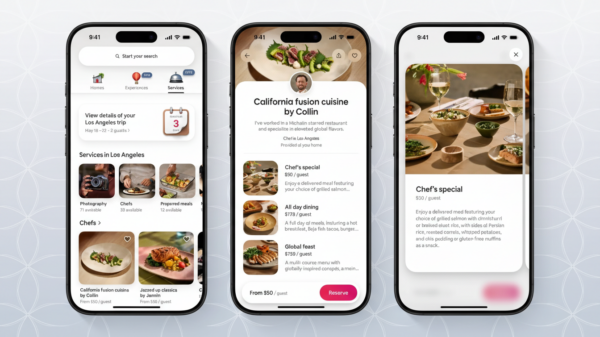

Apple, in contrast, is projected to spend a relatively modest $13 billion (€10.9 billion). The company recently announced a multi-year partnership with Google to integrate Gemini AI models into future iterations of Apple Intelligence, focusing on upgrading Siri and enhancing on-device AI capabilities, suggesting Apple is outsourcing some of its necessary investment in AI development.

Nvidia is set to report its earnings and projections on February 25. As a primary player in the AI chip market, Nvidia is expected to capture a significant portion of Big Tech’s spending, particularly for data center development. In a past earnings call, CEO Jensen Huang projected a cost per gigawatt of data center capacity between $50 billion (€42.1 billion) and $60 billion (€50.5 billion), with about $35 billion (€29.5 billion) allocated to Nvidia hardware.

Despite the immense planned spending, Wall Street is experiencing mixed sentiments. While investors recognize the urgency of building a competitive advantage in the AI landscape, some remain apprehensive about the scale of the investments. The market’s tolerance for such expenditures will depend on demonstrable returns on investment starting this year. Morgan Stanley estimates that hyperscalers are likely to borrow around $400 billion (€337 billion) in 2026, more than double the $165 billion (€139 billion) loaned in 2025. This surge could push the total issuance of high-grade U.S. corporate bonds to a record $2.25 trillion (€1.9 trillion).

Currently, projected AI revenue for 2026 does not match the expected spending, raising concerns about rapid hardware depreciation and high operational costs, including energy consumption. Google CEO Sundar Pichai acknowledged this month that there exist “elements of irrationality in the current spending pace.” Some analysts, like Alex Haissl from Rothschild & Co, have expressed doubts, suggesting that the current spending levels may not yield returns comparable to previous tech booms.

As 2026 unfolds, the divide between American and European efforts in AI infrastructure becomes increasingly pronounced. While U.S. firms mobilize nearly €600 billion in a single year, total European investments in sovereign cloud data infrastructure are forecast to reach only €10.6 billion in 2026. Despite initiatives such as the AI Factories and the AI Continent Action Plan, the numbers starkly illustrate the continent’s limitations in this tech race.

In this context, Mistral AI stands out as a symbol of European ambition, recently confirming a €1 billion CapEx plan for 2026, alongside a €1.2 billion investment in a data center in Sweden aimed at fostering data sovereignty. As U.S. tech titans attempt to appease European regulators with “sovereign-light” solutions, the gap in investment and ambition raises critical questions about the continent’s ability to compete in the AI era.

See also Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity

Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity Affordable Android Smartwatches That Offer Great Value and Features

Affordable Android Smartwatches That Offer Great Value and Features Russia”s AIDOL Robot Stumbles During Debut in Moscow

Russia”s AIDOL Robot Stumbles During Debut in Moscow AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse

AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech

Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech