Dell Technologies Inc., HP Inc., and several other tech companies are raising alarms about potential memory-chip supply shortages anticipated in the coming year. This warning stems from soaring demand linked to the rapid buildout of infrastructure for artificial intelligence (AI). Consumer electronics manufacturers such as Xiaomi Corp. have voiced concerns regarding possible price increases, while companies like Lenovo Group Ltd. have started stockpiling memory chips to prepare for escalating costs.

This forecast from Counterpoint Research suggests a staggering 50% price rise for memory modules through the second quarter of next year. A shortage could significantly impact manufacturing costs across various sectors, including smartphones, medical devices, and automobiles, as memory chips are integral to nearly all modern electronic devices that store data. The burgeoning AI sector is cited as a primary factor, with manufacturers prioritizing the production of advanced memory chips used in AI systems, thereby limiting the availability of more conventional memory types.

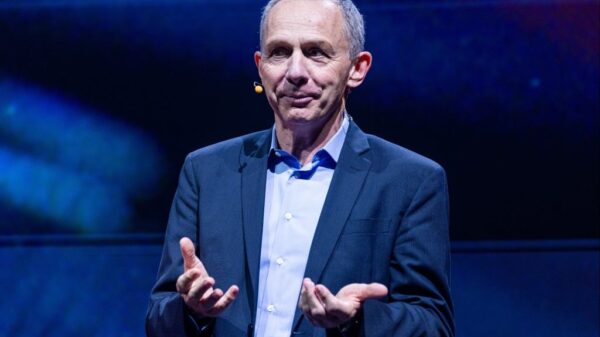

Chief Operating Officer Jeff Clarke of Dell expressed concern during a recent analysts’ call, stating that the company has not witnessed costs fluctuating at such a rapid pace before. Dell has reported tighter supplies of dynamic random access memory (DRAM), which encompasses high-bandwidth memory for AI as well as chips for personal computers, alongside other storage solutions like hard drives and NAND flash memory. “The cost basis is going up across all products,” Clarke noted.

To mitigate these challenges, Dell plans to adjust its product configurations and mix, although Clarke acknowledged that the impact will inevitably reach customers. He indicated that Dell might consider repricing certain devices in response to the rising costs. Meanwhile, US sanctions have exacerbated the supply situation by restricting the technological capabilities of new entrants in the Chinese market.

HP, based in Palo Alto, California, foresees particular challenges in the latter half of 2026 and is prepared to raise prices as necessary. CEO Enrique Lores told Bloomberg News that the company is adopting a cautious approach, implementing measures such as onboarding additional memory suppliers and reducing memory allocations in its products. HP estimates that memory constitutes approximately 15% to 18% of the typical PC’s cost.

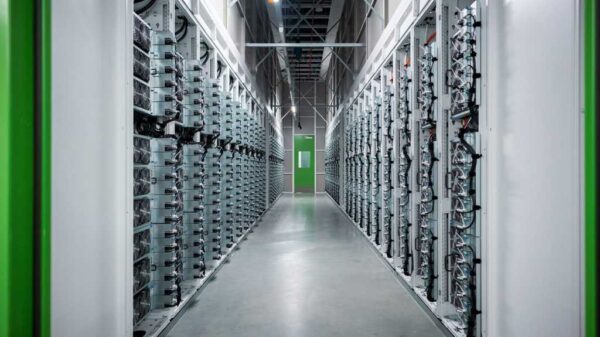

The race to establish AI infrastructure has already driven up energy costs in regions near large data centers and boosted the valuations of leading memory manufacturers. Shares of South Korea’s Samsung Electronics Co., SK Hynix Inc., and Micron Technology Inc. have surged recently as inventories diminish and supply challenges become more pronounced. SK Hynix announced last month that it has sold out its entire memory chip lineup for the upcoming year, while Micron anticipates tight supply through 2026.

Japan’s Kioxia Holdings Corp., which focuses on NAND production, has seen its stock multiply following a public listing in December, driven by the same tight supply dynamics. “Everything that’s related to memory — advanced or conventional — is in very strong demand and supply is lagging,” stated Sanjeev Rana, head of research at CLSA Securities Korea, following Samsung’s recent earnings announcement. He predicts that the price upturn for DRAM and NAND could persist for several quarters.

Manufacturers of logic chips, essential for processing data and critical to AI systems, may also experience adverse effects, as customers may hesitate to place orders without securing sufficient memory. Semiconductor Manufacturing International Corp. (SMIC), China’s largest chipmaker, noted that the memory shortage coincides with manufacturers prioritizing partnerships with Nvidia Corp., the world’s foremost AI chip provider. SMIC cautioned that a memory shortfall could hinder production in the automotive and electronics sectors by 2026.

In Beijing, Xiaomi has already raised prices on its flagship devices, stating that it expects the memory chip shortage to lead to further price hikes for mobile devices in the coming year. Lenovo has emphasized its economies of scale, claiming a chance to capture more market share as competitors face supply chain difficulties. Nonetheless, Chief Financial Officer Winston Cheng echoed Dell’s sentiment, labeling the cost surge as “unprecedented.”

Conversely, Apple Inc. has adopted a more optimistic outlook. CFO Kevan Parekh acknowledged on an analyst call that while there’s a “slight tailwind” on memory prices, the company is effectively managing its costs. Apple’s status as a major customer for numerous players in the electronics supply chain allows it to secure favorable terms for ongoing supply.

Lenovo’s memory inventories are reportedly about 50% higher than usual, with Asustek Computer Inc. also racing to stockpile. Both companies plan to hold prices steady during the holiday quarter, with intent to reassess market conditions in the new year. Chey Tae-won, chairman of SK Hynix’s parent company SK Group, recently reiterated concerns over a supply bottleneck, stating, “We have entered an era in which supply is facing a bottleneck. We are receiving memory chip supply requests from many companies, and we are thinking hard about how to address all demands.”

See also Google Offers AI Chips to Meta at Deep Discounts, Challenging Nvidia’s Dominance

Google Offers AI Chips to Meta at Deep Discounts, Challenging Nvidia’s Dominance Quantum Computing Market to Reach $97B by 2025, AI Set to Surpass Trillions

Quantum Computing Market to Reach $97B by 2025, AI Set to Surpass Trillions Africa’s AI Revolution: $10B Investment Needed in Connectivity, Compute, and Talent

Africa’s AI Revolution: $10B Investment Needed in Connectivity, Compute, and Talent AI Computing in Space to Be 50% Cheaper Than Earth by 2030, Analysts Predict

AI Computing in Space to Be 50% Cheaper Than Earth by 2030, Analysts Predict Foxconn Invests $569 Million in Wisconsin to Expand AI Hardware Operations, Adding 1,300 Jobs

Foxconn Invests $569 Million in Wisconsin to Expand AI Hardware Operations, Adding 1,300 Jobs