The quantum computing sector is poised for substantial growth in the coming years, following the rapid advancements seen in artificial intelligence (AI). A recent report from the Boston Consulting Group suggests that quantum computing could generate up to $850 billion in economic value by 2040. Despite the focus on AI, which has seen significant investments from tech giants like Google, the potential for quantum computing remains significant, particularly as innovations like Google’s Willow Chip emerge, aiming to substantially reduce errors in quantum calculations.

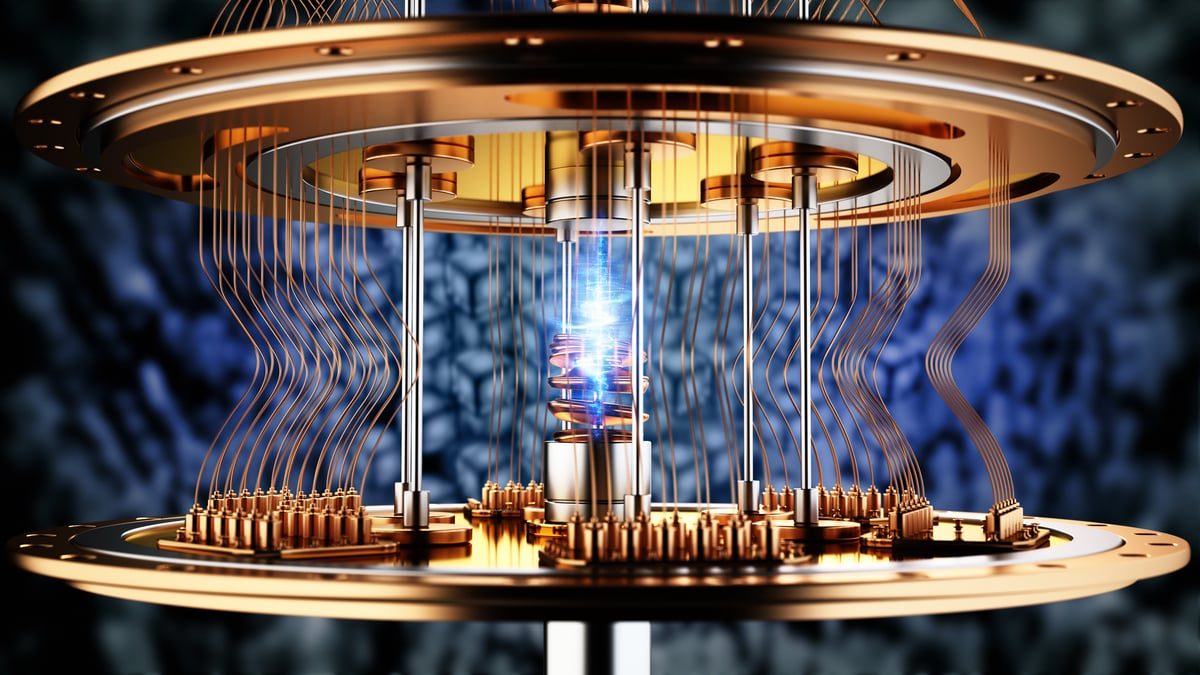

While the timeline for quantum computing to achieve mainstream application is uncertain, its capabilities promise to tackle complex calculations and solve problems currently beyond the reach of classical computing. Potential breakthroughs could be seen in fields such as drug discovery, cryptography, and business optimization. However, realizing this potential necessitates new chips and data centers specifically designed for quantum workloads, as traditional AI infrastructure is inadequate for quantum demands.

This sets the stage for companies that have established dominance in AI, like Nvidia, to transition into the quantum domain. Nvidia’s current trajectory suggests that even amid its success in AI, there is significant room for growth if it effectively capitalizes on quantum computing developments. With shares recently climbing 2.92% to $189.05, Nvidia’s market cap stands at $4.5 trillion, underscoring its financial strength in the technology space.

Nvidia is actively positioning itself in the quantum race, having developed NVQLink, a technology that connects AI chips with quantum computers. The company has also formed partnerships with 17 quantum startups and nine research laboratories to build the necessary software and infrastructure for a quantum computing boom. Although Nvidia is not yet focused on creating quantum chips, that could change as the technology approaches broader application. The integration of both AI and quantum chips will be essential for the next generation of quantum data centers, and Nvidia’s established leadership in AI gives it a competitive edge.

Moreover, Nvidia is investing in quantum computing firms through its venture capital arm, NVentures, having recently acquired stakes in three companies dedicated to quantum technologies. This strategy not only strengthens Nvidia’s influence in the sector but also offers potential financial returns from its investments, even if its own quantum initiatives take time to mature. Notably, companies like IonQ, Rigetti Computing, and D-Wave Quantum have experienced remarkable growth, with stock prices increasing over 1,000% in the past three years, illustrating the potential for significant returns associated with quantum investments.

Nvidia’s strategy appears to position the company advantageously, regardless of which specific quantum computing firms ultimately achieve success. By focusing on providing essential infrastructure and tools, Nvidia is akin to a supplier in a gold rush. With a robust revenue stream—reporting $57 billion in the third quarter of fiscal 2026, a year-over-year increase of 62%—and a net income of $31.8 billion, a 59% rise, Nvidia is well-equipped to leverage its financial resources in the burgeoning quantum space.

The company concluded the quarter with $116.5 billion in total current assets, providing a solid foundation for further investments in quantum technology. Although smaller quantum-focused stocks may see rapid gains, Nvidia’s established reputation and proven business model afford it a level of stability and cash flow that many pure-play quantum companies lack. Thus, as the quantum computing landscape evolves, Nvidia is likely to remain a key player, blending its expertise in AI with the emerging demands of quantum technology.

See also Alphabet Acquires Intersect for $4.75B to Enhance Data Center Energy Solutions

Alphabet Acquires Intersect for $4.75B to Enhance Data Center Energy Solutions Neurable Secures $35M to Advance Brain-Computer Interface AI Technology

Neurable Secures $35M to Advance Brain-Computer Interface AI Technology AI for Enterprises Reveals 7 Proven Use Cases to Eliminate Engineering Bottlenecks

AI for Enterprises Reveals 7 Proven Use Cases to Eliminate Engineering Bottlenecks Gold Hunter Deploys AI with Windfall Geotek to Optimize Drill Targets at Great Northern

Gold Hunter Deploys AI with Windfall Geotek to Optimize Drill Targets at Great Northern ByteDance Announces $23 Billion AI Spending Spree to Boost Doubao and Infrastructure

ByteDance Announces $23 Billion AI Spending Spree to Boost Doubao and Infrastructure