Artificial intelligence chip startup Groq Inc. announced today that Nvidia Corp. will license its technology on a nonexclusive basis. The agreement will also see several key Groq employees, including founding Chief Executive Officer Jonathan Ross and president Sunny Madra, join Nvidia. According to Alex Davis, CEO of Groq investor Disruptive Technology Advisers, the transaction is valued at $20 billion.

This licensing arrangement, characterized as a reverse acquihire, allows Nvidia to access Groq’s talent and technology without assuming the full ownership of the startup. This method has gained traction among major tech firms like Microsoft Corp. and Meta Platforms Inc., who have pursued similar deals over the past three years to enhance their AI capabilities while circumventing antitrust scrutiny typically associated with traditional acquisitions.

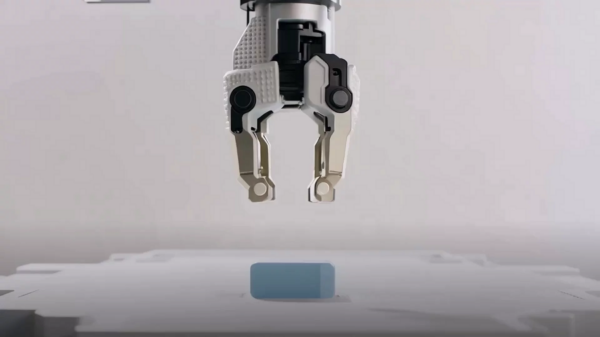

The reported $20 billion that Nvidia will pay represents a significant $13.1 billion premium over Groq’s valuation from September. The licensing deal focuses on Groq’s “inference technology,” likely referring to its flagship LPU inference chip, which the company claims can execute inference workloads using ten times less power than conventional graphics cards.

Groq attributes this efficiency to its deterministic design, allowing for precise control over calculation timing. This contrasts with standard nondeterministic chips that may suffer from unexpected delays, complicating computational processes. The LPU also features hundreds of megabytes of on-chip SRAM, the fastest memory type available, which outperforms graphics card memory while consuming less power.

In addition to its processing capabilities, Groq connects LPU-equipped servers into inference clusters using an internally developed interconnect known as RealScale. This technology addresses a challenge known as crystal-based drift, which complicates the synchronization of AI servers. Typically, processors rely on a quartz crystal clock to regulate calculation frequencies, but crystal-based drift can lead to unexpected slowdowns. Groq’s RealScale technology mitigates this issue by automatically adjusting processor clocks.

Nvidia CEO Jensen Huang reportedly informed employees via an internal memo that the company intends to integrate Groq’s low-latency processors into the Nvidia AI factory architecture, broadening its platform to accommodate a wider array of AI inference and real-time workloads.

Despite this significant licensing deal, Groq will maintain its status as an independent entity. Following the transaction, Simon Edwards, the company’s chief financial officer, will succeed Jonathan Ross as CEO. Groq is anticipating a strong financial performance, expecting to finish the year with $500 million in revenue. The company markets access to its chips via a cloud platform named GroqCloud, which also offers a library of open-source AI models and tools for processing various prompts.

As the tech landscape evolves, such strategic partnerships illustrate a growing trend where major firms seek to enhance their AI capabilities through innovative licensing agreements and talent acquisitions, potentially reshaping competitive dynamics within the industry.

See also Nvidia Acquires Groq for $20B, Boosting AI Inference Capabilities and Market Position

Nvidia Acquires Groq for $20B, Boosting AI Inference Capabilities and Market Position Microsoft Denies AI Overhaul of Windows 11 After Engineer’s Controversial Code Claims

Microsoft Denies AI Overhaul of Windows 11 After Engineer’s Controversial Code Claims AI’s Energy Consumption Doubles CO2 Emissions; New Strategies Needed for Sustainability

AI’s Energy Consumption Doubles CO2 Emissions; New Strategies Needed for Sustainability Nvidia Licenses Groq’s Inference Tech, Acquires Key Executives to Boost AI Dominance

Nvidia Licenses Groq’s Inference Tech, Acquires Key Executives to Boost AI Dominance AI Disrupts U.S. Labor Market: 12% of Jobs at Risk, MIT Study Reveals

AI Disrupts U.S. Labor Market: 12% of Jobs at Risk, MIT Study Reveals