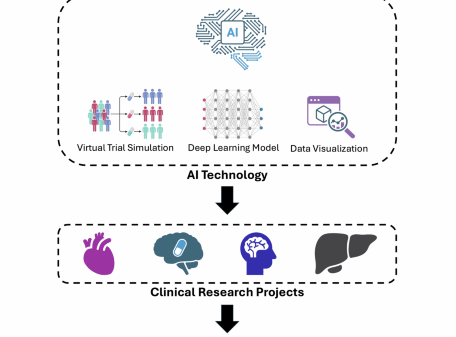

Strong market demand for artificial intelligence (AI) infrastructure is projected to persist in the coming years, defying expectations of a slowdown in spending. This trend is particularly notable as the construction of large data centers is time-consuming, indicating a favorable outlook for companies operating within the AI sector. Key players such as Nvidia, Taiwan Semiconductor Manufacturing Company (TSMC), and Broadcom are poised to capitalize on this ongoing investment boom, particularly as the four major hyperscalers plan to invest approximately $650 billion in capital expenditures this year.

Nvidia (NVDA) has solidified its position as the leading provider of AI computing units in 2023. The company’s latest Rubin chip architecture dramatically reduces the number of GPUs required for training AI models, driving customer demand for upgrades. Analysts forecast a remarkable 65% revenue growth for Nvidia in fiscal year 2027, emphasizing the company’s robust market potential as AI spending continues to escalate.

Meanwhile, TSMC, recognized as the world’s largest chip foundry, is anticipated to achieve nearly 30% revenue growth this year, benefiting from the significant capital investment plans of major tech firms. The aggressive spending on AI infrastructure signals TSMC’s indispensable role in meeting the increasing demand for semiconductor manufacturing, which underpins advancements in AI technology.

Broadcom (AVGO) is also experiencing a surge in demand for its custom AI chips, with management projecting a doubling of AI chip revenue in the next quarter. This positions Broadcom as a formidable competitor to Nvidia within the rapidly evolving AI computing landscape. Broadcom’s advancements and market strategies highlight the increasing importance of custom solutions tailored to the specific needs of AI implementations.

Analyst Perspectives on Nvidia’s Growth

Wall Street analysts remain bullish on Nvidia’s stock, anticipating future price increases. Current estimates set Nvidia’s stock price at $187.90, reflecting strong growth expectations amid the ongoing AI infrastructure investment. Over the past decade, Nvidia’s stock has skyrocketed nearly 27,000%, turning a $10,000 investment into approximately $2.7 million. This staggering return underscores investor confidence and Nvidia’s potential as a long-term investment.

Looking ahead, Nvidia is expected to report a 57% revenue growth for fiscal 2026, accelerating to 65% in fiscal 2027. This optimistic outlook is fueled by the tech giants’ plans to spend significantly on capital expenditures, further driving demand for Nvidia’s AI products. Despite this positive trajectory, analysts highlight that Nvidia’s forward price-to-earnings ratio is projected to be under 24, rendering the current stock price relatively attractive ahead of the upcoming earnings report scheduled for February 25.

Nvidia’s product portfolio encompasses a broad spectrum of applications, including accelerated computing platforms, networking solutions, and AI software, positioning the company as a key player in the ongoing technological revolution. The company’s efforts to innovate and lead in GPU technology have set a formidable standard in the AI computing sector, with its products being integral to the operations of major industry players.

The sustained demand for AI infrastructure is expected to last well into the next decade, bolstering Nvidia’s growth prospects. As noted, the increasing investments by hyperscalers signify not only a robust market for AI hardware but also a larger trend towards integrating AI capabilities into various operational frameworks, thereby enhancing productivity and innovation across sectors.

In conclusion, the landscape for AI technology is rapidly evolving, with companies like Nvidia, TSMC, and Broadcom positioned to reap the benefits of escalating market demand. This dynamic environment presents significant opportunities for investors and stakeholders as the focus on AI infrastructure intensifies. With strong revenue projections and an expanding market presence, these companies are well-placed to drive the next wave of innovation in the tech industry.

See also Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity

Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity Affordable Android Smartwatches That Offer Great Value and Features

Affordable Android Smartwatches That Offer Great Value and Features Russia”s AIDOL Robot Stumbles During Debut in Moscow

Russia”s AIDOL Robot Stumbles During Debut in Moscow AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse

AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech

Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech